a. Establish the relevant costs that could be quoted by Berjaya Berhad for the special job order, compared with the alternative use of the spare capacity. b. Evaluate the adoption of the relevant cost in (a) above as the pricing policy for the special job order.

a. Establish the relevant costs that could be quoted by Berjaya Berhad for the special job order, compared with the alternative use of the spare capacity. b. Evaluate the adoption of the relevant cost in (a) above as the pricing policy for the special job order.

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 4EB: Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all...

Related questions

Question

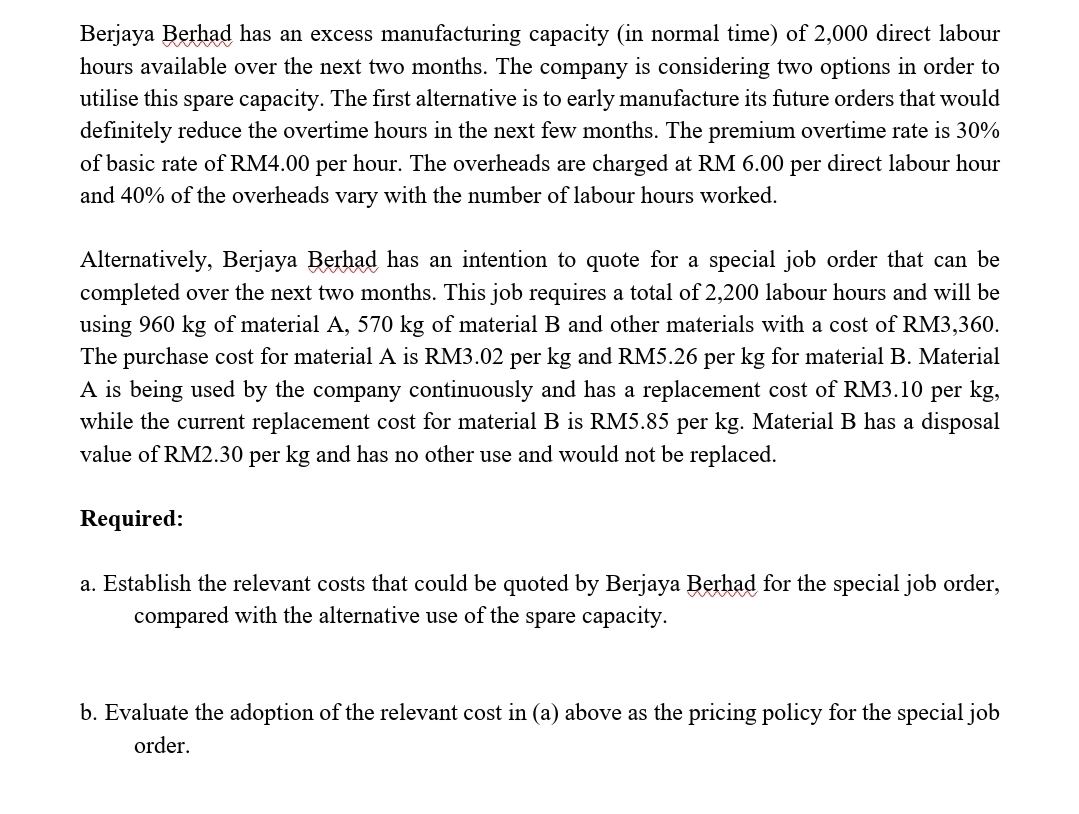

Transcribed Image Text:Berjaya Berhad has an excess manufacturing capacity (in normal time) of 2,000 direct labour

hours available over the next two months. The company is considering two options in order to

utilise this spare capacity. The first alternative is to early manufacture its future orders that would

definitely reduce the overtime hours in the next few months. The premium overtime rate is 30%

of basic rate of RM4.00 per hour. The overheads are charged at RM 6.00 per direct labour hour

and 40% of the overheads vary with the number of labour hours worked.

Alternatively, Berjaya Berhad has an intention to quote for a special job order that can be

completed over the next two months. This job requires a total of 2,200 labour hours and will be

using 960 kg of material A, 570 kg of material B and other materials with a cost of RM3,360.

The purchase cost for material A is RM3.02 per kg and RM5.26 per kg for material B. Material

A is being used by the company continuously and has a replacement cost of RM3.10 per kg,

while the current replacement cost for material B is RM5.85 per kg. Material B has a disposal

value of RM2.30 per kg and has no other use and would not be replaced.

Required:

a. Establish the relevant costs that could be quoted by Berjaya Berhad for the special job order,

compared with the alternative use of the spare capacity.

b. Evaluate the adoption of the relevant cost in (a) above as the pricing policy for the special job

order.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning