a. What was the deareciation for the first year? Round your intermediate calculations to 4 decimal places. Round the depreciation for the year to the nearest whole dollar. b. Assuming the equipment was sold at the end of the second year for $605,702, determine the gain or loss on the sale of the equipment. C. Journalize the entry on December 31 to record the sale. Refer to the Chart of Accounts for exact wording of account titles.

a. What was the deareciation for the first year? Round your intermediate calculations to 4 decimal places. Round the depreciation for the year to the nearest whole dollar. b. Assuming the equipment was sold at the end of the second year for $605,702, determine the gain or loss on the sale of the equipment. C. Journalize the entry on December 31 to record the sale. Refer to the Chart of Accounts for exact wording of account titles.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter23: Flexible Budgeting (flexbud)

Section: Chapter Questions

Problem 6R

Related questions

Question

Help please?

Transcribed Image Text:Show Me How

E Calculator

ons

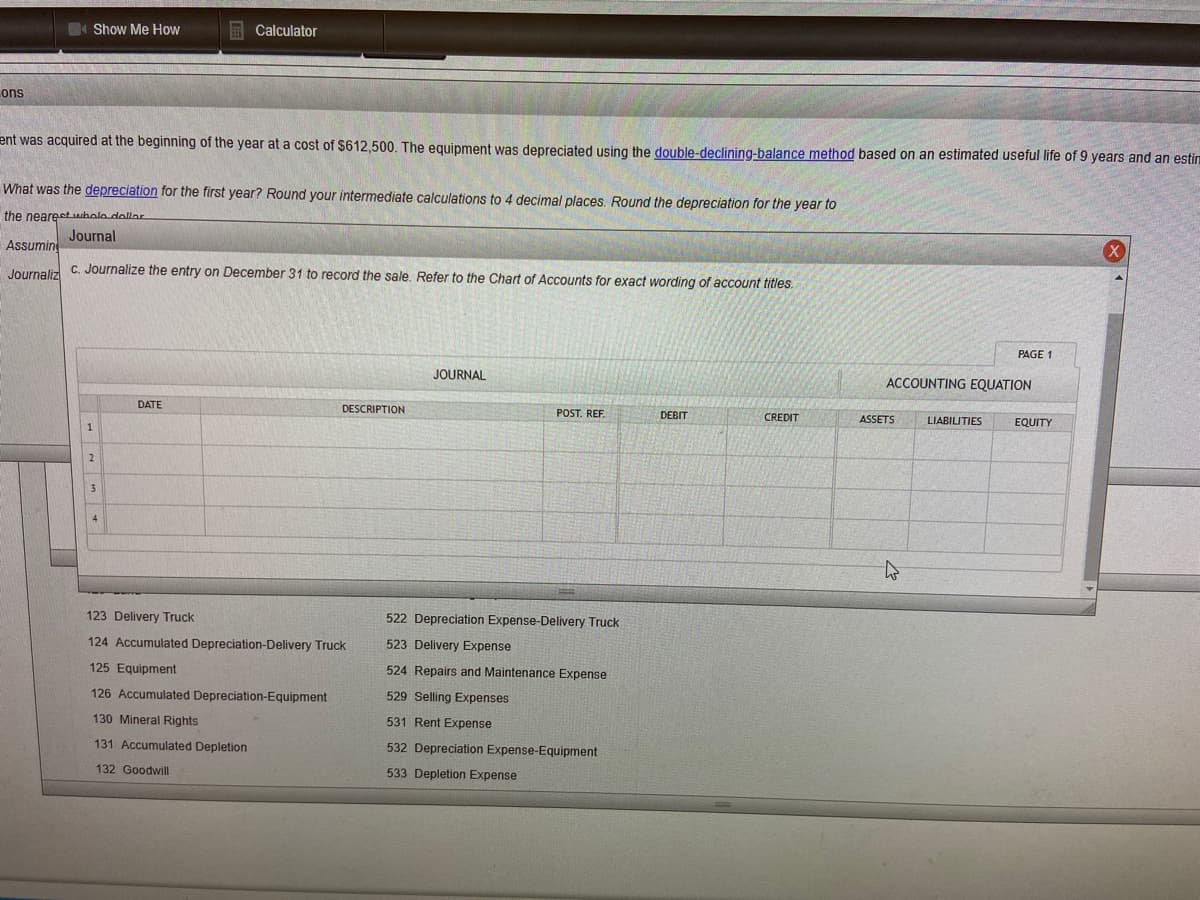

ent was acquired at the beginning of the year at a cost of $612,500. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of 9 years and an estin

What was the depreciation for the first year? Round your intermediate calculations to 4 decimal places. Round the depreciation for the year to

the nearestuholo dollar

Journal

Assumin

Journaliz

C. Journalize the entry on December 31 to record the sale. Refer to the Chart of Accounts for exact wording of account titles.

PAGE 1

JOURNAL

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

123 Delivery Truck

522 Depreciation Expense-Delivery Truck

124 Accumulated Depreciation-Delivery Truck

523 Delivery Expense

125 Equipment

524 Repairs and Maintenance Expense

126 Accumulated Depreciation-Equipment

529 Selling Expenses

130 Mineral Rights

531 Rent Expense

131 Accumulated Depletion

532 Depreciation Expense-Equipment

132 Goodwill

533 Depletion Expense

Transcribed Image Text:- ricky.a.mann@stu x

O Dashboard

* CengageNOwv2 | Online teachir

nment/takeAssignmentMain.do?invoker &takeAssignmentSessionLocator%=&inprogress=false

Book

4Show Me How

A Calculator

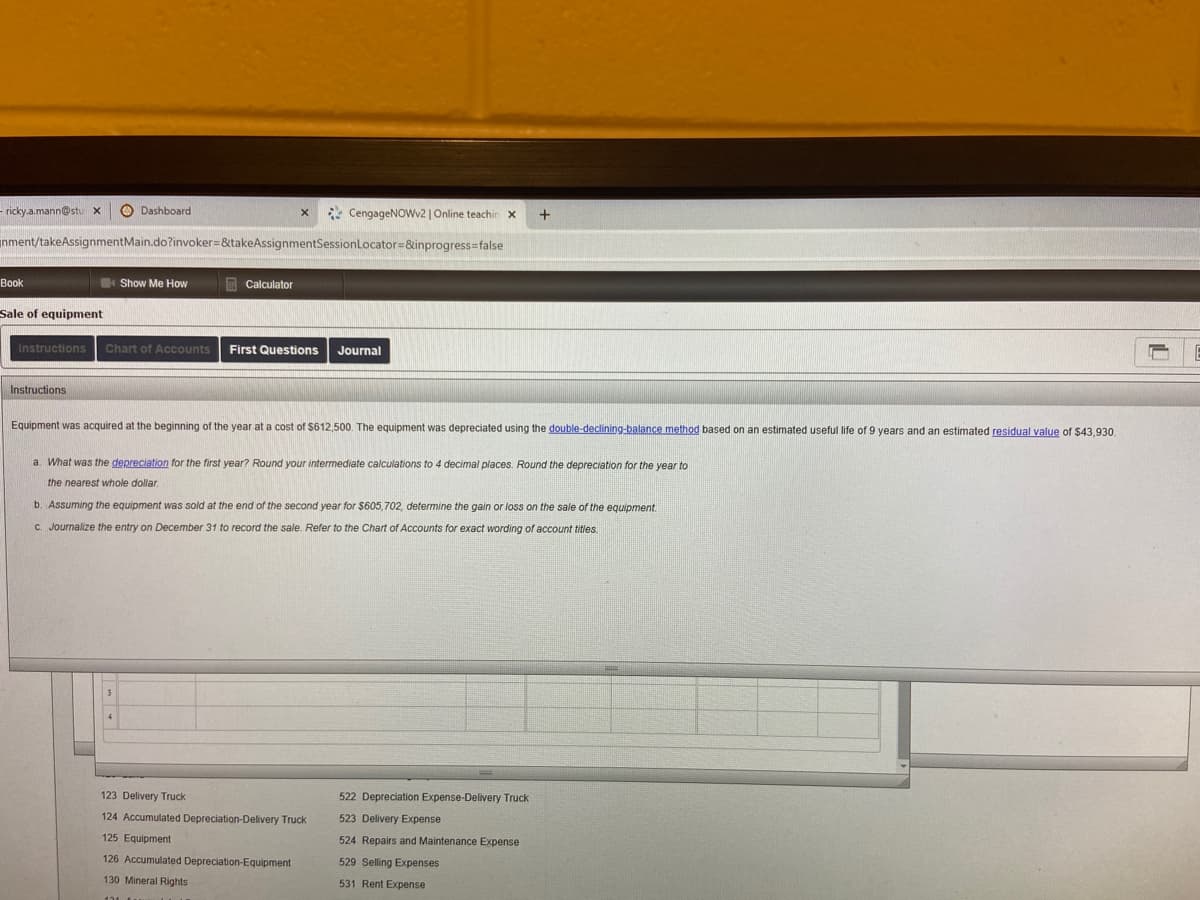

Sale of equipment

Instructions Chart of Accounts

First Questions

Journal

Instructions

Equipment was acquired at the beginning of the year at a cost of $612,500. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of 9 years and an estimated residual value of $43,930.

a. What was

depreciation for the first year? Round your intermediate calculations to 4 decimal places. Round the depreciation for the year to

the nearest whole dollar.

b. Assuming the equipment was sold at the end of the second year for $605,702, determine the gain or loss on the sale of the equipment.

C. Journalize the entry on December 31 to record the sale. Refer to the Chart of Accounts for exact wording of account titles.

123 Delivery Truck

522 Depreciation Expense-Delivery Truck

124 Accumulated Depreciation-Delivery Truck

523 Delivery Expense

125 Equipment

524 Repairs and Maintenance Expense

126 Accumulated Depreciation-Equipment

529 Selling Expenses

130 Mineral Rights

531 Rent Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning