a. If the weight of portfolio assets assigned to investment X is 0.8, the portfolio expected return is S (Type an integer or a decimal.) b. If the weight of portfolio assets assigned to investment X is 0.8, the portfolio risk is approximately s (Round to two decimal places as needed.)

a. If the weight of portfolio assets assigned to investment X is 0.8, the portfolio expected return is S (Type an integer or a decimal.) b. If the weight of portfolio assets assigned to investment X is 0.8, the portfolio risk is approximately s (Round to two decimal places as needed.)

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter4: Eigenvalues And Eigenvectors

Section4.6: Applications And The Perron-frobenius Theorem

Problem 22EQ

Related questions

Question

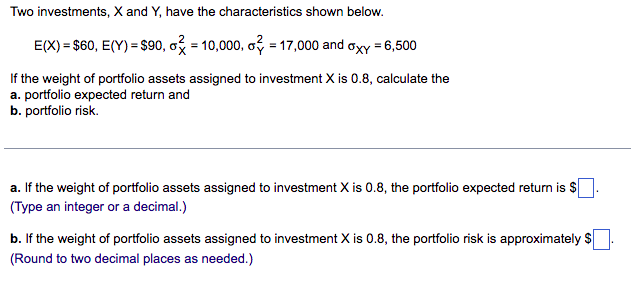

Transcribed Image Text:Two investments, X and Y, have the characteristics shown below.

E(X) = $60, E(Y) = $90, o = 10,000, o? = 17,000 and axy = 6,500

If the weight of portfolio assets assigned to investment X is 0.8, calculate the

a. portfolio expected return and

b. portfolio risk.

a. If the weight of portfolio assets assigned to investment X is 0.8, the portfolio expected return is $

(Type an integer or a decimal.)

b. If the weight of portfolio assets assigned to investment X is 0.8, the portfolio risk is approximately $.

(Round to two decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning