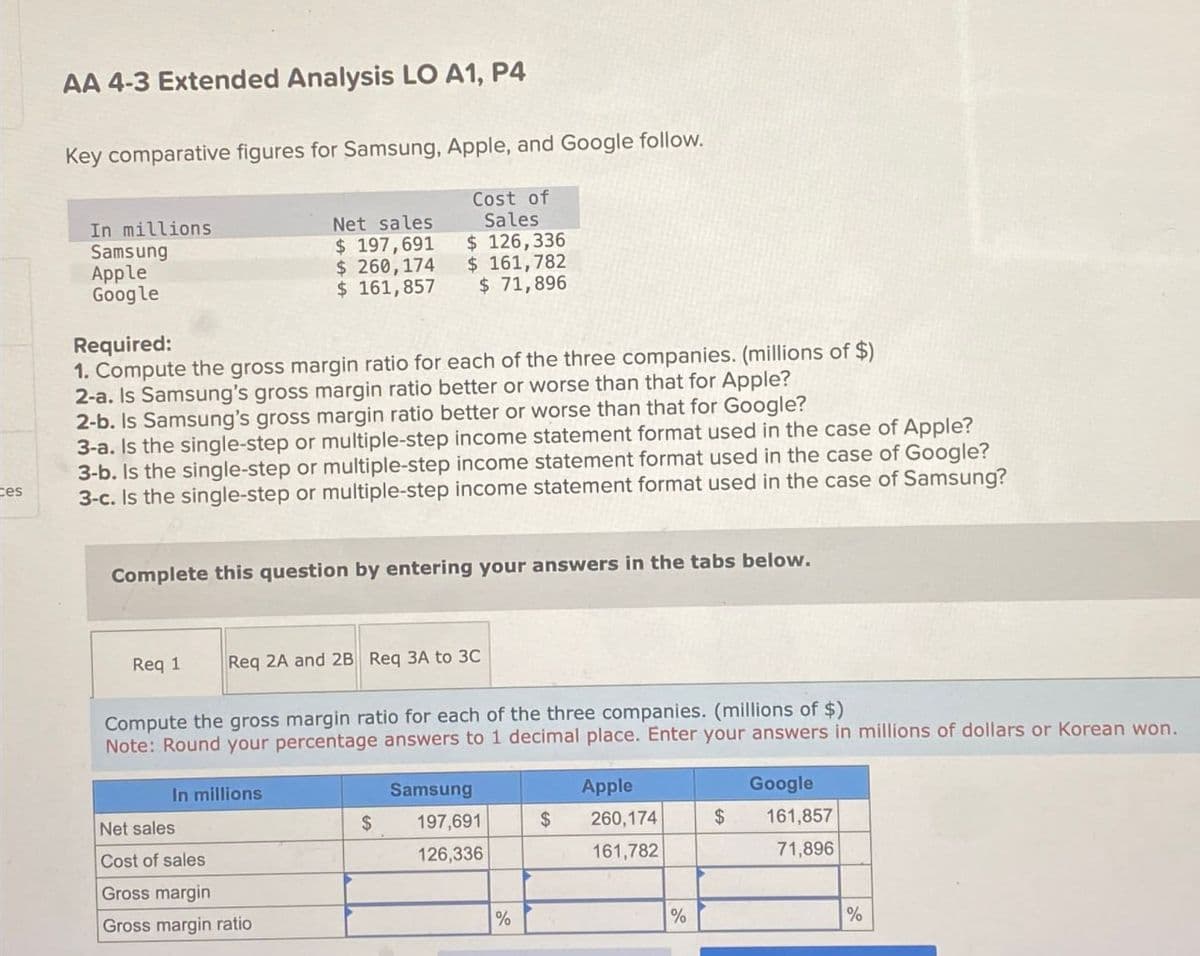

AA 4-3 Extended Analysis LO A1, P4 Key comparative figures for Samsung, Apple, and Google follow. In millions Samsung Apple Google Net sales Cost of Sales $ 126,336 $ 197,691 $ 260,174 $ 161,782 $ 161,857 $ 71,896 tes Required: 1. Compute the gross margin ratio for each of the three companies. (millions of $) 2-a. Is Samsung's gross margin ratio better or worse than that for Apple? 2-b. Is Samsung's gross margin ratio better or worse than that for Google? 3-a. Is the single-step or multiple-step income statement format used in the case of Apple? 3-b. Is the single-step or multiple-step income statement format used in the case of Google? 3-c. Is the single-step or multiple-step income statement format used in the case of Samsung? Complete this question by entering your answers in the tabs below. Req 1 Req 2A and 2B Req 3A to 3C Compute the gross margin ratio for each of the three companies. (millions of $) Note: Round your percentage answers to 1 decimal place. Enter your answers in millions of dollars or Korean won. In millions Samsung Apple Google Net sales $ 197,691 $ 260,174 $ 161,857 Cost of sales 126,336 161,782 71,896 Gross margin Gross margin ratio % % %

AA 4-3 Extended Analysis LO A1, P4 Key comparative figures for Samsung, Apple, and Google follow. In millions Samsung Apple Google Net sales Cost of Sales $ 126,336 $ 197,691 $ 260,174 $ 161,782 $ 161,857 $ 71,896 tes Required: 1. Compute the gross margin ratio for each of the three companies. (millions of $) 2-a. Is Samsung's gross margin ratio better or worse than that for Apple? 2-b. Is Samsung's gross margin ratio better or worse than that for Google? 3-a. Is the single-step or multiple-step income statement format used in the case of Apple? 3-b. Is the single-step or multiple-step income statement format used in the case of Google? 3-c. Is the single-step or multiple-step income statement format used in the case of Samsung? Complete this question by entering your answers in the tabs below. Req 1 Req 2A and 2B Req 3A to 3C Compute the gross margin ratio for each of the three companies. (millions of $) Note: Round your percentage answers to 1 decimal place. Enter your answers in millions of dollars or Korean won. In millions Samsung Apple Google Net sales $ 197,691 $ 260,174 $ 161,857 Cost of sales 126,336 161,782 71,896 Gross margin Gross margin ratio % % %

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.29EX

Related questions

Question

Transcribed Image Text:AA 4-3 Extended Analysis LO A1, P4

Key comparative figures for Samsung, Apple, and Google follow.

In millions

Samsung

Apple

Google

Net sales

Cost of

Sales

$ 126,336

$ 197,691

$ 260,174

$ 161,782

$ 161,857

$ 71,896

tes

Required:

1. Compute the gross margin ratio for each of the three companies. (millions of $)

2-a. Is Samsung's gross margin ratio better or worse than that for Apple?

2-b. Is Samsung's gross margin ratio better or worse than that for Google?

3-a. Is the single-step or multiple-step income statement format used in the case of Apple?

3-b. Is the single-step or multiple-step income statement format used in the case of Google?

3-c. Is the single-step or multiple-step income statement format used in the case of Samsung?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2A and 2B Req 3A to 3C

Compute the gross margin ratio for each of the three companies. (millions of $)

Note: Round your percentage answers to 1 decimal place. Enter your answers in millions of dollars or Korean won.

In millions

Samsung

Apple

Google

Net sales

$

197,691

$

260,174

$

161,857

Cost of sales

126,336

161,782

71,896

Gross margin

Gross margin ratio

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning