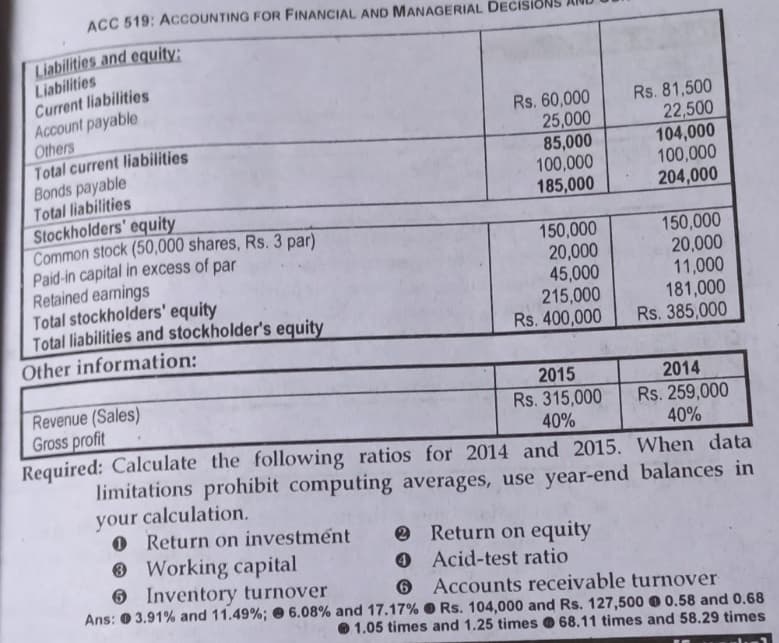

ACC 519: Liabilities and equity; Liabilities Current liabilities Account payable Others Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock (50,000 shares, Rs. 3 par) Paid-in capital in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholder's equity Other information: Rs. 60,000 25,000 85,000 100,000 185,000 150,000 20,000 45,000 Working capital 6 6 Inventory turnover Ans: 3.91% and 11.49%; 6.08% and 17.17% 215,000 Rs. 400,000 2015 Rs. 315,000 40% Rs. 81,500 22,500 104,000 100,000 204,000 150,000 20,000 11,000 181,000 Rs. 385,000 2014 Rs. 259,000 40% Revenue (Sales) Gross profit Required: Calculate the following ratios for 2014 and 2015. When data limitations prohibit computing averages, use year-end balances in your calculation. 0 Return on investment Return on equity Acid-test ratio Accounts receivable turnover Rs. 104,000 and Rs. 127,500 0.58 and 0.68 1.05 times and 1.25 times 68.11 times and 58.29 times

ACC 519: Liabilities and equity; Liabilities Current liabilities Account payable Others Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock (50,000 shares, Rs. 3 par) Paid-in capital in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholder's equity Other information: Rs. 60,000 25,000 85,000 100,000 185,000 150,000 20,000 45,000 Working capital 6 6 Inventory turnover Ans: 3.91% and 11.49%; 6.08% and 17.17% 215,000 Rs. 400,000 2015 Rs. 315,000 40% Rs. 81,500 22,500 104,000 100,000 204,000 150,000 20,000 11,000 181,000 Rs. 385,000 2014 Rs. 259,000 40% Revenue (Sales) Gross profit Required: Calculate the following ratios for 2014 and 2015. When data limitations prohibit computing averages, use year-end balances in your calculation. 0 Return on investment Return on equity Acid-test ratio Accounts receivable turnover Rs. 104,000 and Rs. 127,500 0.58 and 0.68 1.05 times and 1.25 times 68.11 times and 58.29 times

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.10E

Related questions

Question

100%

PLEASE CHECK THE ANSWER AT THE BOTTOM OF THE QUESTION TOO. DONT POST WRONG ANSWER.THANKYOU

Transcribed Image Text:ACC 519: ACCOUNTING FOR FINANCIAL AND MANAGERIAL DECISION

Liabilities and equity:

Liabilities

Current liabilities

Account payable

Others

Total current liabilities

Bonds payable

Total liabilities

Stockholders' equity

Common stock (50,000 shares, Rs. 3 par)

Paid-in capital in excess of par

Retained earnings

Total stockholders' equity

Total liabilities and stockholder's equity

Other information:

Rs. 60,000

25,000

85,000

100,000

185,000

150,000

20,000

45,000

Working capital

6

6 Inventory turnover

Ans: 3.91% and 11.49%; 6.08% and 17.17%

215,000

Rs. 400,000

2015

Rs. 315,000

40%

Rs. 81,500

22,500

104,000

100,000

204,000

150,000

20,000

11,000

181,000

Rs. 385,000

2014

Rs. 259,000

40%

Revenue (Sales)

Gross profit

Required: Calculate the following ratios for 2014 and 2015. When data

limitations prohibit computing averages, use year-end balances in

your calculation.

0 Return on investment

Return on equity

Acid-test ratio

Accounts receivable turnover

Rs. 104,000 and Rs. 127,500 0.58 and 0.68

1.05 times and 1.25 times 68.11 times and 58.29 times

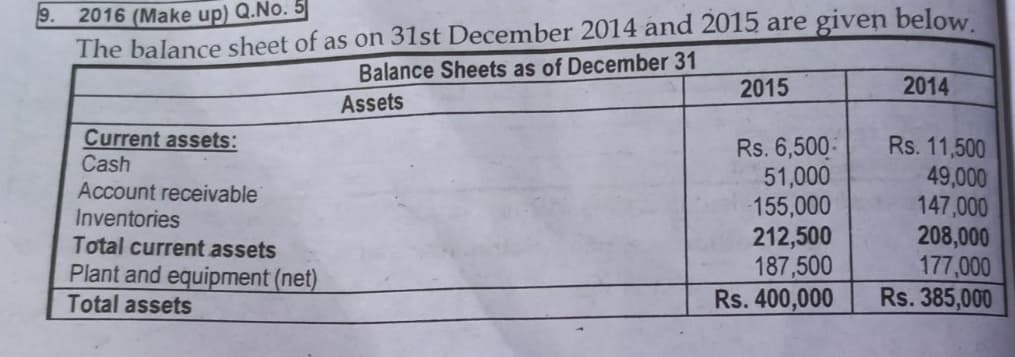

Transcribed Image Text:19. 2016 (Make up) Q.No. 5

The balance sheet of as on 31st December 2014 and 2015 are given below.

Balance Sheets as of December 31

Assets

Current assets:

Cash

Account receivable

Inventories

Total current assets

Plant and equipment (net)

Total assets

2015

Rs. 6,500-

51,000

155,000

212,500

187,500

Rs. 400,000

2014

Rs. 11,500

49,000

147,000

208,000

177,000

Rs. 385,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning