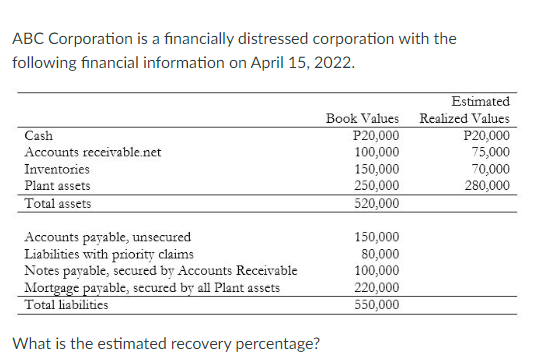

ABC Corporation is a financially distressed corporation with the following financial information on April 15, 2022. Estimated Book Values Realized Values P20,000 100,000 150,000 250,000 520,000 Cash P20,000 75,000 70,000 280,000 Accounts receivable.net Inventories Plant assets Total assets Accounts payable, unsecured Liabilities with priority claims Notes payable, secured by Accounts Receivable Mortgage payable, secured by all Plant assets Total liabilities 150,000 80,000 100,000 220,000 550,000

Q: Amount Sales 123,000 Variable expenses 49,200 Contribution margin 73,800 Fixed expenses 24,000 Net…

A: Formula used: Degree of operating leverage = ( Total contribution margin / Net operating income )…

Q: For the coming period Candy has budgeted to purchase and use 41,650 ounces of icing at $0.21 an…

A: 1. Flexible-budget variance =Actual Cost Incurred - Budgeted cost for actual oitput= 43,000…

Q: Question 3 Aminu Ltd started a delivery service, Aminu Ltd Deliveries, on June 1, 20X1. The…

A: Income statement determines the net income of the company. Statement of financial position…

Q: The assets and liabilities of Matt Wesley Auto Shop are as follows: Cash, S10,000; Accounts…

A: Introduction: Accounting equation: Sum of Liabilities and owner equity value derives the Total…

Q: On March 31, 2021, Susquehanna Insurance purchased an office building for $10,200,000. Based on…

A: The question is related to Depreciation Accounting. Depreciation reduces the value of the assets…

Q: n from the separ ome of P Compa as follows: ial position acco ..... ...

A: Given The percent of non-controlling interest ownership in S Company as of December 31, 2019.

Q: luded merchandise purchased from N Company amounting to P39,000 which was sold to them by

A: Equity shareholder's net income is the net income of the parent adjusted for the intercompany…

Q: Exercise 10-26 (Algo) Research and development [LO10-8] In 2021, Space Technology Company modified…

A: A journal entry is used to document a business deal in a company's accounting records. A journal…

Q: ABC and XYZ establish a joint arrangement using a separate vehicle. The legal form of the separate…

A: A joint arrangement is one in which two or more parties have shared control. A distinct vehicle is…

Q: How is the Non-Controlling Interest displayed in a consolidated balance sheet? a. As a separate…

A: Introduction:- Non-controlling interest occurred in business combination. The parent acquires less…

Q: Gelbart Company manufactures gas grills. Fixed costs amount to $16,335,000 per year. Variablecosts…

A: The break-even point seems to be the output level where the total revenues equals total costs. In…

Q: Required:1. Compute the ROI and the margin and turnover ratios for each year for the…

A: Margin refers to the operating income expressed as a percentage of sales.

Q: 1 18rohto s profit ar net as of the last five years is as IOws: Net Assets Profit P 4,000,000…

A: Calculation of Goodwill on acquisition Good Will Valuation

Q: Compa placing 2 150.

A: Since you have asked multiple questions, we will solve the first question with its sub-parts for…

Q: Changes in Current Operating Assets and Liabilities—Indirect Method Mohammed Corporation's…

A: The question is based on the concept of Cash flow Statement. Cash flow statement is the statement…

Q: On January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the…

A: The excess of the purchase amount paid for an acquired firm above the amount of the price not…

Q: Vet-Pro, Ic., produces a veterinary grade anti-anxiety mixture for pets with behavioral prob- lems.…

A: Variance refers to the difference of budgeted and actual revenues and expenditures.

Q: Determine the break-even quantity and margin of safety (units and value) if com sold 8,000 units of…

A: Break Even Point is the level of sales where the company neither earns any profits nor incurs any…

Q: 1. A is defined as a business that does work for a customer and occasionally provides goods, but is…

A: A _____ is defined as a business that does work for a customer and occasionally provide goods, but…

Q: 14. Zelgius, Ike, and Greil are partners in an accounting firm. Their ending capital balances were:…

A: Answer) Calculation of Greil’s Share in Total Profits Greil’s share in Total Profits = Greil’s…

Q: In September Manson Paint Corporation began operations in a state that requires new employers of one…

A: Employers must pay the FUTA unemployment tax. The Federal Unemployment Tax Act (FUTA) is an…

Q: What is the difference between tax rates and tax rate structures? How does this notion of…

A: Income tax payable is an obligation for the tax payers to the government on the taxable income.…

Q: On March 31, 2021, management of Quality Appliances committed to a plan to sell equipment. The…

A: The question is related to the Depreciation Accounting. The Depreciation as ler Straight-line Method…

Q: If JoBlo Inc., has a retained earnings opening balance of $50,000 at the beginning of the and an…

A: Formula: Ending Retained Earnings balance = Beginning Retained Earnings + Net income - Dividends…

Q: Current Attempt in Progress Blossom Company provides the following information about its defined…

A: Pension expenses- Pension expense is the amount that a company charges to expense in relation to its…

Q: only interested in measuring cash flows when they actually occur, not when they accrue as an…

A: the company makes an investment in the project an individual make investment in various types of…

Q: egarding the confirmation of accounts payable is true? Group of answer choices The confirmation of…

A: it is important to understand the client account payable and account receivable valences in order to…

Q: Complete Shadee's budgeted income statement for the months of May and June. Required information…

A: Budgeted income statement.

Q: 1.Equipment Capital 1. The owner invests equipment in the business. 2. The company receives cash…

A: The business transactions affects two or more accounts of the business where one account is credited…

Q: What is the advantage and disadvantage of paying your employees stock option?

A: employee stock option plan is a plan that gives benefit to the employees ownership or shares in the…

Q: niums and discounts on a straight line basis. Sneezy Ltd. has a January 31 year end. uired: 1.…

A: Accounting for Bond

Q: Cash Flows from Operating Activities—Indirect Method Staley Inc. reported the following data: Net…

A: Cash flow from operating activities indicates the amount of money a company brings in form its…

Q: A manufacturing company has budgeted a manufacturing level of 100,000 units. The manufacturing unit…

A: Variance costing is a method in the costing system under which various types of variances are…

Q: A workers wages for a guaranteed 44 hours per week is 0.75 per hour the estimated time to produce 1…

A: “Halsey premium plan is a simple combination of time and speed bases of payment. Under this plan, a…

Q: hat is the amount of the monthly principal and interest portion, PI, of Michael's n? Purchase price…

A: Concept of Loan Amortisation

Q: Home ownership has other expenses, including taxes, homeowner's insurance and utilities. The annual…

A: Amount borrowed = $145,000 a) Annual property tax = 1% of amount borrowed = $145,000×1%=$1,450…

Q: At the end of the prior year ending on December 31, Year 1, O'Connor Company's records reflected the…

A: A journal entry is often recorded in the main ledger; however, it may also be entered in a…

Q: Equipment for immersion cooling of electronic components has an installed value of P 819,000 with an…

A: The question is based on the concept of Depreciation Accounting. Depreciation is the reduction in…

Q: he image belo

A: Consolidated Statement: Consolidated statement is the accounting report of both the parent company…

Q: Assuming the taxpayer is a CORPORATION, how much is the OSD and net taxable income using OSD?

A: Tax Tax refers to the compulsory payment made by individuals or corporations to the government.…

Q: 5. S1: Consolidated statements worksheet elimination of intercompany sales of inventory does affect…

A: Basic Concept of Consolidation of financial Statement.

Q: Bollozos Afterlife Corporation's Division A manufactures and sells product Brand X, which is used in…

A: Lets understand the basics. Transfer price is a price which is determine for transferring goods from…

Q: low much more total interest will be paid on a 30-year fixed-rate mortgage or $100,000 at 9.25%…

A: Interest- Interest is defined as the amount paid by the borrower to the lender over and above the…

Q: Problem 24-8 (IFRS) Preposterous Company received a government grant of P2,000,000 related to a…

A: Government grant means the amount received from government free of cost . It is received by…

Q: Since the SUTA rates changes are made at the end of each year, the available 2019 rates were used…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: On January, 2018 Leni Corp. grants each of its 200 employees in the production department share…

A: On Jan 2018, Leni Corp. grants 200 Employees in the Production Department Share Options. Actual…

Q: On January 3, 2018, Maris Corporation issued 4,000 shares of $50 par convertible preferred stock at…

A: Additional paid in capital Excessof par - preferred = Number of preferences shares issued × Premium…

Q: Tristen Company purchased a five-story office building on January 1, 2019, at a cost of $6,400,000.…

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage ,…

Q: Patent cost is $ 18000 , life of it is 18 years, calculat the first year amortízation expense.

A: Formula used: Amortization expense per year = Patent cost / Useful life

Q: ______ P120,000 Expense 35,000 35,000 _____________ Profit/(Loss) P _________…

A: Revenue is the total value of all goods and services sold by a company within a given time period.…

Step by step

Solved in 2 steps

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossDistressed Corporation is undergoing liquidation. Relevant information as of January 1, 20x1 is shown below:ASSETSCarryingAmountNet RealizableValueCash P250,000 P300,000Accounts Receivable 150,000 355,649Equipment-net 600,000 200,000Land 1,700,000 1,500,000TOTAL ASSETS P2,700,000 P2,355,649LIABILITIESCarryingAmountSettlementAmountAccounts Payable P1,000,000 P1,000,000Salaries Payable 500,000 500,000Notes Payable 800,000 805,234Loan Payable 800,000 800,000TOTAL LIABILITIES P3,100,000 P3,105,234EQUITYShare Capital P1,600,000Retained Earnings (2,000,000)Capital Deficiency (400,000)TOTAL LIABILITIES & EQUITY P2,700,000Additional Information:• Administrative expenses amounting to P180,744 are expected to be incurred during the liquidationprocess.• The equipment is pledged to the loan payable.• The land is pledged to the notes payable.QUESTIONS:1. What is the amount paid to unsecured creditors without priority? 2. What is the amount paid to partially secured creditors?Distressed Corporation is undergoing liquidation. Relevant information as of January 1, 20x1 is shown below:ASSETSCarryingAmountNet RealizableValueCash P250,000 P300,000Accounts Receivable 150,000 355,649Equipment-net 600,000 200,000Land 1,700,000 1,500,000TOTAL ASSETS P2,700,000 P2,355,649LIABILITIESCarryingAmountSettlementAmountAccounts Payable P1,000,000 P1,000,000Salaries Payable 500,000 500,000Notes Payable 800,000 805,234Loan Payable 800,000 800,000TOTAL LIABILITIES P3,100,000 P3,105,234EQUITYShare Capital P1,600,000Retained Earnings (2,000,000)Capital Deficiency (400,000)TOTAL LIABILITIES & EQUITY P2,700,000Additional Information:• Administrative expenses amounting to P180,744 are expected to be incurred during the liquidationprocess.• The equipment is pledged to the loan payable.• The land is pledged to the notes payable.QUESTIONS:1. How much are the total free assets? _____________2. How much are the unsecured liabilities with priority? _____________3. How much are the…

- Distressed Corporation is undergoing liquidation. Relevant information as of January 1, 20x1 is shown below:ASSETSCarrying AmountNet Realizable ValueCash P250,000 P300,000Accounts Receivable 150,000 355,649Equipment-net 600,000 200,000Land 1,700,000 1,500,000TOTAL ASSETS P2,700,000 P2,355,649LIABILITIESCarrying AmountSettlement AmountAccounts Payable P1,000,000 P1,000,000Salaries Payable 500,000 500,000Notes Payable 800,000 805,234Loan Payable 800,000 800,000TOTAL LIABILITIES P3,100,000 P3,105,234EQUITYShare Capital P1,600,000Retained Earnings (2,000,000)Capital Deficiency (400,000)TOTAL LIABILITIES & EQUITY P2,700,000Additional Information:• Administrative expenses amounting to P180,744 are expected to be incurred during the liquidation process.• The equipment is pledged to the loan payable.• The land is pledged to the notes payable.QUESTIONS:1. How much are the total free assets? _____________2. How much are the unsecured liabilities with priority? _____________3. How much are…Distressed Corporation is undergoing liquidation. Relevant information as of January 1, 20x1 is shown below:ASSETSCarrying AmountNet Realizable ValueCash P250,000 P300,000Accounts Receivable 150,000 355,649Equipment-net 600,000 200,000Land 1,700,000 1,500,000TOTAL ASSETS P2,700,000 P2,355,649LIABILITIESCarrying AmountSettlement AmountAccounts Payable P1,000,000 P1,000,000Salaries Payable 500,000 500,000Notes Payable 800,000 805,234Loan Payable 800,000 800,000TOTAL LIABILITIES P3,100,000 P3,105,234EQUITYShare Capital P1,600,000Retained Earnings (2,000,000)Capital Deficiency (400,000)TOTAL LIABILITIES & EQUITY P2,700,000Additional Information:• Administrative expenses amounting to P180,744 are expected to be incurred during the liquidation process.• The equipment is pledged to the loan payable.• The land is pledged to the notes payable. QUESTIONS: 7. What is the amount paid to unsecured creditors without priority? _____________8. What is the amount paid to partially secured…Distressed Corporation is undergoing liquidation. Relevant information as of January 1, 20x1 is shown below:ASSETSCarrying AmountNet Realizable ValueCash P250,000 P300,000Accounts Receivable 150,000 355,649Equipment-net 600,000 200,000Land 1,700,000 1,500,000TOTAL ASSETS P2,700,000 P2,355,649LIABILITIESCarrying AmountSettlement AmountAccounts Payable P1,000,000 P1,000,000Salaries Payable 500,000 500,000Notes Payable 800,000 805,234Loan Payable 800,000 800,000TOTAL LIABILITIES P3,100,000 P3,105,234EQUITYShare Capital P1,600,000Retained Earnings (2,000,000)Capital Deficiency (400,000)TOTAL LIABILITIES & EQUITY P2,700,000Additional Information:• Administrative expenses amounting to P180,744 are expected to be incurred during the liquidation process.• The equipment is pledged to the loan payable.• The land is pledged to the notes payable. QUESTIONS: 4. How much are the net free assets? _____________5. What is the estimated deficiency? _____________6. What is the estimated recovery…

- When preparing a draft of its 2020 statement of financial position, A Inc. reported net assets totaling P875,000. Included in the asset section of the statement of financial position were the following: Treasury shares of Mount, Inc. at cost, which approximates market value P24,000 Idle machinery 11,200 Cash surrender value of life insurance policy on corporate executives 13,700 Allowance for decline in market value of available-for-sale securities 8,400 At what amount should A’s net assets be reported in the December 31, 2020 statement of financial position?The following selected account balances were taken from the balance sheet of Q Corp. as of December 31, 2021, immediately before the take over of the trustee: Marketable securities P300,000; Inventories P110,000; Land P150,000; Building P400,000. Marketable securities have present market value of P320,000. These securities have been pledged to secure notes payable of P280,000. The estimated worth of inventories of P70,000. However, inventories with book value of P50,000 have been pledged to secure notes payable of P60,000. The realizable value of the inventories pledged estimated to be P40,000. The land and building are estimated to have a total realizable value of P450,000. This property was pledged to secure the mortgage payable of P250,000. What is the amount available for preferred claims and unsecured creditors out of assets pledged with fully secured creditors?The following selected account balances were taken from the balance sheet of Q Corp. as of December 31, 2021, immediately before the take over of the trustee; Marketable securities P300,000; Inventories P110,000; Land P150,000; Building P400,000; Marketable securities have present market value of P320,000. These securities have been pledged to secure notes payable of P280,000. The estimated worth of inventories of P70,000. However, inventories with book value of P50,000 have been pledged to secure notes payable of P60,000. The realizable value of the inventories pledged estimated to be P40,000. The land and building are estimated to have a total realizable value of P450,000. This property was pledged to secure the mortgage payable of P250,000. What is the amount available for preferred claims and unsecured creditors out of assets pledged with fully secured creditors? Please provide a solution. Thank you!

- Boulter, Incorporated, began business on January 1, 2024. At the end of December 2024, Boulter had the following investments in debt securities: Trading Available-for-Sale Cost $ 60,000 $ 110,000 Fair value 54,000 107,500 All declines in value are deemed to be temporary in nature. How should the corresponding losses be reflected in the financial statements at December 31, 2024? Income Statement Accumulated Other Comprehensive Income in Shareholders' Equity a. $ 8,500 $ 0 b. $ 0 $ 8,500 c. $ 6,000 $ 2,500 d. $ 2,500 $ 6,000The following selected account balances were taken from the balance sheet of Quitting Corp. as of December 31, 2020, immediately before the take over of the trustee: Marketable securities P300,000 Inventories 110,000 Land 150,000 Building 400,000 Additional information: • Marketable securities have present market value of P320,000. These securities have been pledged to secure notes payable of P280,000. • The estimated worth of inventories is P70,000. However, inventories with book value of P50,000 have been pledged to secure notes payable of P60,000. The realizable value of the inventories pledged is estimated to be P40,000. • Land and building are estimated to have a total realizable value of P450,000. This property is pledged to secure the mortgage payable of P250,000. What is the estimated amount available for preferred claims and unsecured creditors out of the assets pledged with fully secured creditors?a. P240,000b. P840,000c. P770,000ABC Company is in a capital deficiency position and is considering the possibility of liquidation. An analysis of the assets and liabilities of the entity is provided: Assets at net realizable value (pledged against liabilities of P150,000) 250,000 Assets at net realizable value (pledged against liabilities of P260,000) 100,000 Assets at net realizable value (not pledged against any liabilities) 160,000 Liabilities with priority 85,000 Unsecured creditors 400,000 Round off the estimated recovery percentage to XX.XX%, if needed. How much is the estimated payment to partially secured creditors?