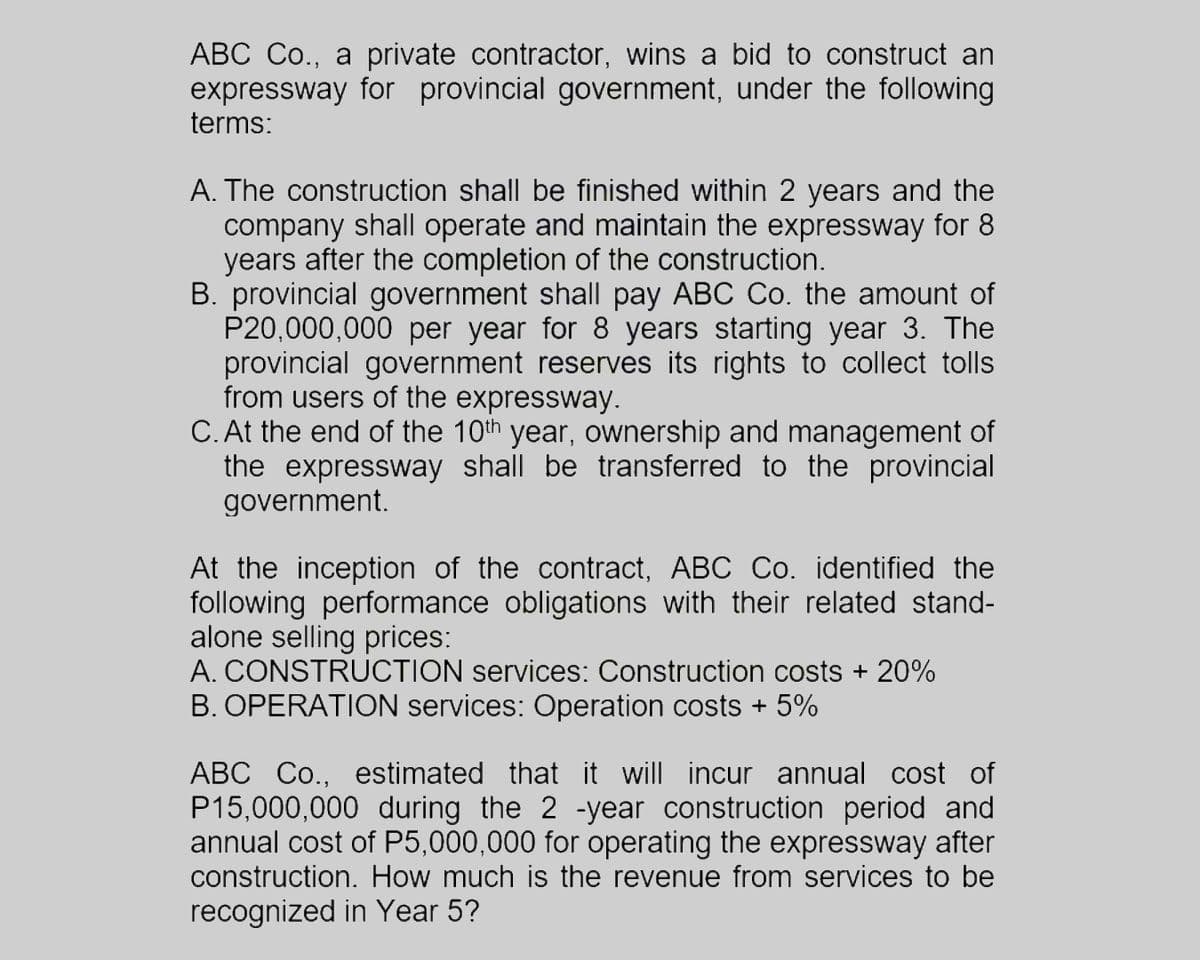

ABC Co., a private contractor, wins a bid to construct an expressway for provincial government, under the following terms: A. The construction shall be finished within 2 years and the company shall operate and maintain the expressway for 8 years after the completion of the construction. B. provincial government shall pay ABC Co. the amount of P20,000,000 per year for 8 years starting year 3. The provincial government reserves its rights to collect tolls from users of the expressway. C. At the end of the 10th year, ownership and management of the expressway shall be transferred to the provincial government. At the inception of the contract, ABC Co. identified the following performance obligations with their related stand- alone selling prices: A. CONSTRUCTION services: Construction costs + 20% B. OPERATION services: Operation costs + 5% ABC Co., estimated that it will incur annual cost of P15,000,000 during the 2 -year construction period and annual cost of P5,000,000 for operating the expressway after construction. How much is the revenue from services to be recognized in Year 5?

ABC Co., a private contractor, wins a bid to construct an expressway for provincial government, under the following terms: A. The construction shall be finished within 2 years and the company shall operate and maintain the expressway for 8 years after the completion of the construction. B. provincial government shall pay ABC Co. the amount of P20,000,000 per year for 8 years starting year 3. The provincial government reserves its rights to collect tolls from users of the expressway. C. At the end of the 10th year, ownership and management of the expressway shall be transferred to the provincial government. At the inception of the contract, ABC Co. identified the following performance obligations with their related stand- alone selling prices: A. CONSTRUCTION services: Construction costs + 20% B. OPERATION services: Operation costs + 5% ABC Co., estimated that it will incur annual cost of P15,000,000 during the 2 -year construction period and annual cost of P5,000,000 for operating the expressway after construction. How much is the revenue from services to be recognized in Year 5?

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 85P

Related questions

Question

Transcribed Image Text:ABC Co., a private contractor, wins a bid to construct an

expressway for provincial government, under the following

terms:

A. The construction shall be finished within 2 years and the

company shall operate and maintain the expressway for 8

years after the completion of the construction.

B. provincial government shall pay ABC Co. the amount of

P20,000,000 per year for 8 years starting year 3. The

provincial government reserves its rights to collect tolls

from users of the expressway.

C. At the end of the 10th year, ownership and management of

the expressway shall be transferred to the provincial

government.

At the inception of the contract, ABC Co. identified the

following performance obligations with their related stand-

alone selling prices:

A. CONSTRUCTION services: Construction costs + 20%

B. OPERATION services: Operation costs + 5%

ABC Co., estimated that it will incur annual cost of

P15,000,000 during the 2 -year construction period and

annual cost of P5,000,000 for operating the expressway after

construction. How much is the revenue from services to be

recognized in Year 5?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning