a. Jovier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000, $65,000, $70,000, and $72,000 for years 1, 2, 3, and 4, respectively. DNL uses a five-year cliff vesting schedule. Annual beforo-tax beneft Javier recently graduated and started his career with DNL Incorporated DNL provides a defined benefit plan to all employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees may accrue only 30 years of benefit under the plan (45 percent). Determine Javier's annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1: (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) b. Javier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000, $65,000, $70,000, and $72,000 for years 1, 2, 3, and 4, respectively. DNL uses a seven-year graded vesting schedule.

a. Jovier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000, $65,000, $70,000, and $72,000 for years 1, 2, 3, and 4, respectively. DNL uses a five-year cliff vesting schedule. Annual beforo-tax beneft Javier recently graduated and started his career with DNL Incorporated DNL provides a defined benefit plan to all employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees may accrue only 30 years of benefit under the plan (45 percent). Determine Javier's annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1: (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) b. Javier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000, $65,000, $70,000, and $72,000 for years 1, 2, 3, and 4, respectively. DNL uses a seven-year graded vesting schedule.

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 50P

Related questions

Question

5

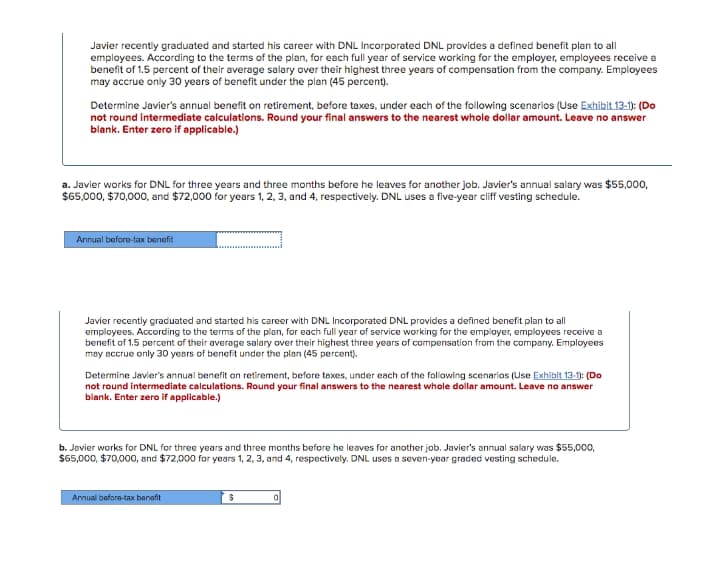

Transcribed Image Text:Javier recently graduated and started his career with DNL Incorporated DNL provides a defined benefit plan to all

employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a

benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees

may accrue only 30 years of benefit under the plan (45 percent).

Determine Javier's annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1): (Do

not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer

blank. Enter zero if applicable.)

a. Javier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000,

$65,000, $70,000, and $72,000 for years 1, 2, 3, and 4, respectively. DNL uses a five-year cliff vesting schedule.

Annual beforg-tax benefit

Javier recently graduated and started his career with DNL Incorporated DNL provides a defined benefit plan to all

employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a

benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees

may accrue only 30 years of benefit under the plan (45 percent).

Determine Javier's annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1): (Do

not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer

blank. Enter zero if applicable.)

b. Javier works for DNL for three years and three months before he leaves for another job. Javier's annual salary was $55,000,

$65,000, $70,000, and $72,000 for years 1, 2, 3, and 4, respectively. DNL uses a seven-year graded vesting schedule.

Annual before-tax benafit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT