Abram, Macher, and Bailey have capital balances of $20,000, $30,000, and $50,000, respectively. The partners share profits and losses as follows: The first $30,000 is divided based on the partners' capital balances. b. The next $30,000 is based on service, shared equally by Abram and Bailey. Macher does not receive a salary allowance. c. The remainder is divided equally. Read the requirements Requirement 1. Compute each partner's share of the $78,000 net income for the year. (Complete all answer boxes. For amounts that are $0, make sure to enter "0" in the appropriate column.) Abram Macher Bailey Total Net income (loss) Requirements Capital allocation: Abram 1. Compute each partner's share of the $78,000 net income for the year. Macher 2. Journalize the closing entry to allocate net income for the year. Bailey Salary allowance: Abram Print Done Macher Bailey Total salary and capital allocation Net income (loss) remaining for allocation

Abram, Macher, and Bailey have capital balances of $20,000, $30,000, and $50,000, respectively. The partners share profits and losses as follows: The first $30,000 is divided based on the partners' capital balances. b. The next $30,000 is based on service, shared equally by Abram and Bailey. Macher does not receive a salary allowance. c. The remainder is divided equally. Read the requirements Requirement 1. Compute each partner's share of the $78,000 net income for the year. (Complete all answer boxes. For amounts that are $0, make sure to enter "0" in the appropriate column.) Abram Macher Bailey Total Net income (loss) Requirements Capital allocation: Abram 1. Compute each partner's share of the $78,000 net income for the year. Macher 2. Journalize the closing entry to allocate net income for the year. Bailey Salary allowance: Abram Print Done Macher Bailey Total salary and capital allocation Net income (loss) remaining for allocation

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

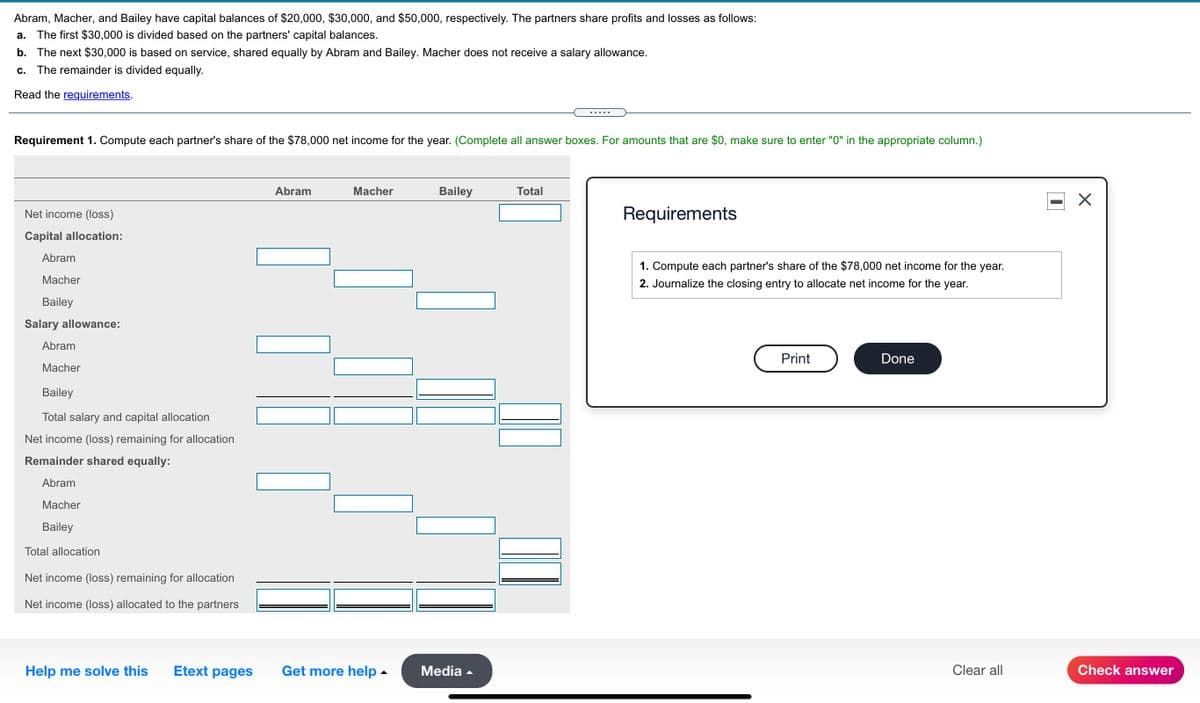

Transcribed Image Text:Abram, Macher, and Bailey have capital balances of $20,000, $30,000, and $50,000, respectively. The partners share profits and losses as follows:

a. The first $30,000 is divided based on the partners' capital balances.

b. The next $30,000 is based on service, shared equally by Abram and Bailey. Macher does not receive a salary allowance.

с.

The remainder is divided equally.

Read the requirements.

Requirement 1. Compute each partner's share of the $78,000 net income for the year. (Complete all answer boxes. For amounts that are $0, make sure to enter "0" in the appropriate column.)

Abram

Macher

Bailey

Total

Net income (Iloss)

Requirements

Capital allocation:

Abram

1. Compute each partner's share of the $78,000 net income for the year.

Мacher

2. Journalize the closing entry to allocate net income for the year.

Bailey

Salary allowance:

Abram

Print

Done

Macher

Bailey

Total salary and capital allocation

Net income (loss) remaining for allocation

Remainder shared equally:

Abram

Macher

Bailey

Total allocation

Net income (loss) remaining for allocation

Net income (loss) allocated to the partners

Help me solve this

Etext pages

Get more help -

Media -

Clear all

Check answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT