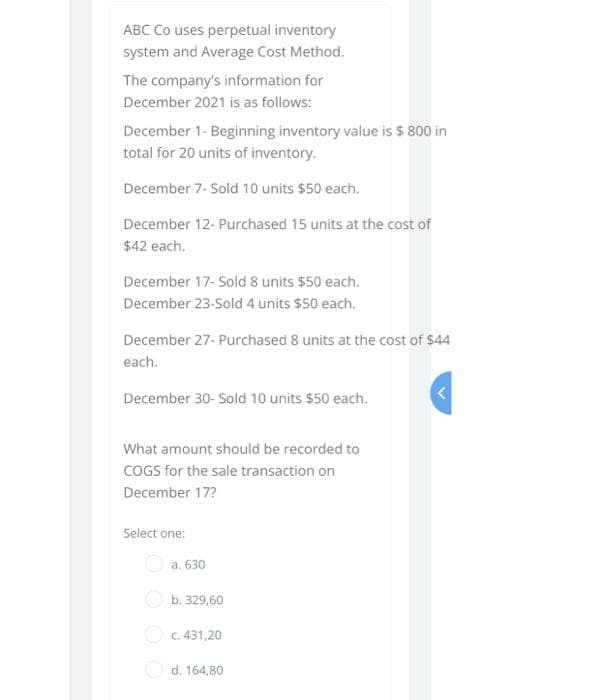

ABC Co uses perpetual inventory system and Average Cost Method. The company's information for December 2021 is as follows: December 1- Beginning inventory value is $ 800 in total for 20 units of inventory. December 7- Sold 10 units $50 each. December 12- Purchased 15 units at the cost of $42 each. December 17- Sold 8 units $50 each. December 23-Sold 4 units $50 each. December 27- Purchased 8 units at the cost of $44 each. December 30- Sold 10 units $50 each. What amount should be recorded to COGS for the sale transaction on December 17? Select one: O a. 630 Ob. 329,60 Oc. 431,20 O d. 164,80

ABC Co uses perpetual inventory system and Average Cost Method. The company's information for December 2021 is as follows: December 1- Beginning inventory value is $ 800 in total for 20 units of inventory. December 7- Sold 10 units $50 each. December 12- Purchased 15 units at the cost of $42 each. December 17- Sold 8 units $50 each. December 23-Sold 4 units $50 each. December 27- Purchased 8 units at the cost of $44 each. December 30- Sold 10 units $50 each. What amount should be recorded to COGS for the sale transaction on December 17? Select one: O a. 630 Ob. 329,60 Oc. 431,20 O d. 164,80

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 11RE: Jessie Stores uses the periodic system of calculating inventory. The following information is...

Related questions

Topic Video

Question

Transcribed Image Text:ABC Co uses perpetual inventory

system and Average Cost Method.

The company's information for

December 2021 is as follows:

December 1- Beginning inventory value is $ 800 in

total for 20 units of inventory.

December 7- Sold 10 units $50 each.

December 12- Purchased 15 units at the cost of

$42 each.

December 17- Sold 8 units $50 each.

December 23-Sold 4 units $50 each.

December 27- Purchased 8 units at the cost of $44

each.

December 30- Sold 10 units $50 each.

What amount should be recorded to

COGS for the sale transaction on

December 17?

Select one:

a. 630

O b. 329,60

O c. 431,20

O d. 164,80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT