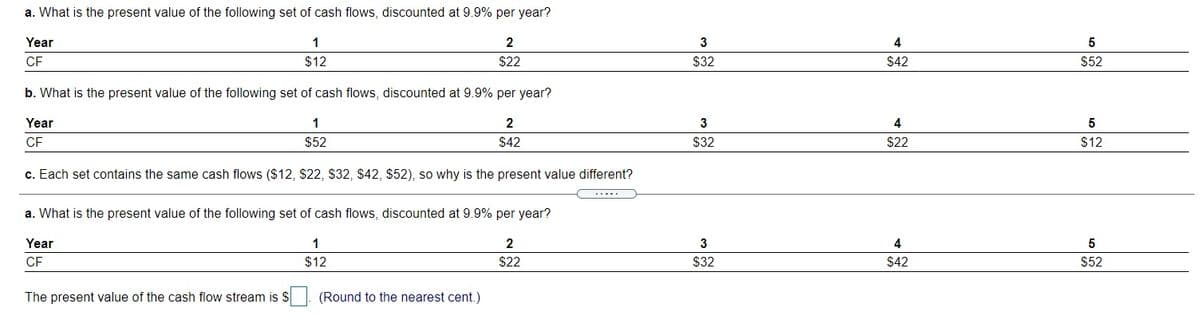

a. What is the present value of the following set of cash flows, discounted at 9.9% per year? Year 1 2 3 CE $12 $22 $32 $42 $52 b. What is the present value of the following set of cash flows, discounted at 9.9% per year? Year 1 2 3 4 CF $52 $42 $32 $22 $12 c. Each set contains the same cash flows ($12, $22, $32, $42, $52), so why is the present value different? a. What is the present value of the following set of cash flows, discounted at 9.9% per year? Year 3 4 5 CF $12 $2 $32 $42 $52 The present value of the cash flow stream is S (Round to the nearest cent.)

a. What is the present value of the following set of cash flows, discounted at 9.9% per year? Year 1 2 3 CE $12 $22 $32 $42 $52 b. What is the present value of the following set of cash flows, discounted at 9.9% per year? Year 1 2 3 4 CF $52 $42 $32 $22 $12 c. Each set contains the same cash flows ($12, $22, $32, $42, $52), so why is the present value different? a. What is the present value of the following set of cash flows, discounted at 9.9% per year? Year 3 4 5 CF $12 $2 $32 $42 $52 The present value of the cash flow stream is S (Round to the nearest cent.)

Chapter4: Time Value Of Money

Section4.12: Uneven, Or Irregular, Cash Flows

Problem 3ST

Related questions

Question

100%

Transcribed Image Text:a. What is the present value of the following set of cash flows, discounted at 9.9% per year?

Year

1

2

3

4

5

CF

$12

$22

$32

$42

$52

b. What is the present value of the following set of cash flows, discounted at 9.9% per year?

Year

1

2

3

4

CF

$52

$42

$32

$22

$12

c. Each set contains the same cash flows ($12, $22, S32, $42, $52), so why is the present value different?

a. What is the present value of the following set of cash flows, discounted at 9.9% per year?

Year

1

2

4

CF

$12

$22

$32

$42

$52

The present value of the cash flow stream is S

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning