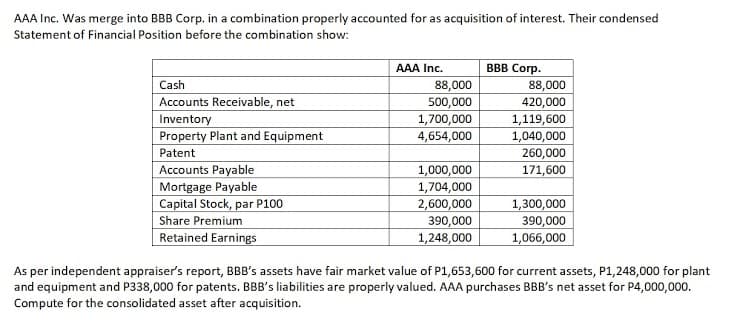

AAA Inc. Was merge into BBB Corp. in a combination properly accounted for as acquisition of interest. Their condensed Statement of Financial Position before the combination show: AAA Inc. ВBB Coгр. Cash Accounts Receivable, net 88,000 500,000 1,700,000 88,000 420,000 Inventory 1,119,600 Property Plant and Equipment 4,654,000 1,040,000 Patent 260,000 171,600 Accounts Payable Mortgage Payable Capital Stock, par P100 Share Premium Retained Earnings 1,000,000 1,704,000 2,600,000 390,000 1,248,000 1,300,000 390,000 1,066,000 As per independent appraiser's report, BBB's assets have fair market value of P1,653,600 for current assets, P1,248,000 for plant and equipment and P338,000 for patents. BBB's liabilities are properly valued. AAA purchases BBB's net asset for P4,000,000. Compute for the consolidated asset after acquisition.

AAA Inc. Was merge into BBB Corp. in a combination properly accounted for as acquisition of interest. Their condensed Statement of Financial Position before the combination show: AAA Inc. ВBB Coгр. Cash Accounts Receivable, net 88,000 500,000 1,700,000 88,000 420,000 Inventory 1,119,600 Property Plant and Equipment 4,654,000 1,040,000 Patent 260,000 171,600 Accounts Payable Mortgage Payable Capital Stock, par P100 Share Premium Retained Earnings 1,000,000 1,704,000 2,600,000 390,000 1,248,000 1,300,000 390,000 1,066,000 As per independent appraiser's report, BBB's assets have fair market value of P1,653,600 for current assets, P1,248,000 for plant and equipment and P338,000 for patents. BBB's liabilities are properly valued. AAA purchases BBB's net asset for P4,000,000. Compute for the consolidated asset after acquisition.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 2DIC

Related questions

Question

Transcribed Image Text:AAA Inc. Was merge into BBB Corp. in a combination properly accounted for as acquisition of interest. Their condensed

Statement of Financial Position before the combination show:

ввB Cогр.

88,000

420,000

1,119,600

1,040,000

260,000

171,600

AAA Inc.

Cash

88,000

500,000

1,700,000

4,654,000

Accounts Receivable, net

Inventory

Property Plant and Equipment

Patent

Accounts Payable

Mortgage Payable

Capital Stock, par P100

Share Premium

Retained Earnings

1,000,000

1,704,000

2,600,000

390,000

1,300,000

390,000

1,066,000

1,248,000

As per independent appraiser's report, BBB's assets have fair market value of P1,653,600 for current assets, P1,248,000 for plant

and equipment and P338,000 for patents. BBB's liabilities are properly valued. AAA purchases BBB's net asset for P4,000,000.

Compute for the consolidated asset after acquisition.

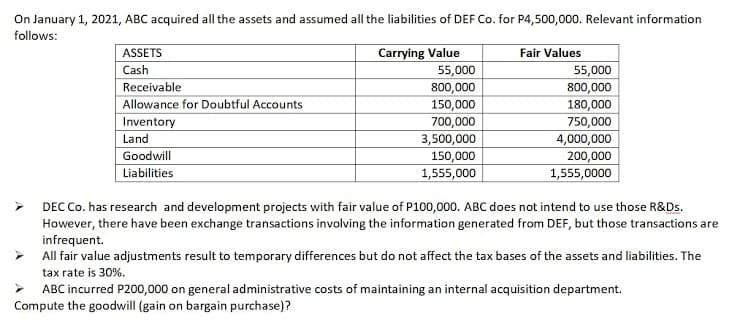

Transcribed Image Text:On January 1, 2021, ABC acquired all the assets and assumed all the liabilities of DEF Co. for P4,500,000. Relevant information

follows:

ASSETS

Fair Values

Carrying Value

55,000

Cash

55,000

800,000

Receivable

800,000

Allowance for Doubtful Accounts

150,000

180,000

750,000

4,000,000

200,000

1,555,0000

Inventory

Land

700,000

3,500,000

150,000

Goodwill

Liabilities

1,555,000

DEC Co. has research and development projects with fair value of P100,000. ABC does not intend to use those R&Ds.

However, there have been exchange transactions involving the information generated from DEF, but those transactions are

infrequent.

> All fair value adjustments result to temporary differences but do not affect the tax bases of the assets and liabilities. The

tax rate is 30%.

ABC incurred P200,000 on general administrative costs of maintaining an internal acquisition department.

Compute the goodwill (gain on bargain purchase)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning