a. What is net income for 2018?

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 12P

Related questions

Question

please answer all

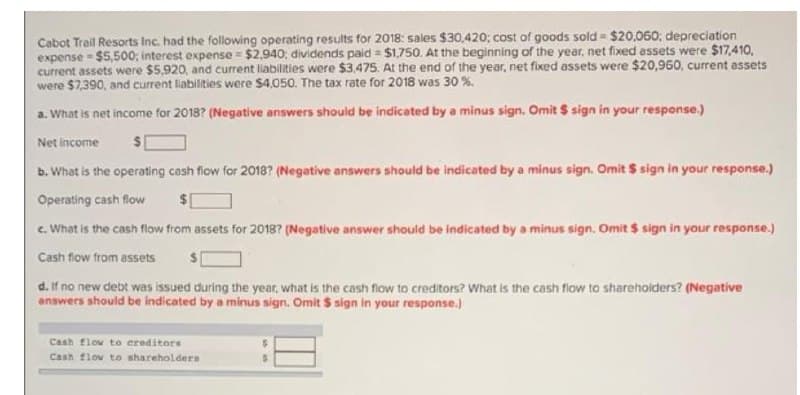

Transcribed Image Text:Cabot Trail Resorts Inc. had the following operating results for 2018: sales $30,420; cost of goods sold = $20,060; depreciation

expense - $5,500; interest expense = $2,940, dividends paid = $1,750. At the beginning of the year, net fixed assets were $17,410,

current assets were $5,920, and current liabilities were $3.475. At the end of the year, net fixed assets were $20,960, current assets

were $7,390, and current liabilities were $4,050. The tax rate for 2018 was 30 %.

a. What is net income for 2018? (Negative answers should be indicated by a minus sign. Omit $ sign in your response.)

Net income

b. What is the operating cash flow for 20187 (Negative answers should be indicated by a minus sign. Omit $ sign in your response.)

Operating cash flow

24

e. What is the cash flow from assets for 2018? (Negative answer should be indicated by a minus sign. Omit $ sign in your response.)

Cash flow from assets

d. If no new debt was issued during the year, what is the cash fiow to creditors? What is the cash flow to sharehoiders? (Negative

answers should be indicated by a minus sign. Omit $ sign in your response.)

Cash flow to ereditors

Cash flow to shareholders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT