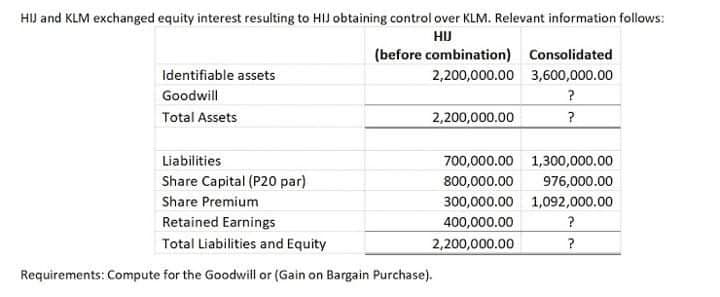

HIJ and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant information follows: HU (before combination) Consolidated 2,200,000.00 3,600,000.00 Identifiable assets Goodwill Total Assets 2,200,000.00 Liabilities 700,000.00 1,300,000.00 Share Capital (P20 par) 800,000.00 976,000.00 Share Premium 300,000.00 1,092,000.00 Retained Earnings 400,000.00 Total Liabilities and Equity 2,200,000.00 ? Requirements: Compute for the Goodwill or (Gain on Bargain Purchase).

Q: Ice Co. owns 75% interest in Fire Co. On acquisition date, the carrying amount of Fire Co.’s net…

A: Controlling interest represents the interest controlled by the parent company in the subsidiary…

Q: overvalued Building. As a consideration, OPQ Co. issued its own shares of stock with a market value…

A: Business combination: When a company takes a business of another company, such taking over is known…

Q: AAA Inc. Was merge into BBB Corp. in a combination properly accounted for as acquisition of…

A: What is Consolidation of Financial Statement? Consolidated means combined. Thus, when two merged…

Q: Companies X, Y and Z, parties to a consolidation, have the following data:…

A: Issue of shares or stock is one of the important source of finance being used by the business. These…

Q: On January 1, 20X9, Ute Corporation acquired 75 percent of Cougar Company's common stock for…

A: Consolidation Statement The purpose of preparing the consolidation statement whether the parent…

Q: On February 1, 20x1, Paco Corp. acquired outstanding ordinary shares of School Inc. for cash. The…

A: Introduction Goodwill is considered as an intangible assets and linked with purchasing of one…

Q: Silver Enterprises has acquired All Gold Mining in a merger transaction. The following balance…

A: Balance sheet is a financial statement that represents all the assets, liabilities and stockholders…

Q: As a result of the merger, what is the goodwill? * The following are the condensed balance sheet of…

A: Particulars To GM To SR Total Cash paid P 185,000 P 72,000 P 257,000 Add: Market value of…

Q: DDD Company issued its ordinary shares for the net assets of EEE Company in a business combination…

A: When a combination or consolidation occurs, all acquired assets must be combined at fair value…

Q: West, Inc. holds 80% of the common stock of Coast Company, an investment acquired for $680,000.…

A: At the time of acquisition of shares or business of another company, if net assets value is less…

Q: Par Company acquires 100% of the common stock of Sub Company for an agreedupon price of $900,000.…

A: Introduction: Consolidation is a process in which financial statements of subsidiary is merged…

Q: Parent Company purchases 80% of the outstanding shares of Subsidiary Company for P9,000,000. The…

A: Goodwill: It is an intangible asset. It is the value of the company over the value of all assets…

Q: Prior to being united in a business combination, Atkins, Inc., and Waterson Corporation had the…

A: The additional paid-in capital is the value of share capital above its par value. The additional…

Q: DDD Company issued its ordinary shares for the net assets of EEE Company in a business combination…

A: The given problem is taken from Business combination and it will be solved using IFRS -3. If…

Q: Parent Company purchased 90% of the outstanding shares of Subsidiary Company paying P975,000. At…

A: This question deals with the concept of business combination which covered in the IFRS 3 "Business…

Q: The Elf Co. acquired a 60% interest in the Pea Co. when Pea's equity comprised share capital of…

A: Non –controlling interest: Non-controlling interest can be defined as a portion of the shareholder’s…

Q: 6. ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On…

A: When a company acquires all the shares of another company, all the assets and liabilities of the…

Q: AAA Inc. Was merge into BBB Corp. in a combination properly accounted for as acquisition of…

A: When an asset is exchanged at a fair price between knowledgeable and desirous parties, the sum for…

Q: Panda Corporation paid $2,000,000 in cash for all of Sim Corporation’s assets and liabilities in a…

A: Merger and Acquisition Ownership of companies are transferred or consolidated with other entities…

Q: AAA Inc. Was merge into BBB Corp. in a combination properly accounted for as acquisition of…

A: Asset refers to any economic value resource for an individual, corporation or a country. It…

Q: est, Inc. holds 100 % of the common stock of Coast Company, an investment acquired for $680,000.…

A: The goodwill at the time of acquisition is calculated as difference between consideration price and…

Q: rchases 80% of the outstanding shares of S Company for P9,000,000. The carrying value of S Company's…

A: Goodwill is the additional cost incurred by the parent company to acquire the shares of subsidiary…

Q: On May 1, 20x1, ABC Inc acquired most of the outstanding shares of XYZ Co for cash. The incomplete…

A: Goodwill is the intangible asset that is reported on the balance sheet of the company. It shows the…

Q: PPP Corporation issued ordinary share capital with a par value of P675,000 and a market value of…

A: Business Combination:-It is happening when one company takes over the business of another business…

Q: Parent Company purchases 80% of the outstanding shares of Subsidiary Company for P9,000,000. The…

A: Goodwill: It is an intangible asset that is related with the purchase of one company by another.

Q: The Josh Company acquired an 80% interest in The Earl Company when Earl’s equity comprised share…

A: Under PAS 27 Consolidated and separate financial statements, the Earl’s retained earnings should be…

Q: Assume that Company A acquires 70 per cent of Company B for a cash price of $14 million when the…

A: Solution:- Preparation of the journal entries to record the non-controlling interest as follows…

Q: Papa Ltd. acquires 80% shares of Child Ltd. for $90,000 with control. The fair value of Child's net…

A: Consolidated Financial Statements: Asset, liabilities, equity, income, expenses and cash flows of a…

Q: Two companies operating in the industry where one company A Lld decides to acquire B Ltd@ Rs 25 per…

A: Merger means two or more companies join hands for business operations and form a new legal entity.

Q: PPP Corporation issued ordinary share capital with a par value of P675,000 and a market value of…

A: Total assets define the total amount of the resources that a business owns at a particular date.…

Q: On February 1, 20x1, Paco Corp, acquired outstanding ordinary shares of School Inc. for cash. The…

A: Control premium: Control premium means an amount that the purchaser will pay over the fair market…

Q: On February 1, 20x1, Paco Corp. acquired outstanding ordinary shares of School Inc. for cash. The…

A: Working paper elimination entries are prepared in the consolidation process of group companies’…

Q: AAA Inc. Was merge into BBB Corp. in a combination properly accounted for as acquisition of…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: PPP Corporation issued ordinary share capital with a par value of P675,000 and a market value of…

A: In the consolidated financial statement, the total assets of the combined entity are the sum of the…

Q: On January 31, 2022, Parent Company purchased all the identifiable net assets of Sub Company by…

A: The cost of investment includes the cash transferred, Fair value of assets transferred, fair value…

Q: HU and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant…

A: Hello. Since your question has multiple parts, we will solve the first question for you. If you want…

Q: ompany A acquires 70 per cent of Company B for a cash price of $14 million when the share capital…

A: Consolidated statement of financial position Note: Since you have posted a question with multiple…

Q: In the consolidated statement of financial position of Yogi and its subsidiary Bear at 31 December…

A: Goodwill is an intangible asset shown in consolidated statement of financial position i.e. balance…

Q: Miner Ltd acquired 75% of the share capital of Iver Ltd (Iver) for £1.2m three years ago, when Iver…

A: Acquisition is the taking over of the assets and liabilities by one company of the other to have…

Q: On January 1, 20x1, AAA Co. acquired 30% ownership interest in BBB, Inc. for ₱200,000. Because the…

A: Working note: Computation of non-controlling interest : Non-controlling interest=Fair value of net…

Q: HIJ and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant…

A: When one company acquires another company that is called an acquisition.

Q: On January 1, 20x1, Magnum Corp. acquired all the identifiable assets and assumed the liabilities of…

A:

Q: On May 1, 20xl, ABC Inc acquired most of the outstanding shares of XYZ Co for cash. The incomplete…

A: Investment in Subsidiary: The "investment in subsidiary" will be reported as an asset by the parent…

Q: HIJ and KLM exchanged equity interest resulting to HIJ obtaining control over KLM. Relevant…

A: After Consolidation: The increase in identifiable assets is 3,600,000-2,200,000= 1,400,000. The…

Q: On January 2, 2021, the Statement of Financial Position of Parent and Subsidiary Company prior to…

A: Consolidated Shareholder's Equity- Consolidated Shareholders’ Equity means the sum of Assets of the…

Q: On May 1, 20x1, ABC Inc acquired most of the outstanding shares of XYZ Co for cash. The incomplete…

A: Bussiness Acquisition means one company purchased most or all of another company's share. Company…

Q: How does joint control differ from control as applied on consolidation? Oceania Limited acquired…

A: Oceania Limited Acquired 100% of the share capital of the broadwater. Total shareholder's equity=…

Step by step

Solved in 2 steps

- 5. On January 1, 20x1, DIAPHANOUS Co. acquired all of the identifiable assets and assumed all of the liabilities of TRANSPARENT, Inc. by paying cash of P4,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of P6,400,000 and P3,600,000, respectively. Additional information:In addition to the business combination transaction, the following have also transcribed during the negotiation period: a. After the business combination, TRANSPARENT will enter into liquidation and DIAPHANOUS agreed to reimburse TRANSPARENT for liquidation costs estimated at P80,000. b. DIAPHANOUS agreed to reimburse TRANSPARENT for the appraisal fee of a building included in the identifiable assets acquired. The agreed reimbursement is P40,000.c. DIAPHANOUS entered into an agreement to retain the top management of TRANSPARENT for continuing employment. On acquisition date, DIAPHANOUS agreed to pay the key employees signing bonuses totaling P400,000.d. To persuade, Mr.…On January 1, 20X1, Par Inc acquires 85.77% of Sub Corp for $211,625 in cash. Immediately before the acquisition, the book value of Sub's identifiable net assets was $143,426 with a fair value of $161,060, while the book value of Par's net assets was $282,155. What will be the amount of total shareholders' equity on the consolidated balance sheet immediately after the acquisition if the fair-value-enterprise (FVE) method is used? $309,334 b. $333,129 c. $301,402 d. $317,265 e. $325,197On January 1, 20x1, John Corp. acquired the identifiable net assets of Jose Corp. by paying cash of ₱1,500,000 and issuing 10,000 ordinary shares with par and fair value of ₱100 and ₱120 per share, respectively. The identifiable assets of Jose had book values of ₱3,200,000 and fair values of ₱4,000,000 and its liabilities have book values equal to its fair values amounting to ₱1,500,000. As per agreement, John Corp. agreed to pay additional amount equal to 20% of the 20x1 year-end profit that exceeds ₱500,000 on January 2, 20x2. On the date of acquisition Jon estimated that the fair value of contingent consideration is ₱15,000. Assume the actual profit of ABC on December 31, 20x1 is ₱600,000. What is the gain (loss) on extinguishment of contingent consideration liability.

- The Elf Co. acquired a 60% interest in the Pea Co. when Pea's equity comprised share capital of P100,000 and retained earnings of P150,000. Pea's current statement of financial position shows share capital of P100,000, a revaluation reserve of P75,000 and retained earnings of P300,000. Under IAS 27, Consolidated and Separate Financial Statements, what amount in respect of the non-controlling interest should be included in Elf Co.'s consolidated statement of financial position?On January 1, 20x1, the partners of ABC Partnership decided to admit other investors. As a result, thepartnership was converted to a corporation. Relevant information follows:Carrying amounts Fair valuesCash20,000 20,000Receivables60,000 40,000Inventory80,000 70,000Equipment 540,000 670,000PayablesA, Capital (20%)B, Capital (30%)C, Capital (50%)50,000150,000200,000300,00050,000N/AN/AN/AThe corporation has an authorized capitalization of P2,000,000 divided into 200,000 ordinary shareswith par value of P10 per share. Shares were issued to the former partners based on their respectiveadjusted capital balances. How many shares did each of the partners receive? Show computation.Pab Corporation decided to establish Sollon Company as a wholly owned subsidiary by transferring some of its existing assets and liabilities to the new entity. In exchange, Sollon issued Pab 35,000 shares of $7 par value common stock. The following information is provided on the assets and accounts payable transferred: Cost Book Value Fair Value Cash $ 32,000 $ 32,000 $ 32,000 Inventory 83,000 83,000 83,000 Land 69,000 69,000 99,000 Buildings 188,000 147,000 249,000 Equipment 95,000 74,000 123,000 Accounts Payable 58,000 58,000 58,000 Required: Prepare the journal entry that Pab recorded for the transfer of assets and accounts payable to Sollon Prepare the journal entry that Sollon recorded for the receipt of assets and accounts payable from Pab.

- Entity A acquired 75% of the outstanding voting shares of Entity B for P1,800,000. On the acquisition date, Entity B's identifiable assets and liabilities have fair values of P4,000,000 and P1,600,000, respectively. Additional information: Entity A replaces Entity B as a guarantor on a loan of a third party. As of the acquisition date, the third party has defaulted on the loan. However, because negotiations for debt restructuring are ongoing with the lender and the Entity strongly believes that the lender will agree to the proposed terms, no provision was recognized. The fair value of the guarantee is P200,000. Entity A chose to measure the non-controlling interest at the NCI's proportionate share in the acquiree's net identifiable assets. Requirement: Compute for the goodwill.If PROMDI Co., a new company would acquire the net assets of CARDO Co and SYANO Co. PROMDI Co will be issuing 30,000 shares to CARDO and 12,000 shares to SYANO. The following is the balance sheet of PROMDI Co, followed by the fair values and additional unpaid costs incurred by PROMDI in the acquisition: REQUIREMENTS:A. GoodwillB. Consolidated Total Assets at the date of acquisitionC. Consolidated Total Liabilities at the date of acquisitionD. Consolidated Equity at the date of acquisitionSheman Corporation exchanged its common stock, worth P500,000 for all of the net assets of Darna Company in a business combination treated as a purchase. At the date of combination, Sheman’s net assets had a book value of P650,000 and a fair value of P900,000. Darna Company’s net assets had a book value of P450,000 and a fair value of P460,000. Immediately following the combination, the net assets of the combined company should have been reported at what amount?

- P Limited obtained control with the acquisition of an 80% equity interest in the share capital of S Limited on 1 January20.9 and paid R140 000 cash to the sellers of the shares (previous shareholder(s)) to settle the purchase price.At acquisition date the equity of S Limited consisted of the following:Share capital (100 000 shares) R100 000Retained earnings R50 000What amount would be recognized as Goodwill in proforma consolidation journals of P Ltd?Select one:a.R20 000b.R30 000c.R50 000d.R10 000Parent and Sub Inc had the following balance sheets on December 31, 2021 (see image below). On January 1, 2022 Parent purchased all of Sub Inc’s Common Shares for P40,000 in cash. On that date, Sub’s Current Assets and Fixed Assets were worth P26,000 and P54,000, respectively. Assuming that Consolidated Financial Statements were prepared on that date, the Current Assets of the combined entity should be valued at how much? Using the same information, Assuming that Consolidated Financial Statements were prepared on that date, the Goodwill of the combined entity should be valued at how much?6. ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On January 1, 2022 ABC purchased all of XYZ Inc’s Common Shares for P40,000 in cash. On that date, XYZ’s Current Assets and Fixed Assets were worth P26,000 and P54,000, respectively. Assuming that Consolidated Financial Statements were prepared on that date, a) determine the value of the current assets of the combined entity: b) how much is the Goodwill arising from this Business Combination? c) how much is the Shareholder’s Equity section of the Consolidated Balance Sheet?