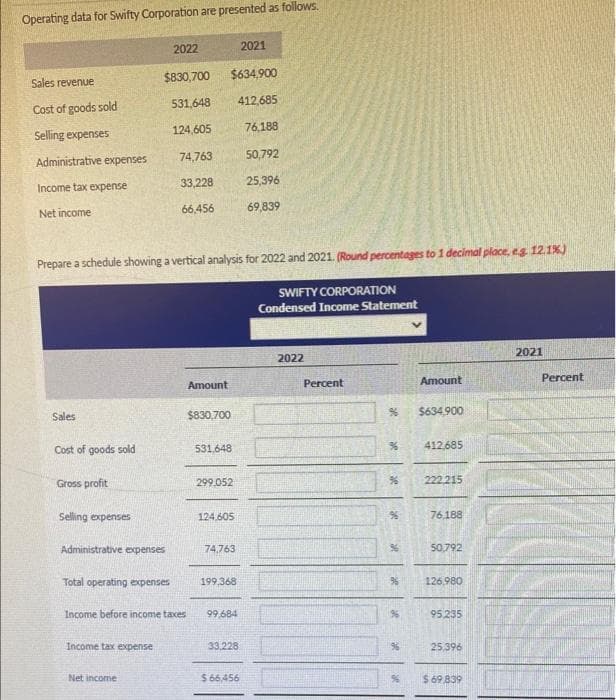

Prepare a schedule showing a vertical analysis for 2022 and 20 SWIFTY CORPORATION Condensed Income Statement 2021 2022 Amount Percent Amount Percent $830,700 $634.900 Sales Cost of goods sold 531.648 412,685 Gross profit 299.052 222,215 Selling expenses 124.605 76,188 Administrative experses 74.763 50,792 Total operating expenses 199.368 126,980

Prepare a schedule showing a vertical analysis for 2022 and 20 SWIFTY CORPORATION Condensed Income Statement 2021 2022 Amount Percent Amount Percent $830,700 $634.900 Sales Cost of goods sold 531.648 412,685 Gross profit 299.052 222,215 Selling expenses 124.605 76,188 Administrative experses 74.763 50,792 Total operating expenses 199.368 126,980

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.4ADM

Related questions

Question

Please help me

Transcribed Image Text:Operating data for Swifty Corporation are presented as follows.

2022

2021

$830,700

$634,900

Sales revenue

531,648

412,685

Cost of goods sold

124,605

76,188

Selling expenses

Administrative expenses

74,763

50,792

33,228

25,396

Income tax expense

66,456

69,839

Net income

Prepare a schedule showing a vertical analysis for 2022 and 2021. (Round percentages to 1 decimal place, eg 12.1%)

SWIFTY CORPORATION

Condensed Income Statement

2021

2022

Amount

Percent

Amount

Percent

Sales

$830,700

$634.900

Cost of goods sold

531.648

412,685

Gross profit

299.052

222.215

Selling expenses

124.605

76,188

Administrative expenses

74,763

50,792

Total operating expenses

199,368

126,980

Income before income taxes

99,684

95 235

Income tax expense

33,228

25,396

Net income

$ 66,456

$ 69 839

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning