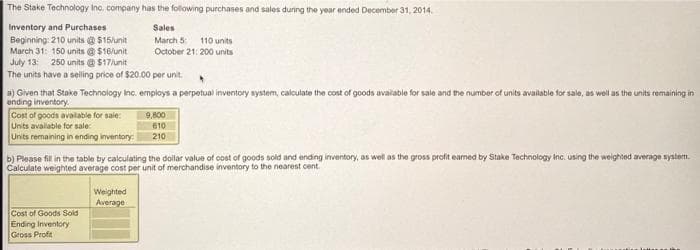

The Stake Technology Inc. company has the following purchases and sales during the year ended December 31, 2014, Inventory and Purchases Sales Beginning: 210 units @ $15/unit March 5: 110 units October 21:200 units March 31: 150 units @ $16/unit July 13: 250 units @ $17/unit The units have a selling price of $20.00 per unit. a) Given that Stake Technology Inc. employs a perpetual inventory system, calculate the cost of goods available for sale and the number of units available for sale, ending inventory. Cost of goods available for sale: Units available for sale: Units remaining in ending inventory: Cost of Goods Sold Ending Inventory Gross Profit 9,800 610 210 b) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit eamed by Stake Technology Inc. using the weighted average system. Calculate weighted average cost per unit of merchandise inventory to the nearest cent Weighted Average is the units remaining in

The Stake Technology Inc. company has the following purchases and sales during the year ended December 31, 2014, Inventory and Purchases Sales Beginning: 210 units @ $15/unit March 5: 110 units October 21:200 units March 31: 150 units @ $16/unit July 13: 250 units @ $17/unit The units have a selling price of $20.00 per unit. a) Given that Stake Technology Inc. employs a perpetual inventory system, calculate the cost of goods available for sale and the number of units available for sale, ending inventory. Cost of goods available for sale: Units available for sale: Units remaining in ending inventory: Cost of Goods Sold Ending Inventory Gross Profit 9,800 610 210 b) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit eamed by Stake Technology Inc. using the weighted average system. Calculate weighted average cost per unit of merchandise inventory to the nearest cent Weighted Average is the units remaining in

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Topic Video

Question

100%

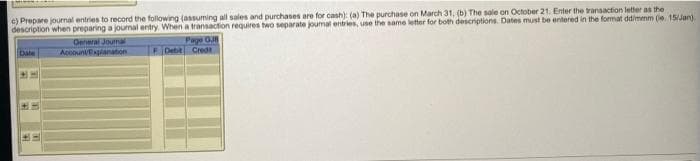

Transcribed Image Text:c) Prepare journal entries to record the following (assuming all sales and purchases are for cash): (a) The purchase on March 31, (b) The sale on October 21. Enter the transaction letter as the

description when preparing a journal entry. When a transaction requires two separate joumal entries, use the same letter for both descriptions. Dates must be entered in the format ddimmm (ie. 15/Jan).

Page GJE

Date

1

General Journal

Accoun/Explanation

Debit Credit

Transcribed Image Text:The Stake Technology Inc. company has the following purchases and sales during the year ended December 31, 2014.

Sales

March 5: 110 units

October 21: 200 units

Inventory and Purchases

Beginning: 210 units @ $15/unit

March 31: 150 units @ $16/unit

July 13: 250 units @ $17/unit

The units have a selling price of $20.00 per unit.

a) Given that Stake Technology Inc. employs a perpetual inventory system, calculate the cost of goods available for sale and the number of units available for sale, as well as the units remaining in

ending inventory.

Cost of goods available for sale:

Units available for sale:

Units remaining in ending inventory:

b) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit eamed by Stake Technology Inc. using the weighted average system.

Calculate weighted average cost per unit of merchandise inventory to the nearest cent

Cost of Goods Sold

Ending Inventory

Gross Profit

9,800

610

210

Weighted

Average

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning