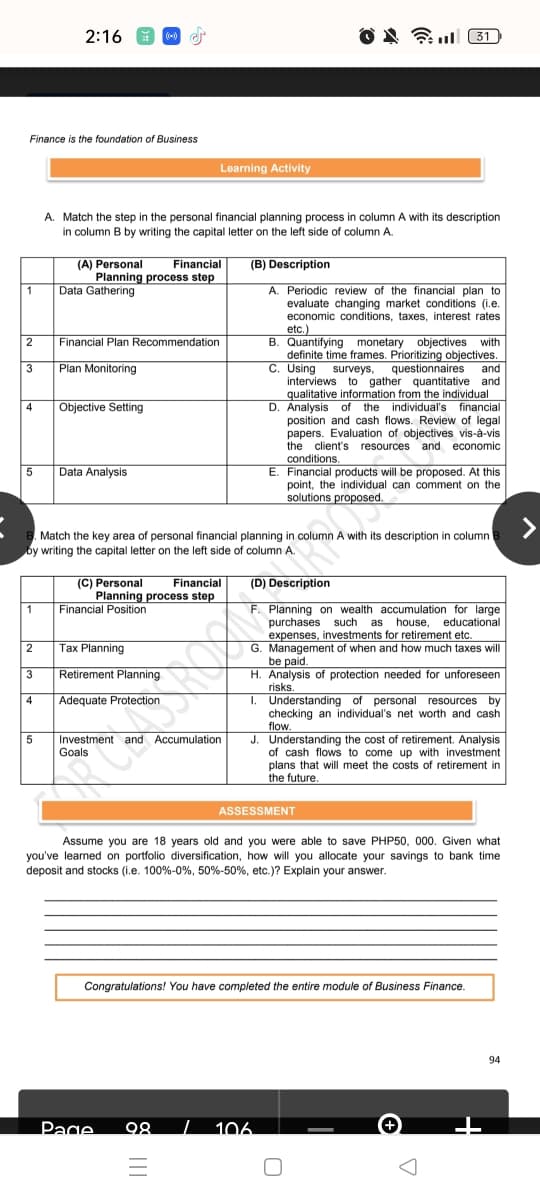

A. Match the step in the personal financial planning process in column A with its description in column B by writing the capital letter on the left side of column A. (A) Personal Planning process stop Data Gathering Financial (B) Description A. Periodic review of the financial plan to evaluate changing market conditions (i.e. economic conditions, taxes, interest rates etc.) B. Quantifying monetary objectives with definite time frames. Prioritizing objectives. C. Using surveys, interviews to gather quantitative and qualitative information from the individual D. Analysis of the individual's financial position and cash flows. Review of legal papers. Evaluation of objectives vis-à-vis the client's resources and economic 2 Financial Plan Recommendation Plan Monitoring questionnaires and Objective Setting 4 conditions. Data Analysis E. Financial products will be proposed. At this point, the individual can comment on the solutions proposed.

A. Match the step in the personal financial planning process in column A with its description in column B by writing the capital letter on the left side of column A. (A) Personal Planning process stop Data Gathering Financial (B) Description A. Periodic review of the financial plan to evaluate changing market conditions (i.e. economic conditions, taxes, interest rates etc.) B. Quantifying monetary objectives with definite time frames. Prioritizing objectives. C. Using surveys, interviews to gather quantitative and qualitative information from the individual D. Analysis of the individual's financial position and cash flows. Review of legal papers. Evaluation of objectives vis-à-vis the client's resources and economic 2 Financial Plan Recommendation Plan Monitoring questionnaires and Objective Setting 4 conditions. Data Analysis E. Financial products will be proposed. At this point, the individual can comment on the solutions proposed.

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

Transcribed Image Text:2:16

O N Full 31

Finance is the foundation of Business

Learning Activity

A. Match the step in the personal financial planning process in column A with its description

in column B by writing the capital letter on the left side of column A.

(A) Personal

Financial

(B) Description

Planning process step

Data Gathering

A. Periodic review of the financial plan to

evaluate changing market conditions (i.e.

economic conditions, taxes, interest rates

1

etc.)

B. Quantifying monetary objectives with

definite time frames. Prioritizing objectives.

C. Using surveys,

interviews to gather quantitative and

qualitative information from the individual

D. Analysis of the individual's financial

position and cash flows. Review of legal

papers. Evaluation of objectives vis-à-vis

the client's resources and economic

conditions,

E. Financial products will be proposed. At this

point, the individual can comment on the

solutions proposed.

Financial Plan Recommendation

3

Plan Monitoring

questionnaires

and

4

Objective Setting

5

Data Analysis

Match the key area of personal financial planning in column A with its description in column

by writing the capital letter on the left side of column A.

(C) Personal

Planning process step

Financial

(D) Description

1

Financial Position

Planning on wealth accumulation for large

purchases such

as

house, educational

expenses, investments for retirement etc.

G. Management of when and how much taxes will

be paid.

H. Analysis of protection needed for unforeseen

risks.

I. Understanding of personal resources by

checking an individual's net worth and cash

flow.

J. Understanding the cost of retirement. Analysis

of cash flows to come up with investment

plans that will meet the costs of retirement in

the future.

Tax Planning

3

Retirement Planning

4

Adequate Protection

Investment and Accumulation

Goals

ASSESSMENT

Assume you are 18 years old and you were able to save PHP50, 000. Given what

you've learned on portfolio diversification, how will you allocate your savings to bank time

deposit and stocks (i.e. 100%-0%, 50%-50%, etc.)? Explain your answer.

Congratulations! You have completed the entire module of Business Finance.

94

Page

98

| 106.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON