Potter Company has installed a JIT purchasing and manufacturing system and is using backflush accounting for its cost flows. It currently uses a two-trigger approach with the purchase of materials as the first trigger point and the completion goods as the second trigger point. During the month of June, Potter had the following transactions: Raw materials purchased $245,000 Direct labor cost 42,000 210,250 273,000" Overhead cost Conversion cost applied "$42,000 labor plus $231,000 overhead. There were no beginning or ending inventories. All goods produced were sold with a 50 percent markup. Any variance is closed Cost of Goods Sold. (Variances are recognized monthly.) Required: 1. Prepare the journal entries for the month of May using backflush costing, assuming that Potter uses the completion of goods as the only trigger point. For a compound transaction, if an amount box does not require an entry, leave blank. Prepare your entries in the following order: (a) completion of goods, (b) cost of sales, (c) sales revenue, and (d) recognition of the variance between applied and actual production costs. progres

Potter Company has installed a JIT purchasing and manufacturing system and is using backflush accounting for its cost flows. It currently uses a two-trigger approach with the purchase of materials as the first trigger point and the completion goods as the second trigger point. During the month of June, Potter had the following transactions: Raw materials purchased $245,000 Direct labor cost 42,000 210,250 273,000" Overhead cost Conversion cost applied "$42,000 labor plus $231,000 overhead. There were no beginning or ending inventories. All goods produced were sold with a 50 percent markup. Any variance is closed Cost of Goods Sold. (Variances are recognized monthly.) Required: 1. Prepare the journal entries for the month of May using backflush costing, assuming that Potter uses the completion of goods as the only trigger point. For a compound transaction, if an amount box does not require an entry, leave blank. Prepare your entries in the following order: (a) completion of goods, (b) cost of sales, (c) sales revenue, and (d) recognition of the variance between applied and actual production costs. progres

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 18E: For E2-17, prepare any journal entries that would have been different if the only trigger points had...

Related questions

Question

Mostly need assistance with 2. Thanks!

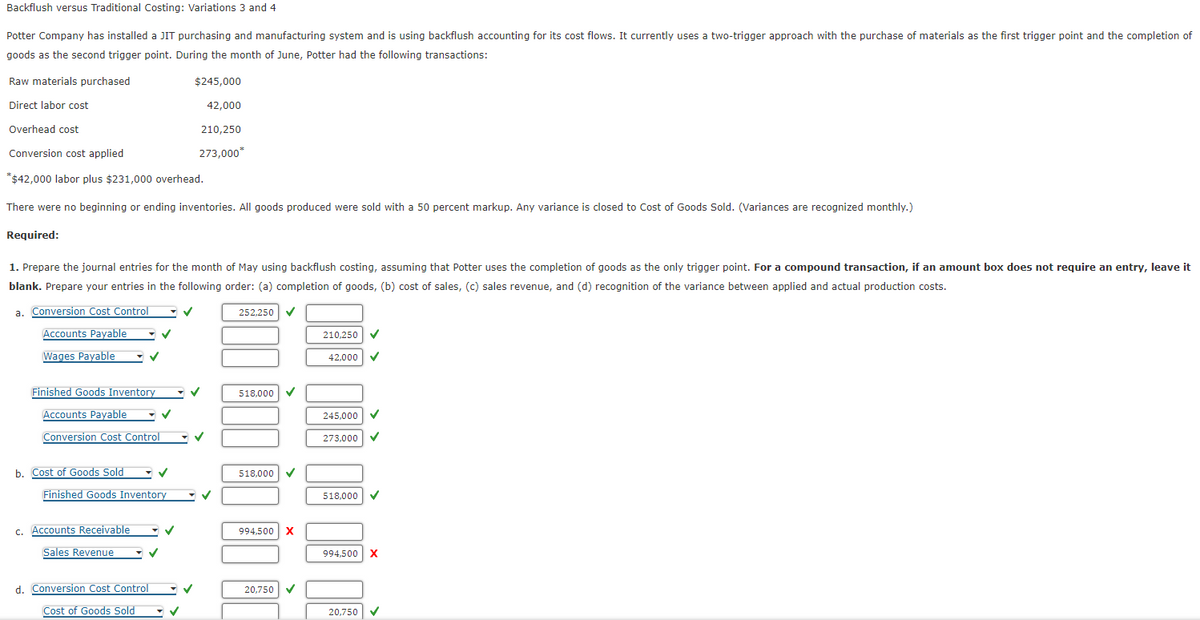

Transcribed Image Text:Backflush versus Traditional Costing: Variations 3 and 4

Potter Company has installed a JIT purchasing and manufacturing system and is using backflush accounting for its cost flows. It currently uses a two-trigger approach with the purchase of materials as the first trigger point and the completion of

goods as the second trigger point. During the month of June, Potter had the following transactions:

Raw materials purchased

$245,000

Direct labor cost

Overhead cost

Conversion cost applied

*$42,000 labor plus $231,000 overhead.

There were no beginning or ending inventories. All goods produced were sold with a 50 percent markup. Any variance is closed to Cost of Goods Sold. (Variances are recognized monthly.)

Required:

1. Prepare the journal entries for the month of May using backflush costing, assuming that Potter uses the completion of goods as the only trigger point. For a compound transaction, if an amount box does not require an entry, leave it

blank. Prepare your entries in the following order: (a) completion of goods, (b) cost of sales, (c) sales revenue, and (d) recognition of the variance between applied and actual production costs.

a. Conversion Cost Control

Accounts Payable

Wages Payable

Finished Goods Inventory

Accounts Payable

Conversion Cost Control

b. Cost of Goods Sold

Finished Goods Inventory

c. Accounts Receivable

Sales Revenue

✓

✓

d. Conversion Cost Control

Cost of Goods Sold

✓

✓

✓

42,000

210,250

273,000*

✓

✓

✓

✓

252,250 ✓

518,000 ✓

518,000 ✓

994,500 X

20,750 ✓

210,250

42,000

245,000

273,000

518,000 ✓

994,500 X

20,750 ✔

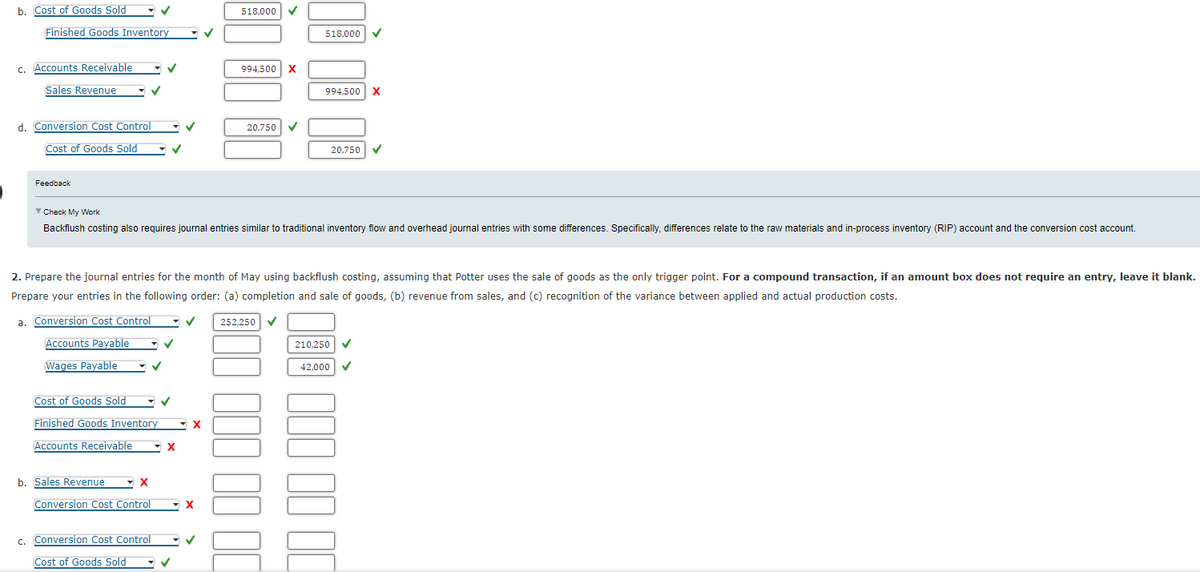

Transcribed Image Text:b. Cost of Goods Sold

Finished Goods Inventory

c. Accounts Receivable

Sales Revenue

d. Conversion Cost Control

Cost of Goods Sold

Feedback

✓

Accounts Payable

Wages Payable

b. Sales Revenue

X

✓

Conversion Cost Control

✓

Cost of Goods Sold

Finished Goods Inventory ▼ X

Accounts Receivable

c. Conversion Cost Control

✓

Check My Work

Backflush costing also requires journal entries similar to traditional inventory flow and overhead journal entries with some differences. Specifically, differences relate to the raw materials and in-process inventory (RIP) account and the conversion cost account.

X

Cost of Goods Sold - ✓

2. Prepare the journal entries for the month of May using backflush costing, assuming that Potter uses the sale of goods as the only trigger point. For a compound transaction, if an amount box does not require an entry, leave it blank.

Prepare your entries in the following order: (a) completion and sale of goods, (b) revenue from sales, and (c) recognition of the variance between applied and actual production costs.

a. Conversion Cost Control

252,250 ✓

✓

✓

▼ X

518,000 ✓

✓

994,500 X

20,750 ✓

518,000

994,500 X

20,750

210,250 ✓

42,000 ✓

300 00 00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College