Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following Prepare the master budget Set target levels of perfomance for fexibie budpets dentity performance standards Set sales prices of products and servioes Decrease accounting costs Requirement 2. Calcuate the direct materials coat variance and the direct materials effciency variance as well as the dieect labor cost and efficiency variances. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identily whether each variance ia favorable (F) or untavorabie (U), (Abbreviations used ACactual cost. AQactual quartiny FOH feed overthead SC standard cost sa tandard quantty) Formula Variance Direct materiais cost variance Requirements Direct labor cost variance 1. What are the benefits of setting cost standards? Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances. Print Done

Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following Prepare the master budget Set target levels of perfomance for fexibie budpets dentity performance standards Set sales prices of products and servioes Decrease accounting costs Requirement 2. Calcuate the direct materials coat variance and the direct materials effciency variance as well as the dieect labor cost and efficiency variances. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identily whether each variance ia favorable (F) or untavorabie (U), (Abbreviations used ACactual cost. AQactual quartiny FOH feed overthead SC standard cost sa tandard quantty) Formula Variance Direct materiais cost variance Requirements Direct labor cost variance 1. What are the benefits of setting cost standards? Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances. Print Done

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 13E: Wyandotte Company provided the following information for the last calendar year: During the year,...

Related questions

Question

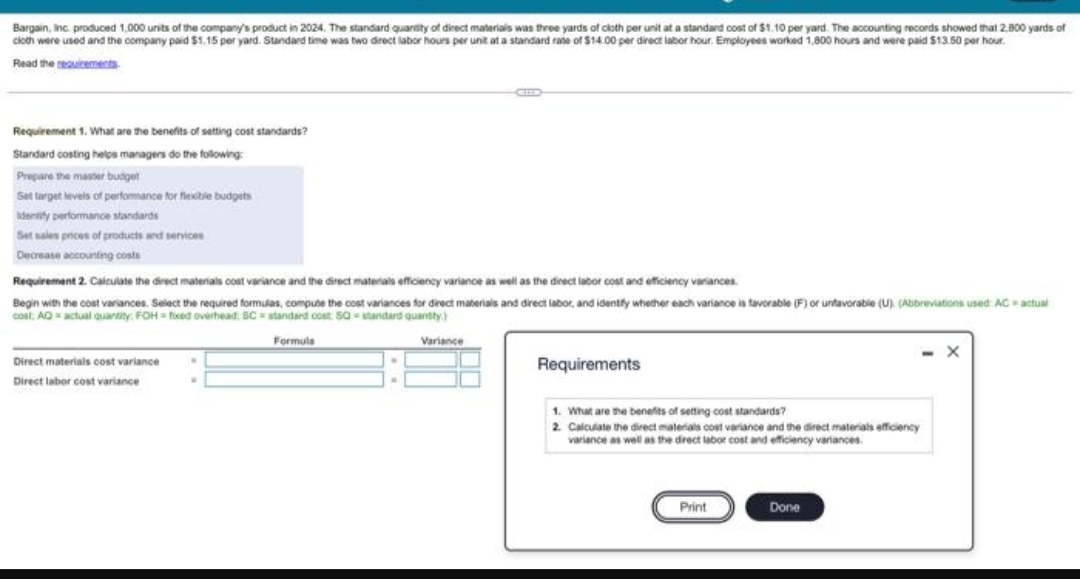

Transcribed Image Text:Bargain, Inc. produced 1.000 units of the company's product in 2024. The standard quandity of direct materials was three yards of cloth per unit at a standard cost of $1.10 per yard. The accounting records showed that 2,800 yards of

cioth were used and the company paid $1.15 per yard. Standard time was two direct labor hours per unit at a standard rate of $14.00 per direct labor hour. Employees worked 1,800 hours and were paid $13.50 per hour.

Read the seauiements

Requirement 1. What are the benefits of setting cost standards?

Standard costing helps managers do the following

Prepare the master budget

Set target levels of perfomance for fleibie budgets

dentity performance standards

Set sales prices of products and services

Decrease accounting costs

Requirement 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances

Begin with the cost variances. Select the required formulas, compute the cost variances for direct maberials and direct labor, and idently whether each variance ia favorable (F) or unfavorable (U). (Abbreviations used ACactual

cost, AQactual quantity. FOH= fced overhead, SC = standard cost Sa standard quantty.)

Formula

Variance

Direct materials oost variance

Requirements

Direct labor cost variance

1. What are the benefits of seting cost standards?

2. Calculate the direct materials cost variance and the direct materials efficiency

variance as well as the direct labor cost and efficiency variances.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,