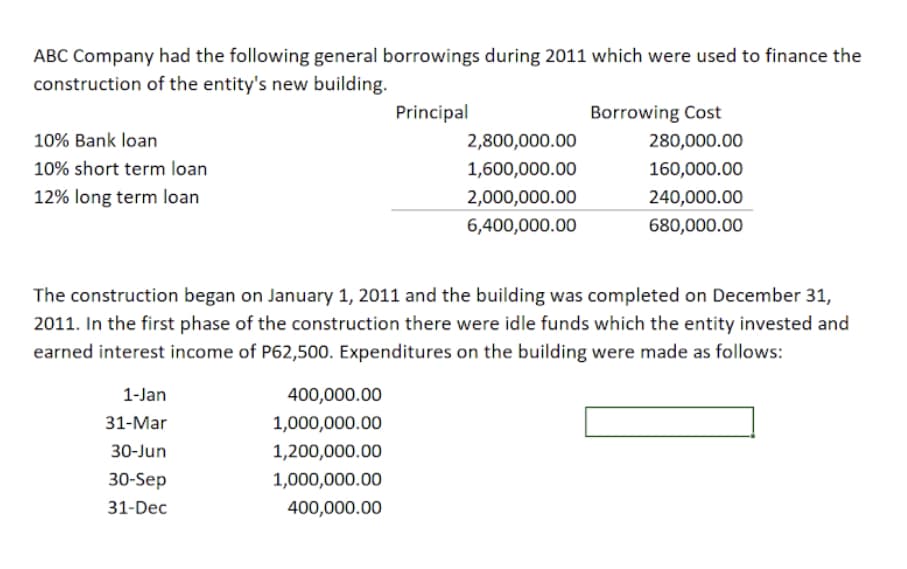

ABC Company had the following general borrowings during 2011 which were used to finance the construction of the entity's new building. Principal Borrowing Cost 10% Bank loan 2,800,000.00 280,000.00 10% short term loan 1,600,000.00 160,000.00 12% long term loan 2,000,000.00 240,000.00 6,400,000.00 680,000.00 The construction began on January 1, 2011 and the building was completed on December 31, 2011. In the first phase of the construction there were idle funds which the entity invested and earned interest income of P62,500. Expenditures on the building were made as follows: 1-Jan 400,000.00 31-Mar 1,000,000.00 30-Jun 1,200,000.00 30-Sep 1,000,000.00 31-Dec 400,000.00

ABC Company had the following general borrowings during 2011 which were used to finance the construction of the entity's new building. Principal Borrowing Cost 10% Bank loan 2,800,000.00 280,000.00 10% short term loan 1,600,000.00 160,000.00 12% long term loan 2,000,000.00 240,000.00 6,400,000.00 680,000.00 The construction began on January 1, 2011 and the building was completed on December 31, 2011. In the first phase of the construction there were idle funds which the entity invested and earned interest income of P62,500. Expenditures on the building were made as follows: 1-Jan 400,000.00 31-Mar 1,000,000.00 30-Jun 1,200,000.00 30-Sep 1,000,000.00 31-Dec 400,000.00

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 18E

Related questions

Question

What is the amount of capitalizable borrowing cost?

A. 680,000

B. 150,000

C. 212,500

D. 425,000

Transcribed Image Text:ABC Company had the following general borrowings during 2011 which were used to finance the

construction of the entity's new building.

Principal

Borrowing Cost

10% Bank loan

2,800,000.00

280,000.00

10% short term loan

1,600,000.00

160,000.00

12% long term loan

2,000,000.00

240,000.00

6,400,000.00

680,000.00

The construction began on January 1, 2011 and the building was completed on December 31,

2011. In the first phase of the construction there were idle funds which the entity invested and

earned interest income of P62,500. Expenditures on the building were made as follows:

1-Jan

400,000.00

31-Mar

1,000,000.00

30-Jun

1,200,000.00

30-Sep

1,000,000.00

31-Dec

400,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning