ABCD Y purchased some plant on 1 January 20X0 for $38,000. The payment for the plant was correctli entered in the cash book but was entered on the debit side of the plant repairs account. 8.3 Y charges depreciation on the straight line basis at 20% per year, with a proportionate charge in years of acquisition and disposal, and assuming no scrap value at the end of the life of the asset. How will Y's profit for the year ended 31 March 20X0 be affected by the error? Understated by $30,400 Understated by $36,100 Understated by $38,000 Overstated by $1,900 (2

ABCD Y purchased some plant on 1 January 20X0 for $38,000. The payment for the plant was correctli entered in the cash book but was entered on the debit side of the plant repairs account. 8.3 Y charges depreciation on the straight line basis at 20% per year, with a proportionate charge in years of acquisition and disposal, and assuming no scrap value at the end of the life of the asset. How will Y's profit for the year ended 31 March 20X0 be affected by the error? Understated by $30,400 Understated by $36,100 Understated by $38,000 Overstated by $1,900 (2

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

Question 8.3 explanation please.

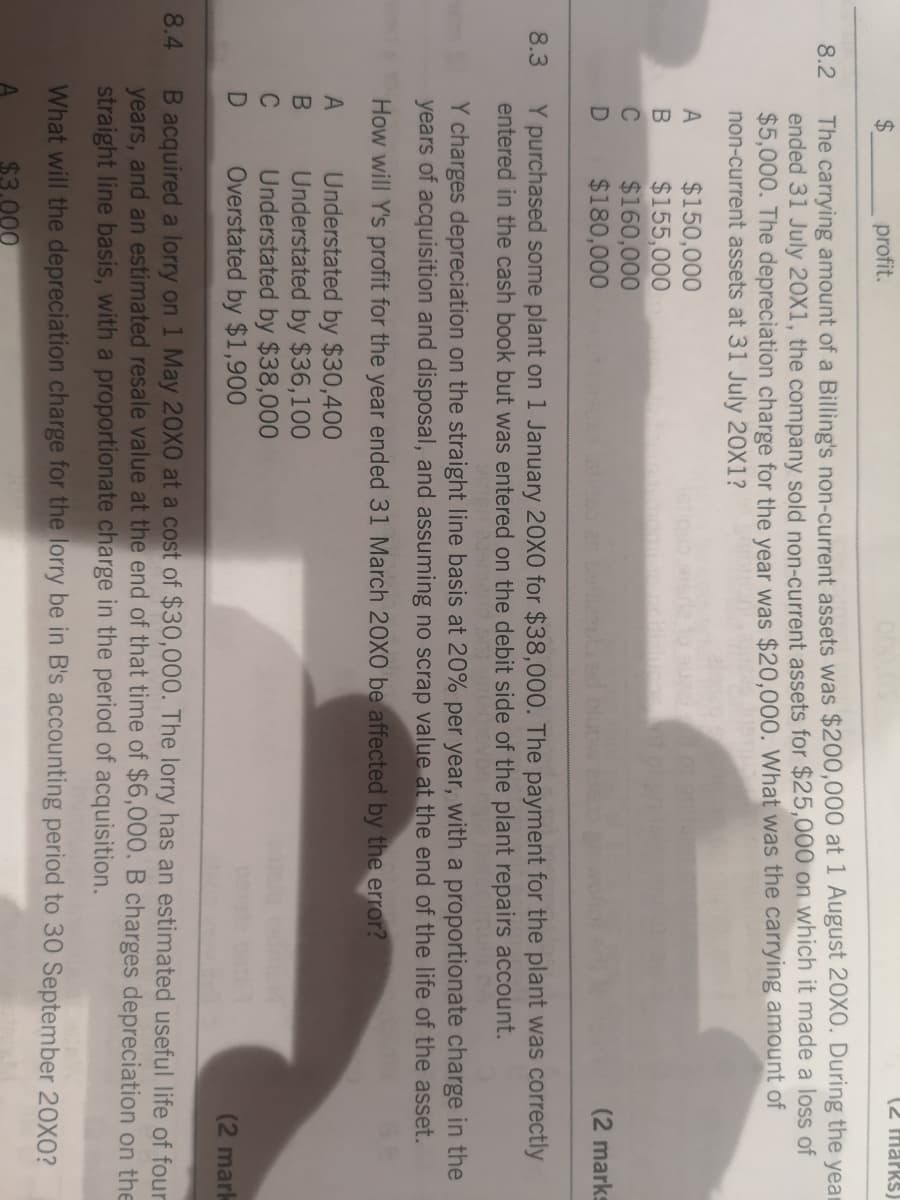

Transcribed Image Text:(2 marks)

profit.

The carrying amount of a Billing's non-current assets was $200,000 at 1 August 20X0. During the year

ended 31 July 20X1, the company sold non-current assets for $25,000 on which it made a loss of

$5,000. The depreciation charge for the year was $20,000. What was the carrying amount of

non-current assets at 31 July 20X1?

8.2

$150,000

$155,000

$160,000

$180,000

A

C

ed

(2 marks

Y purchased some plant on 1 January 20X0 for $38,000. The payment for the plant was correctly

entered in the cash book but was entered on the debit side of the plant repairs account.

8.3

Y charges depreciation on the straight line basis at 20% per year, with a proportionate charge in the

years of acquisition and disposal, and assuming no scrap value at the end of the life of the asset.

How will Y's profit for the year ended 31 March 20X0 be affected by the error?

Understated by $30,400

Understated by $36,100

Understated by $38,000

Overstated by $1,900

C

(2 mark

B acquired a lorry on 1 May 20XO at a cost of $30,000. The lorry has an estimated useful life of four

years, and an estimated resale value at the end of that time of $6,000. B charges depreciation on the

straight line basis, with a proportionate charge in the period of acquisition.

8.4

What will the depreciation charge for the lorry be in B's accounting period to 30 September 20X0?

$3.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning