What is the unadjust

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter14: Activities Required In Completing A Quality Audit

Section: Chapter Questions

Problem 87RSCQ

Related questions

Question

What is the unadjusted net income fro the year 2019?

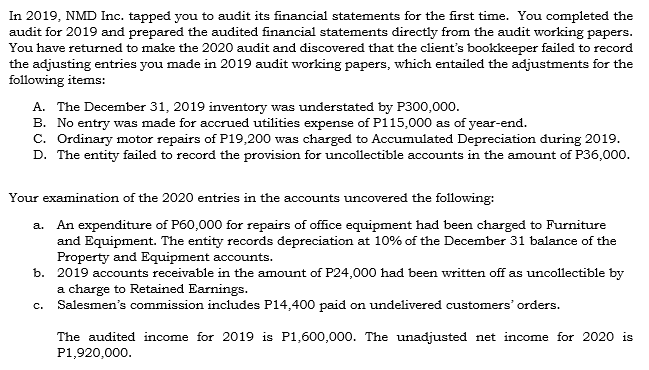

Transcribed Image Text:In 2019, NMD Inc. tapped you to audit its financial statements for the first time. You completed the

audit for 2019 and prepared the audited financial statements directly from the audit working papers.

You have returned to make the 2020 audit and discovered that the client's bookkeeper failed to record

the adjusting entries you made in 2019 audit working papers, which entailed the adjustments for the

following items:

A. The December 31, 2019 inventory was understated by P300,000.

B. No entry was made for accrued utilities expense of P115,000 as of year-end.

c. Ordinary motor repairs of P19,200 was charged to Accumulated Depreciation during 2019.

D. The entity failed to record the provision for uncollectible accounts in the amount of P36,000.

Your examination of the 2020 entries in the accounts uncovered the following:

a. An expenditure of P60,000 for repairs of office equipment had been charged to Furniture

and Equipment. The entity records depreciation at 10% of the December 31 balance of the

Property and Equipment accounts.

b. 2019 accounts receivable in the amount of P24,000 had been written off as uncollectible by

a charge to Retained Earnings.

Salesmen's commission includes P14,400 paid on undelivered customers' orders.

C.

The audited income for 2019 is P1,600,000. The unadjusted net income for 2020 is

P1,920,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning