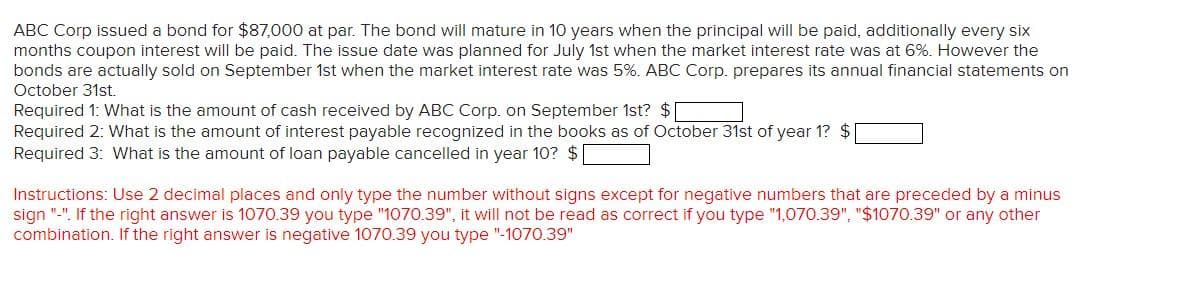

ABC Corp issued a bond for $87,000 at par. The bond will mature in 10 years when the principal will be paid, additionally every six months coupon interest will be paid. The issue date was planned for July 1st when the market interest rate was at 6%. However the bonds are actually sold on September 1st when the market interest rate was 5%. ABC Corp. prepares its annual financial statements on October 31st. Required 1: What is the amount of cash received by ABC Corp. on September 1st? $ Required 2: What is the amount of interest payable recognized in the books as of October 31st of year 1? $ Required 3: What is the amount of loan payable cancelled in year 10? $ Instructions: Use 2 decimal places and only type the number without signs except for negative numbers that are preceded by a minus sign "-". If the right answer is 1070.39 you type "1070.39", it will not be read as correct if you type "1,070.39", "$1070.39" or any other combination. If the right answer is negative 1070.39 you type "-1070.39"

ABC Corp issued a bond for $87,000 at par. The bond will mature in 10 years when the principal will be paid, additionally every six months coupon interest will be paid. The issue date was planned for July 1st when the market interest rate was at 6%. However the bonds are actually sold on September 1st when the market interest rate was 5%. ABC Corp. prepares its annual financial statements on October 31st. Required 1: What is the amount of cash received by ABC Corp. on September 1st? $ Required 2: What is the amount of interest payable recognized in the books as of October 31st of year 1? $ Required 3: What is the amount of loan payable cancelled in year 10? $ Instructions: Use 2 decimal places and only type the number without signs except for negative numbers that are preceded by a minus sign "-". If the right answer is 1070.39 you type "1070.39", it will not be read as correct if you type "1,070.39", "$1070.39" or any other combination. If the right answer is negative 1070.39 you type "-1070.39"

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

Transcribed Image Text:ABC Corp issued a bond for $87,000 at par. The bond will mature in 10 years when the principal will be paid, additionally every six

months coupon interest will be paid. The issue date was planned for July 1st when the market interest rate was at 6%. However the

bonds are actually sold on September 1st when the market interest rate was 5%. ABC Corp. prepares its annual financial statements on

October 31st.

Required 1: What is the amount of cash received by ABC Corp. on September 1st? $

Required 2: What is the amount of interest payable recognized in the books as of October 31st of year 1? $

Required 3: What is the amount of loan payable cancelled in year 10? $

Instructions: Use 2 decimal places and only type the number without signs except for negative numbers that are preceded by a minus

sign "-". If the right answer is 1070.39 you type "1070.39", it will not be read as correct if you type "1,070.39", "$1070.39" or any other

combination. If the right answer is negative 1070.39 you type "-1070.39"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College