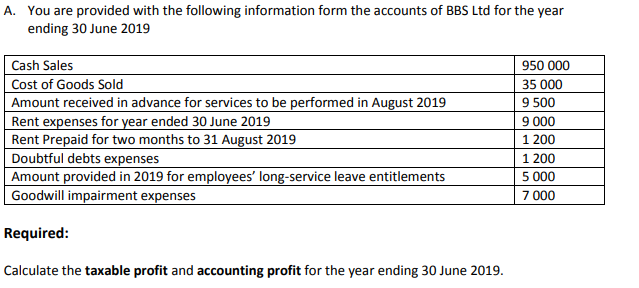

A. You are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019 Cash Sales Cost of Goods Sold Amount received in advance for services to be performed in August 2019 Rent expenses for year ended 30 June 2019 Rent Prepaid for two months to 31 August 2019 Doubtful debts expenses Amount provided in 2019 for employees' long-service leave entitlements Goodwill impairment expenses 950 000 35 000 9 500 9 000 1 200 1 200 5 000 7 000 Required: Calculate the taxable profit and accounting profit for the year ending 30 June 2019.

A. You are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019 Cash Sales Cost of Goods Sold Amount received in advance for services to be performed in August 2019 Rent expenses for year ended 30 June 2019 Rent Prepaid for two months to 31 August 2019 Doubtful debts expenses Amount provided in 2019 for employees' long-service leave entitlements Goodwill impairment expenses 950 000 35 000 9 500 9 000 1 200 1 200 5 000 7 000 Required: Calculate the taxable profit and accounting profit for the year ending 30 June 2019.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 69E: Unearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1,...

Related questions

Question

Subject: Advance finance accounting

Required:

a) From the table A Calculate the taxable profit and accounting profit for the year ending 30 June 2019

b)Provide the

Transcribed Image Text:A. You are provided with the following information form the accounts of BBS Ltd for the year

ending 30 June 2019

Cash Sales

Cost of Goods Sold

Amount received in advance for services to be performed in August 2019

Rent expenses for year ended 30 June 2019

Rent Prepaid for two months to 31 August 2019

Doubtful debts expenses

Amount provided in 2019 for employees' long-service leave entitlements

Goodwill impairment expenses

950 000

35 000

9 500

9 000

1 200

1 200

5 000

7 000

Required:

Calculate the taxable profit and accounting profit for the year ending 30 June 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning