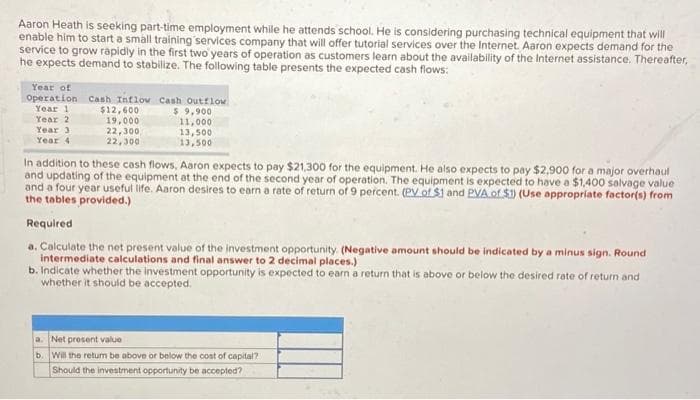

Aaron Heath is seeking part-time employment while he attends school. He is considering purchasing technical equipment that will enable him to start a small training services company that will offer tutorial services over the Internet. Aaron expects demand for the service to grow rapidly in the first two years of operation as customers learn about the availability of the Internet assistance. Thereafter, he expects demand to stabilize. The following table presents the expected cash flows: Year of Operation Year 1 Year 2 Year 3 Year 4 Cash Inflow Cash Outflow $ 9,900 11,000 $12,600 19,000 22,300 22,300 13,500 13,500 In addition to these cash flows, Aaron expects to pay $21,300 for the equipment. He also expects to pay $2,900 for a major overhaul and updating of the equipment at the end of the second year of operation. The equipment is expected to have a $1,400 salvage value and a four year useful life. Aaron desires to earn a rate of return of 9 percent. (PV of $1 and PVA of 5) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the net present value of the investment opportunity (Negative amount should be indicated by a minus sign. Round intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the desired rate of return and whether it should be accepted.

Aaron Heath is seeking part-time employment while he attends school. He is considering purchasing technical equipment that will enable him to start a small training services company that will offer tutorial services over the Internet. Aaron expects demand for the service to grow rapidly in the first two years of operation as customers learn about the availability of the Internet assistance. Thereafter, he expects demand to stabilize. The following table presents the expected cash flows: Year of Operation Year 1 Year 2 Year 3 Year 4 Cash Inflow Cash Outflow $ 9,900 11,000 $12,600 19,000 22,300 22,300 13,500 13,500 In addition to these cash flows, Aaron expects to pay $21,300 for the equipment. He also expects to pay $2,900 for a major overhaul and updating of the equipment at the end of the second year of operation. The equipment is expected to have a $1,400 salvage value and a four year useful life. Aaron desires to earn a rate of return of 9 percent. (PV of $1 and PVA of 5) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the net present value of the investment opportunity (Negative amount should be indicated by a minus sign. Round intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the desired rate of return and whether it should be accepted.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter1: Introduction To Cost Management

Section: Chapter Questions

Problem 4E: Consider the following thoughts of a manager at the end of the companys third quarter: If I can...

Related questions

Question

Subject: acounting

Transcribed Image Text:Aaron Heath is seeking part-time employment while he attends school. He is considering purchasing technical equipment that will

enable him to start a small training services company that will offer tutorial services over the Internet. Aaron expects demand for the

service to grow rapidly in the first two years of operation as customers learn about the availability of the Internet assistance. Thereafter,

he expects demand to stabilize. The following table presents the expected cash flows:

Year of

Operation

Year 1

Year 2

Year 3

Year 4

Cash Inflow Cash Outflow

$ 9,900

11,000

$12,600

19,000

22,300

22,300

13,500

13,500

In addition to these cash flows, Aaron expects to pay $21,300 for the equipment. He also expects to pay $2,900 for a major overhaul

and updating of the equipment at the end of the second year of operation. The equipment is expected to have a $1,400 salvage value

and a four year useful life. Aaron desires to earn a rate of return of 9 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from

the tables provided.)

Required

a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round

intermediate calculations and final answer to 2 decimal places.)

b. Indicate whether the investment opportunity is expected to earn a return that is above or below the desired rate of return and

whether it should be accepted.

a. Net prosent value

b. Will the retum be above or below the cost of capital?

Should the investment opportunity be accepted?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning