ABC Company prepares quarterly calendar interim financial reports. Entity sells goods and normally 8% of customers claim on their warranty.

ABC Company prepares quarterly calendar interim financial reports. Entity sells goods and normally 8% of customers claim on their warranty.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 31E

Related questions

Question

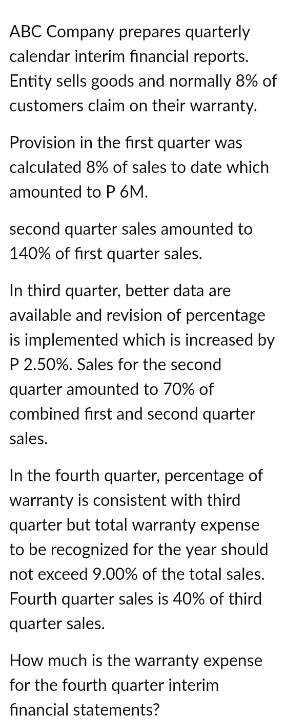

Transcribed Image Text:ABC Company prepares quarterly

calendar interim financial reports.

Entity sells goods and normally 8% of

customers claim on their warranty.

Provision in the first quarter was

calculated 8% of sales to date which

amounted to P 6M.

second quarter sales amounted to

140% of first quarter sales.

In third quarter, better data are

available and revision of percentage

is implemented which is increased by

P 2.50%. Sales for the second

quarter amounted to 70% of

combined first and second quarter

sales.

In the fourth quarter, percentage of

warranty is consistent with third

quarter but total warranty expense

to be recognized for the year should

not exceed 9.00% of the total sales.

Fourth quarter sales is 40% of third

quarter sales.

How much is the warranty expense

for the fourth quarter interim

financial statements?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College