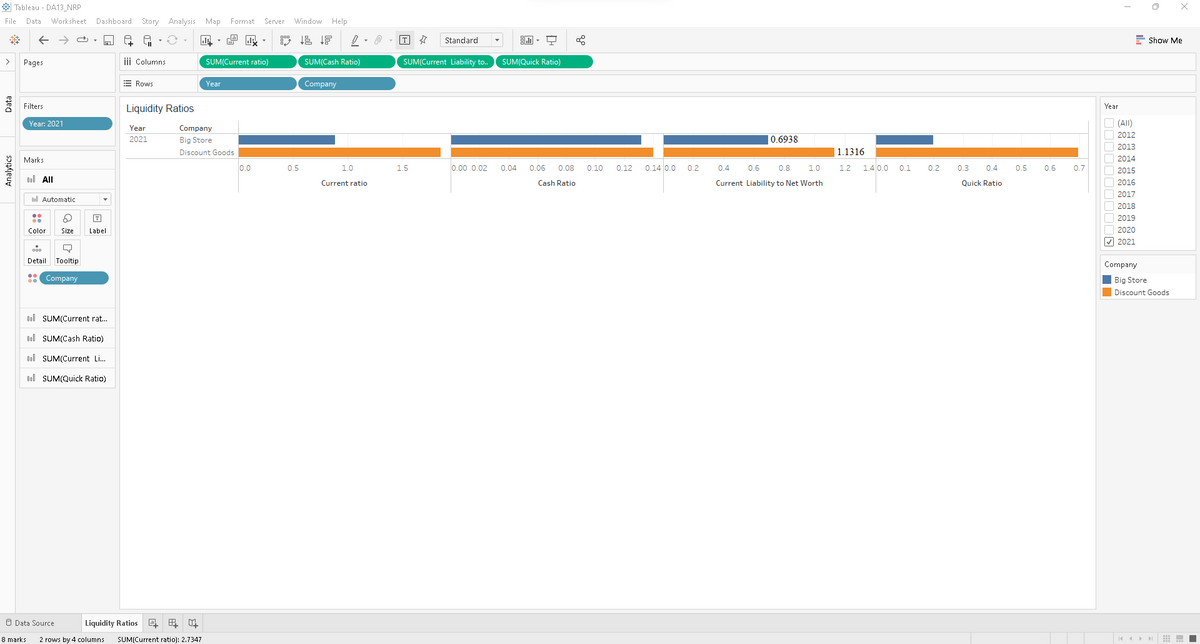

A. Other things being equal, which company appears to have the better liquidity position in terms of their ability to pay short-term debts as they come due as measured by the current ratio? B. Which company appears to offer the better liquidity position in terms of their ability to pay short-term debts as they come due as measured by the acid-test or quick ratio? C. Other things being equal, which company appears to have the better liquidity position in terms of ability of the company’s current liabilities to be covered using its cash and cash equivalents?

A. Other things being equal, which company appears to have the better liquidity position in terms of their ability to pay short-term debts as they come due as measured by the

B. Which company appears to offer the better liquidity position in terms of their ability to pay short-term debts as they come due as measured by the acid-test or quick ratio?

C. Other things being equal, which company appears to have the better liquidity position in terms of ability of the company’s current liabilities to be covered using its cash and cash equivalents?

D. Which company appears to offer the better security for its current obligation creditors as measured by the current liabilities to net worth ratio?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps