AB Partnership earned profit of ₱120,000 in 20x1. What is the capital balance of B on December 31, 20x1?

Q: A partnership began its first year of operations with the following capital balances: Young,…

A: Profit and Loss Appropriation Account is a nominal account prepared for the purpose of distributing…

Q: Elisa Diaz and Ma. Concepcion Manalo formed a partnership, investing P330,000 and P110,000,…

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the…

Q: On December 1, 2022, J and P formed a partnership. J invested land with a cost of P250,000. P…

A: Partnership Capital: A partnership capital account is a separate account that reflects the equity in…

Q: AA and BB entered into partnership on March 1, 2022 by investing the following assets: AA BB…

A: In the given question AA and BB will share profits and losses in the partnership firm in the ratio…

Q: BC and DZ entered into a partnership on September 1, 2021 by investing the following assets: Use the…

A: The partner's capital should be in the ratio as per the partnership agreement which states that…

Q: AUBRRIS Trading was organized and began operations on May 1, 2021. 0n that date, Aubrey invested…

A: In the context of the given question, we can compute the total share of Aubrey in the profit for the…

Q: On February 1, 2022, AA and BB formed a partnership and agreed to share profits in the ratio of 46…

A: Partnership is one of the form of business organisation, under which two or more than two partners…

Q: After the tangible assets have been adjusted to fair values, the capital accounts of Rey Refozar and…

A: Partnership is a organization in which business is owned by two or more people & profits are…

Q: how much should A received from C?

A: Given in the question: A B Initial Contribution 48,000 96,000 Drawing During…

Q: On July 01, 2020, A, B, and C formed a business partnership to be operated as an advertising agency.…

A: SOLUTION- PARTNERSHIP IS THE RELATIONSHIP BETWEEN PARTNERS WHO HAVE AGREED TO SHARE THE FIRMS PROFIT…

Q: A and B's partnership agreement provides for an annual salary allowance of 100,000 for A and 10%…

A: Calculation of weighted average capital balance of B January 1 to March 1- Beginning balance…

Q: On July 1, 20X2, Cua, Wicas, and Suico organized a partnership. Wicas contributed cash amounting to…

A: Insolvent is a condition where a person is unable to pay off the obligation or debts. When a person…

Q: and B formed a partnership on January 1, 2022. A contributed cash of P480,000 and B contributed land…

A: Solution: When any asset is contributed by any partner in partnership, then it is recorded at fair…

Q: XYZ partnership formed its partnership on June 1, 20x1 with the following capital balances:…

A: A interest on capital = P60,000 x10%x7/12 = P3,500 B interest on…

Q: Punongbayan and Araullo formed a partnership. The following were contributed by the partners and…

A: Total capital of the partnership = Total assets - Total liabilities

Q: Sabio, as her original investment in the firm of sabio and mariano, contributed equipment that had…

A: Investment is an amount which is put in business as capital to carried it out. It can be in form of…

Q: On January 1, FRED and GEMMO formed a partnership by contributing cash of P405,000 and P270,000,…

A: Net profit distribution schedule…

Q: A and B’s partnership agreement provides for an annual salary allowance of P100,000 for A and 10%…

A: Partnership is an agreement between two or more than two persons, in which they invest capitals, run…

Q: Hammer and Nail formed a partnership. Hammer contributed equipment with original cost of P370,000…

A: Capital contributed by Hammer = Fair value of equipment P300,000 Capital contributed by Nail =…

Q: tgage on the land. On June 30, 2023, the partnership reported a net loss of P24,000. The…

A: Journal entry refers to the process of documenting all the financial transactions of a company in…

Q: On January 1, 2031, A, B and C formed ABC Partnership with total agreed capitalization of…

A: Partnership is an agreement between two or more persons in which they invest money, run business and…

Q: On January 1 , FRED and GEMMO formed a partnership by contributing cash of P405,000 and P270,000 ,…

A: Partnership is a lawful collaboration between two or more than two parties to carry-out business…

Q: A and G executed a partnership agreement that lists the following assets contributed at the…

A: A partnership is a agreement between two or more person/ parties to manage and operate a business…

Q: On January 1, 20xx, A, B, C and D formed 5G Trading Co., a partnership with capital contributions…

A: To compute the earnings of the partnership, we should consider the given data. So that we compute by…

Q: On January 1, 20xx, A, B, C and D formed 5G Trading Co., a partnership with capital 4. contributions…

A: Partnership is the type of business in which two or more interested persons join hands by…

Q: The partnership of A and B was formed on January 1, 2021. On this date, A invested PHP200,000 cash…

A: SOLUTION- WORKING- PARTICULARS A B TOTAL CASH 200000 220000 OFFICE EQUIPMENT 80000…

Q: Bob is investing in a partnership with Jerry. Bob contributes equipment that originally cost…

A: Business will consider the fair market of the equipment as the business is a separate entity and so…

Q: capital balance of Lucky after admission?

A: WHEN A NEW PARTNER IS AADMISTED INTO THE PARNERSHIP, NEW PROFIT SHARING RATIO WILL BE CALCULATED,…

Q: Blessing and Linda formed a partnership by investing P220,000 and P380,000, respectively. At he end…

A: Step 2 in solution.

Q: Income for the year amounted to P 300,000. How much profit will be distributed to Juan?

A: The calculation of profit that will be distributed to Juan is shown hereunder : Income for the year…

Q: Mr. A and Mr. B start a business on 01st May,2021, with capital of 2,500,000 and 300,000. According…

A:

Q: On March 1, 2015, II and JJ formed a partnership with each contributing the following assets: || JJ…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: During the remainder of the year, the partnership earned P450,000. The temporary withdrawals of Max…

A: A partnership is an agreement between two or more persons who joins hands to operate and handle the…

Q: On June 30, 2015, the balance sheet of Western Marketing, a partnership, is summarized as follows:…

A: A partnership is a legally binding contract between two or more persons to run and manage a business…

Q: Elisa Diaz and Ma. Concepcion Manalo formed a partnership, investing P330,000 and P110,000,…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: In the January 1, 2020 Kalaw and Borromeo formed partnership with each contributing the following:…

A: Partnership refers to agreement between one or more person to share profit and losses of a business…

Q: P430,000 and P570,000, respectively. The operations of the partnership for 2022 resulted to a profit…

A:

Q: The partnership of A and B was formed on January 1, 2021. On this date, A invested PHP200,000 cash…

A: A partnership is a kind of business structure in which two or more people agree to carry out…

Q: Magdaraog and Mercado are partners in Magdaraog and Mercado Partnership with capital balances of…

A: Journal: Journal is considered as a book of original entry because all the transactions that have…

Q: Magdaraog and Mercado are partners in Magdaraog and Mercado Partnership with caoital balances of…

A: On admission of a new partner, the liabilities and assets shall be revalued and the revaluation…

Q: ind and Lucky formed a partnership by contributing cash amounting to P240,000 and P480,000…

A: Partnership : It is the relationship between two or more person who carried on business with the…

Q: A and B entered into a partnership agreement in which A is to have 55% interest in the partnership…

A: Partnership is a form of business run by 2 or more people on predefined terms and conditions .A…

Q: R and S were organized and began operations on March 1, 20x1. On that date, R invested P 150,000 and…

A: Following is the answer to the given question

Q: On June 30, 2015, the balance sheet of Western Marketing, a partnership, is summarized as follows:…

A: The book value method is the method of accounting for the investment by the new partner at the time…

Q: On May 1, 2022, AA and BB formed a partnership, agreeing to share profits and losses in the ratio of…

A: The amount to be recorded as a partner’s capital will be equal to the fair value of Net Assets…

Q: AB Partnership was formed on February 28, 20x1. Partner A invested P150,000 cash while Partner B…

A: Partnership means where two or more person comes together to do some common business activity and…

Q: On February 14, AA and BB formed a partnership and contributed the following assets at historical…

A: Summary of case : AA has contributed in form of cash and furniture and fixtures and BB contributes…

Q: Kim, Tak and Gu are partners in the KIMTAKGU partnership Tak, the genersi partner, contributed…

A: Since we answer only upto three sub-parts, we shall answer first three. Please submit a new question…

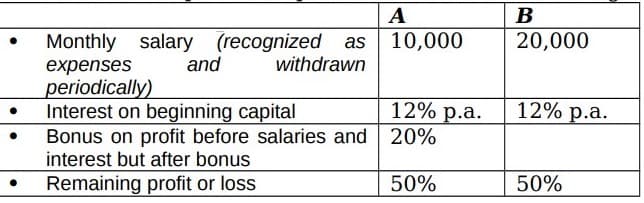

AB

cash while Partner B invested land that he originally bought for ₱70,000 but has a

current fair value of ₱180,000. B invested additional cash of ₱60,000 on November 1, 20x1. The partnership contract states the following:

AB Partnership earned profit of ₱120,000 in 20x1. What is the capital balance of B on December 31, 20x1?

Step by step

Solved in 2 steps with 2 images

- tion 8Income statement for the year ended 31 December, 2019 of KKMTN Ghana Ltd2018 2019ȼ ‘000 ȼ ‘000Turnover 420,000 523,600Cost of sales (330,000) (417,200)Gross profit 89,000 106,400Expenses:Administration 44,600 50,200Selling and distribution 15,400 (60,000) 19,600 (69,800)Profit before interest 29,000 36,600Debenture interest - (2,800)Net profit before tax 29,000 33,800Taxation (8,000) (10,000)Net Profit after tax 21,000 23,800Ordinary dividend paid 8,400 9,250Ordinary shares issued 12 million and trading at ȼ3 each as at yesterday onGSE.You are required to compute the following investment ratios:a). Earnings per shareb). Dividend per sharec). Payout ratiod). Price earnings ratioe). Earnings yieldABC Co. distributes annual bonus to its sales manager. The company reported P2 million profit for 2021 before bonus and income tax. Income tax of ABC Co. is 25%.What is the amount of bonus if bonus is computed at 10% of profit after taxes and bonuses?Summerfields Sdn BhdBalance Sheet as at 31 December 2020 (RM’000)Cash 400 Account payable 1,200Marketable securities 500 Accrued wages 1,200Accounts receivable 750 Notes payable 700Inventories 500 Mortgage payable 2,200Net Fixed Asset 4,850 Common stock 500Retained earnings 1,200TOTAL ASSETS 7,000 TOTAL CLAIMS 7,000Additional information:-i) Sales in 2020 was RM 12 million and it is projected to increase to 18 million in 2021.ii) The company is operating at full capacity.iii) The net profit for this company in 2020 was RM1,200,000 and dividend payment wasRM300,000.iv) All external financing will be absorbed and met by common stock.Prepare a pro-forma balance sheet for Summerfields Sdn Bhd for the year ended 2021by using percent of sales method and determine the external funds required.

- Q15 Under Present value future earnings model, how to compute the value of human resource if Mr. Ansari is appointed at the age of 30 in the organization and his service period expires in 30 years, once he attains the age of 60. The p.v. factor is assumed at 10%. Incase if Mr. Ansari draws a salary of OMR 600 per month then how is salary computed according to this method? a. All options are correct b. His each year’s salary of OMR 7,200 is multiplied with p.v. factor at the rate of 10% c. His salary is OMR 7,200 every year up to 30 years of his service. d. Finally net present value is found and added to get the p.v. of future earningsfor the year ending december 31 2019, settles inc. eanred an ROI of 8.8%. Sales for the year were 16 million and average asset turnover was 2.1. Average stockholder equity was 2.7 million. a. calculate settles margin and net inccome b. calculate settles return on equityEntity A has an incentive compensation plan under which the sales manager receives a bonus equal to 10percent of the company's income after deductions for bonus and income taxes. Income before bonus and incometaxes is P500,000. The effective income tax rate is 30 percent. How much is the amount of bonus (rounded to the nearest peso)?a. 32,710 b. 60,748 c. 30,974 d. 37,210 How much is the amount of income tax?a. 131,776 b. 140,708 c. 138,837 d. 140,187

- Bay’s footnote regarding employee stock compensation details the grant of 2 million options during the year, the fair-value of which was computed as $6.50.If the options have, on average, a four-year vesting schedule and the company faces a 35% tax rate on income, what affect would this option grant have on Bay’s accounts for the year? Select one: a. $4,550,000 decrease to deferred tax asset, $4,550,000 increase to tax expense b. $1,137,500 decrease to deferred tax asset, $1,137,500 increase to tax expense c. Indeterminable since the number of options exercised is unknown. d. $4,550,000 increase to deferred tax asset, $4,550,000 decrease to tax expense e. $1,137,500 increase to deferred tax asset, $1,137,500 decrease to tax expenseMaryland company offers a bonus plan to its employees equal to 3% of net income. Maryland's net income is expected to be $960,000. The amount of the employee's bonus expense is estimated to be? A. $27,961B. $28,800C. $29,000D. $29,691E. $30,000MY MEDALS ARE SHOOKT ENTERPRISE distributes annual bonuses to its sales manager and two sales agents. The company reported P2,000,000 profit for 2019 before bonuses and taxes. Income taxes average 30%. How much is the total amount of bonus if bonus of each is computed at 15% of profit after taxes and bonuses? a. P190,045 b. P397,476 c. P479,087 d. P570,135 Use the same information in MC 10. How much should the sales manager and each sales agent receive respectively, if the sales manager gets 15% and each sales agent gets 10% of profit after bonuses but before income taxes? a. P857,143 and P571,428 b. P518,519 and P518,518 c. P222,222 and P148,148 d. P195,000 and P130,000

- The following is available for Golden Corporation for 2019: Sales 2,000,000 Average invested capital (assets) 500,000 Net income 300,000 Cost of capital 18% What is the residual income for Golden Corp.? P – 0 - P 200,000 P 210,000 P 246,000 Group of answer choices 1 2 3 4Income Statement for the years ending 31 August: 2020 2019 £ £Revenue 950,000 975,000Cost of sales 455,000 460,000Gross profit 495,000 515,000Total expenses 320,000 310,000Net profit 175,000 205,000 Statement of financial position as at 31 August:- 2020 2019£ £Non-current assets 70,000 65,000Current assetsCash at bank…Income Statements for the Year Ended 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 Sales revenue 8,320 11,250 Cost of sales (6,020) (9,030) Gross profit 2,300 2,220 Operating expenses (1,048) (1,535) Operating profit 1,252 685 Finance charges (20) (70) Profit before tax 1,232 615 Taxation (62) (30) Profit for the year 1,170 585 SOFP (Balance Sheet) as at 31st Dec 2020 KM Ltd ROW Ltd £'000 £'000 £'000 £'000 Non-current assets 502 198 Current assets Inventory 1,290 2,437 Trade receivables 730 1,990 2,020 4,427 Total assets 2,522 4,625 Equity Share capital 1,350 800 Reserves 580 1,145 1,930 1,945…