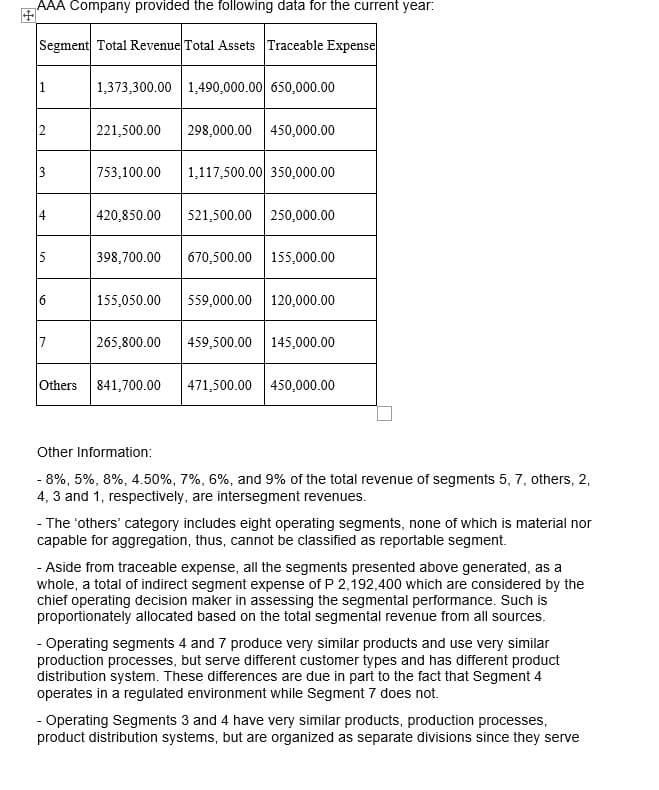

AAA Company provided the following data for the current year: Segment Total Revenue Total Assets Traceable Expense 1 12 3 نیا 4 5 6 7 1,373,300.00 1,490,000.00 650,000.00 221,500.00 753,100.00 420,850.00 398,700.00 155,050.00 265,800.00 298,000.00 450,000.00 1,117,500.00 350,000.00 521,500.00 250,000.00 670,500.00 155,000.00 559,000.00 120,000.00 459,500.00 145,000.00 Others 841,700.00 471,500.00 450,000.00 Other Information: - 8%, 5%, 8%, 4.50%, 7%, 6%, and 9% of the total revenue of segments 5, 7, others, 2, 4,3 and 1, respectively, are intersegment revenues. - The 'others' category includes eight operating segments, none of which is material nor capable for aggregation, thus, cannot be classified as reportable segment. - Aside from traceable expense, all the segments presented above generated, as a whole, a total of indirect segment expense of P 2,192,400 which are considered by the chief operating decision maker in assessing the segmental performance. Such is proportionately allocated based on the total segmental revenue from all sources. - Operating segments 4 and 7 produce very similar products and use very similar production processes, but serve different customer types and has different product distribution system. These differences are due in part to the fact that Segment 4 operates in a regulated environment while Segment 7 does not. - Operating Segments 3 and 4 have very similar products, production processes, product distribution systems, but are organized as separate divisions since they serve

AAA Company provided the following data for the current year: Segment Total Revenue Total Assets Traceable Expense 1 12 3 نیا 4 5 6 7 1,373,300.00 1,490,000.00 650,000.00 221,500.00 753,100.00 420,850.00 398,700.00 155,050.00 265,800.00 298,000.00 450,000.00 1,117,500.00 350,000.00 521,500.00 250,000.00 670,500.00 155,000.00 559,000.00 120,000.00 459,500.00 145,000.00 Others 841,700.00 471,500.00 450,000.00 Other Information: - 8%, 5%, 8%, 4.50%, 7%, 6%, and 9% of the total revenue of segments 5, 7, others, 2, 4,3 and 1, respectively, are intersegment revenues. - The 'others' category includes eight operating segments, none of which is material nor capable for aggregation, thus, cannot be classified as reportable segment. - Aside from traceable expense, all the segments presented above generated, as a whole, a total of indirect segment expense of P 2,192,400 which are considered by the chief operating decision maker in assessing the segmental performance. Such is proportionately allocated based on the total segmental revenue from all sources. - Operating segments 4 and 7 produce very similar products and use very similar production processes, but serve different customer types and has different product distribution system. These differences are due in part to the fact that Segment 4 operates in a regulated environment while Segment 7 does not. - Operating Segments 3 and 4 have very similar products, production processes, product distribution systems, but are organized as separate divisions since they serve

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 88DC

Related questions

Question

8

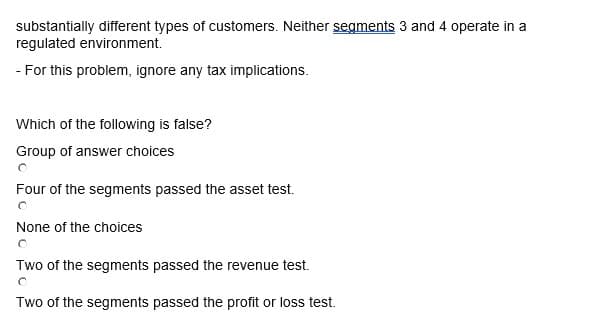

Transcribed Image Text:substantially different types of customers. Neither segments 3 and 4 operate in a

regulated environment.

- For this problem, ignore any tax implications.

Which of the following is false?

Group of answer choices

Four of the segments passed the asset test.

None of the choices

Two of the segments passed the revenue test.

O

Two of the segments passed the profit or loss test.

Transcribed Image Text:AAA Company provided the following data for the current year:

+

Segment Total Revenue Total Assets Traceable Expense

1

2

3

نیا

4

5

6

7

1,373,300.00 1,490,000.00 650,000.00

221,500.00

753,100.00

420,850.00

398,700.00

155,050.00

298,000.00 450,000.00

Others 841,700.00

1,117,500.00 350,000.00

521,500.00 250,000.00

670,500.00 155,000.00

559,000.00 120,000.00

265,800.00 459,500.00 145,000.00

471,500.00 450,000.00

Other Information:

- 8%, 5%, 8%, 4.50%, 7%, 6%, and 9% of the total revenue of segments 5, 7, others, 2,

4, 3 and 1, respectively, are intersegment revenues.

- The 'others' category includes eight operating segments, none of which is material nor

capable for aggregation, thus, cannot be classified as reportable segment.

- Aside from traceable expense, all the segments presented above generated, as a

whole, a total of indirect segment expense of P 2,192,400 which are considered by the

chief operating decision maker in assessing the segmental performance. Such is

proportionately allocated based on the total segmental revenue from all sources.

- Operating segments 4 and 7 produce very similar products and use very similar

production processes, but serve different customer types and has different product

distribution system. These differences are due in part to the fact that Segment 4

operates in a regulated environment while Segment 7 does not.

- Operating Segments 3 and 4 have very similar products, production processes,

product distribution systems, but are organized as separate divisions since they serve

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you