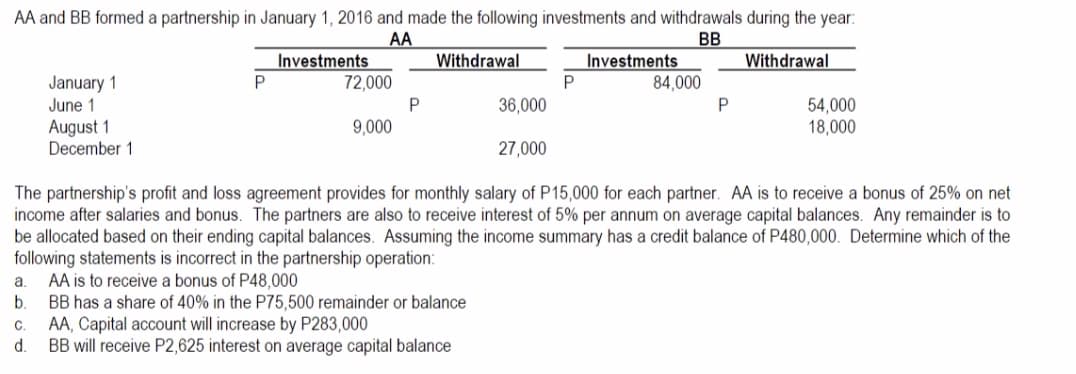

AA and BB formed a partnership in January 1, 2016 and made the following investments and withdrawals during the year. AA BB Investments Withdrawal Investments Withdrawal January 1 June 1 84,000 P. 72,000 54,000 18,000 36,000 August 1 December 1 9,000 27,000 The partnership's profit and loss agreement provides for monthly salary of P15,000 for each partner. AA is to receive a bonus of 25% on net income after salaries and bonus. The partners are also to receive interest of 5% per annum on average capital balances. Any remainder is to be allocated based on their ending capital balances. Assuming the income summary has a credit balance of P480,000. Determine which of the following statements is incorrect in the partnership operation: AA is to receive a bonus of P48,000 b. a. BB has a share of 40% in the P75,500 remainder or balance AA, Capital account will increase by P283,000 d. C. BB will receive P2,625 interest on average capital balance

AA and BB formed a partnership in January 1, 2016 and made the following investments and withdrawals during the year. AA BB Investments Withdrawal Investments Withdrawal January 1 June 1 84,000 P. 72,000 54,000 18,000 36,000 August 1 December 1 9,000 27,000 The partnership's profit and loss agreement provides for monthly salary of P15,000 for each partner. AA is to receive a bonus of 25% on net income after salaries and bonus. The partners are also to receive interest of 5% per annum on average capital balances. Any remainder is to be allocated based on their ending capital balances. Assuming the income summary has a credit balance of P480,000. Determine which of the following statements is incorrect in the partnership operation: AA is to receive a bonus of P48,000 b. a. BB has a share of 40% in the P75,500 remainder or balance AA, Capital account will increase by P283,000 d. C. BB will receive P2,625 interest on average capital balance

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Show your solution and answer.

Transcribed Image Text:AA and BB formed a partnership in January 1, 2016 and made the following investments and withdrawals during the year:

AA

Withdrawal

BB

Investments

Investments

Withdrawal

January 1

June 1

72,000

84,000

54,000

18,000

36,000

August 1

December 1

9,000

27,000

The partnership's profit and loss agreement provides for monthly salary of P15,000 for each partner. AA is to receive a bonus of 25% on net

income after salaries and bonus. The partners are also to receive interest of 5% per annum on average capital balances. Any remainder is to

be allocated based on their ending capital balances. Assuming the income summary has a credit balance of P480,000. Determine which of the

following statements is incorrect in the partnership operation:

AA is to receive a bonus of P48,000

b.

a.

BB has a share of 40% in the P75,500 remainder or balance

C.

AA, Capital account will increase by P283,000

d.

BB will receive P2,625 interest on average capital balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,