a. What is the percentage of debt used to finance Gap? ____________ b. What is the percentage of owner’s equity used to finance Gap? ____________ c. What is the significance of these two percentag

a. What is the percentage of debt used to finance Gap? ____________ b. What is the percentage of owner’s equity used to finance Gap? ____________ c. What is the significance of these two percentag

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 17E: Investing Activities and Depreciable Assets Verlando Company had the following account balances and...

Related questions

Concept explainers

Question

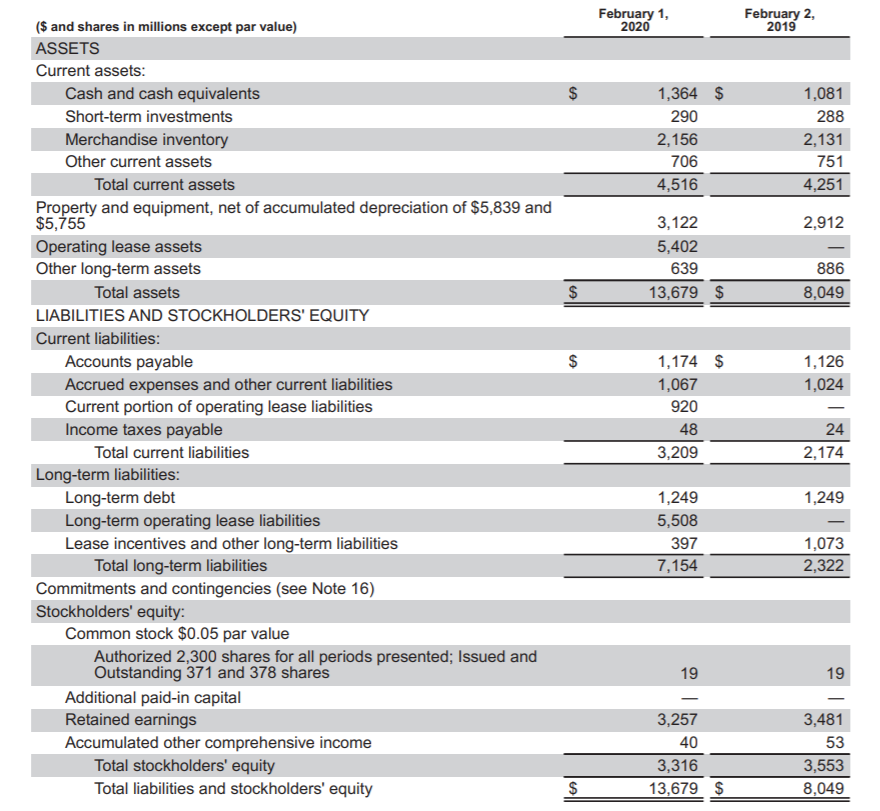

At 2/1/20:

a. What is the percentage of debt used to finance Gap? ____________

b. What is the percentage of owner’s equity used to finance Gap? ____________

c. What is the significance of these two percentages? ________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Transcribed Image Text:February 1,

2020

February 2,

2019

($ and shares in millions except par value)

ASSETS

Current assets:

Cash and cash equivalents

1,364 $

1,081

Short-term investments

290

288

Merchandise inventory

Other current assets

2,156

2,131

706

751

Total current assets

4,516

4,251

Property and equipment, net of accumulated depreciation of $5,839 and

$5,755

3,122

2,912

Operating lease assets

Other long-term assets

5,402

639

886

Total assets

$

13,679 $

8,049

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

Accrued expenses and other current liabilities

Current portion of operating lease liabilities

Income taxes payable

1,174 $

1,126

1,067

1,024

920

48

24

Total current liabilities

3,209

2,174

Long-term liabilities:

Long-term debt

Long-term operating lease liabilities

Lease incentives and other long-term liabilities

Total long-term liabilities

Commitments and contingencies (see Note 16)

Stockholders' equity:

Common stock $0.05 par value

Authorized 2,300 shares for all periods presented; Issued and

Outstanding 371 and 378 shares

1,249

1,249

5,508

397

1,073

2,322

7,154

19

19

Additional paid-in capital

Retained earnings

-

3,257

3,481

Accumulated other comprehensive income

40

53

Total stockholders' equity

Total liabilities and stockholders' equity

3,316

3,553

13,679 $

8,049

%24

%24

%24

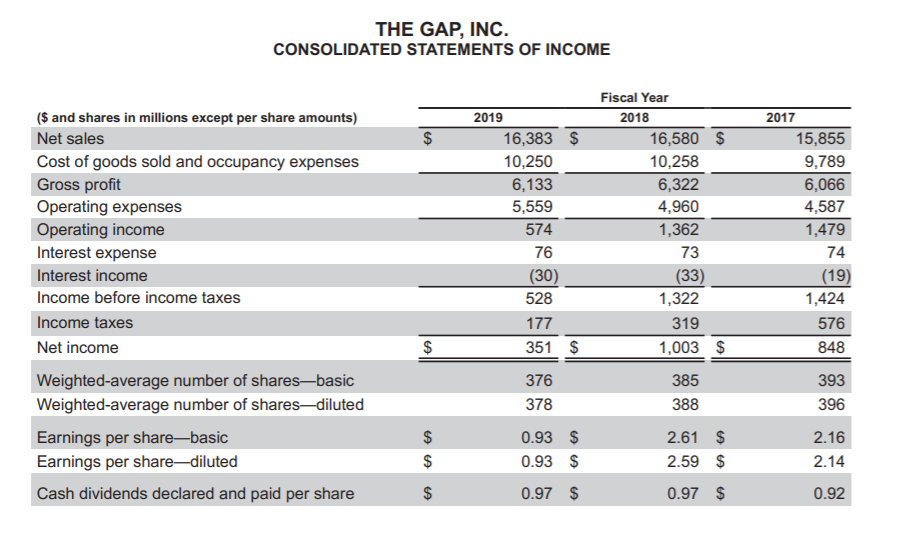

Transcribed Image Text:THE GAP, INC.

CONSOLIDATED STATEMENTS OF INCOME

Fiscal Year

2018

16,580 $

($ and shares in millions except per share amounts)

2019

2017

Net sales

$

16,383 $

15,855

Cost of goods sold and occupancy expenses

Gross profit

Operating expenses

Operating income

Interest expense

Interest income

10,250

10,258

9,789

6,133

6,322

6,066

5,559

4,960

4,587

574

1,362

1,479

76

73

74

(30)

(33)

(19)

1,424

Income before income taxes

528

1,322

Income taxes

177

319

576

Net income

$

351 $

1,003 $

848

Weighted-average number of shares-basic

Weighted-average number of shares-diluted

376

385

393

378

388

396

$

2.61 $

2.16

Earnings per share-basic

Earnings per share-diluted

0.93 $

$

0.93 $

2.59 $

2.14

Cash dividends declared and paid per share

0.97 $

0.97 $

0.92

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning