Javier recently graduated and started his career with DNL Inc. DNL provides a defined benefit plan to all employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees may accrue only 30 years of benefit under the plan (45 percent). Determine Javier’s annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1): (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable.) Q: Javier works for DNL for six years and three months before he leaves for another job. Javier’s annual salary was $93,000, $103,000, $109,800, and $115,700 for years 4, 5, 6, and 7, respectively. DNL uses a five-year cliff vesting schedule.

Javier recently graduated and started his career with DNL Inc. DNL provides a defined benefit plan to all employees. According to the terms of the plan, for each full year of service working for the employer, employees receive a benefit of 1.5 percent of their average salary over their highest three years of compensation from the company. Employees may accrue only 30 years of benefit under the plan (45 percent).

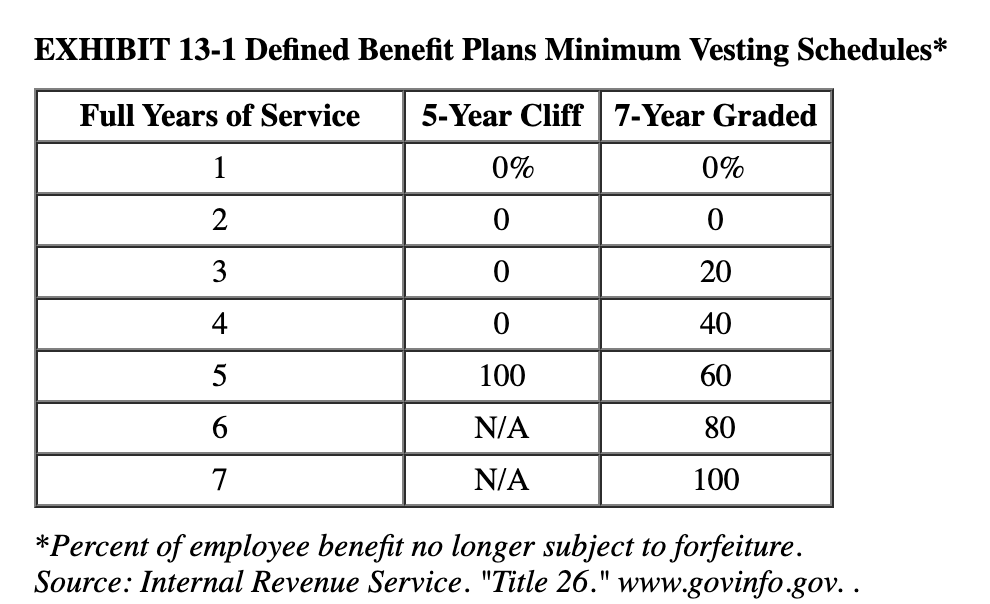

Determine Javier’s annual benefit on retirement, before taxes, under each of the following scenarios (Use Exhibit 13-1): (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable.)

Q: Javier works for DNL for six years and three months before he leaves for another job. Javier’s annual salary was $93,000, $103,000, $109,800, and $115,700 for years 4, 5, 6, and 7, respectively. DNL uses a five-year cliff vesting schedule.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images