licia has been working for JMM Corporated for 32 years. Alicia participates in JMM's defined benefit plan. ear of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive c ompensation from JMM. She retired on January 1, 2021. Before retirement, her annual salary was $570,000 or 2018, 2019, and 2020. What is the maximum benefit Alicia can receive in 2021?

licia has been working for JMM Corporated for 32 years. Alicia participates in JMM's defined benefit plan. ear of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive c ompensation from JMM. She retired on January 1, 2021. Before retirement, her annual salary was $570,000 or 2018, 2019, and 2020. What is the maximum benefit Alicia can receive in 2021?

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 36P

Related questions

Question

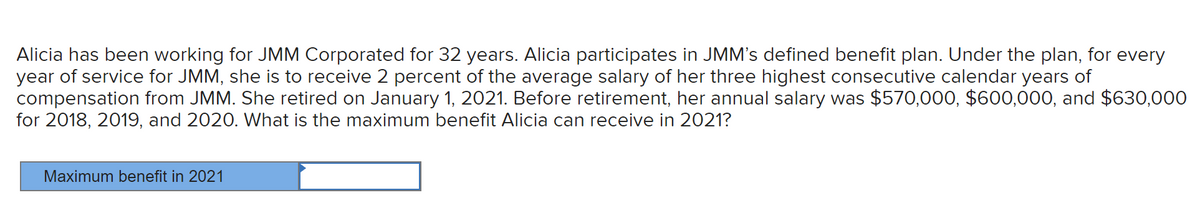

Transcribed Image Text:Alicia has been working for JMM Corporated for 32 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every

year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of

compensation from JMM. She retired on January 1, 2021. Before retirement, her annual salary was $570,000, $600,000, and $630,000

for 2018, 2019, and 2020. What is the maximum benefit Alicia can receive in 2021?

Maximum benefit in 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT