Accepting that there is now a greater need to plan properly for the future, Management has sought your help in revisiting their existing budgets, especially those affecting the cash flow of the company. It had been agreed that the company should maintain a balance of at least $ 40,000 at all times. The balance at the start of the year was $ 45,000. The current sales policy allows for all sales to be done on a credit basis with 50 % of the sales being collected in the month of sale; 40% in the next month and 10% in the second month after the sale. Sales projections for the first three months of 2021 are as follows: January February March $ 150,000 $ 160,000 $ 180,000 You have also learnt that sales in the months of November and December 2020, were $ 130,000 and $ 140,000 respectively. The purchasing policy is also under scrutiny as the market gets more demanding. Currently all purchases are on credit also and payments are made with 30% in the month of purchase, 50% in the following month and the balance in the second month. Purchases for November and December in 2020 were, $ 75,000 and $ 80,000 respectively. In 2021 these are expected to increase to $ 100,000 in January. $ 110,000 in February and $90,000 in March. In addition the company has the following monthly expenses which have to be paid: January February Мarch 30,000 20,000 35,000 15,000 7,500 4,500 Direct Labour 20,000 12,000 Selling & Administrative Expenses Maintenance Costs 5,000 3,000 3,000 2,500 Motor Vehicle Expenses

Accepting that there is now a greater need to plan properly for the future, Management has sought your help in revisiting their existing budgets, especially those affecting the cash flow of the company. It had been agreed that the company should maintain a balance of at least $ 40,000 at all times. The balance at the start of the year was $ 45,000. The current sales policy allows for all sales to be done on a credit basis with 50 % of the sales being collected in the month of sale; 40% in the next month and 10% in the second month after the sale. Sales projections for the first three months of 2021 are as follows: January February March $ 150,000 $ 160,000 $ 180,000 You have also learnt that sales in the months of November and December 2020, were $ 130,000 and $ 140,000 respectively. The purchasing policy is also under scrutiny as the market gets more demanding. Currently all purchases are on credit also and payments are made with 30% in the month of purchase, 50% in the following month and the balance in the second month. Purchases for November and December in 2020 were, $ 75,000 and $ 80,000 respectively. In 2021 these are expected to increase to $ 100,000 in January. $ 110,000 in February and $90,000 in March. In addition the company has the following monthly expenses which have to be paid: January February Мarch 30,000 20,000 35,000 15,000 7,500 4,500 Direct Labour 20,000 12,000 Selling & Administrative Expenses Maintenance Costs 5,000 3,000 3,000 2,500 Motor Vehicle Expenses

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 4P

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Prepare a

Transcribed Image Text:Accepting that there is now a greater need to plan properly for the future,

Management has sought your help in revisiting their existing budgets, especially

those affecting the cash flow of the company.

It had been agreed that the company should maintain a balance of at least

$ 40,000 at all times. The balance at the start of the year was $ 45,000.

The current sales policy allows for all sales to be done on a credit basis with 50 %

of the sales being collected in the month of sale; 40% in the next month and 10%

in the second month after the sale.

Sales projections for the first three months of 2021 are as follows:

January

February

March

$ 150,000

$ 160,000

$ 180,000

You have also learnt that sales in the months of November and December 2020,

were.$ 130,000 and $ 140,000 respectively.

The purchasing policy is also under scrutiny as the market gets more demanding.

Currently all purchases are on credit also and payments are made with 30% in

the month of purchase, 50% in the following month and the balance in the second

month.

Purchases for November and December in 2020 were, $ 75,000 and $ 80,000

respectively. In 2021 these are expected to increase to $ 100,000 in January.

$ 110,000 in February and $90,000 in March.

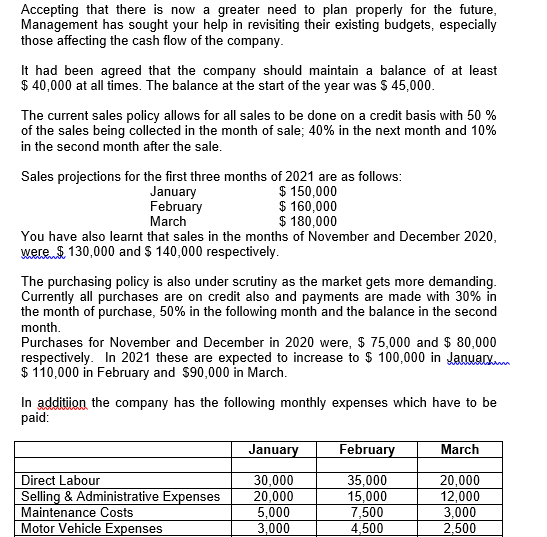

In additiion the company has the following monthly expenses which have to be

paid:

January

February

March

Direct Labour

Selling & Administrative Expenses

30,000

20,000

5,000

3,000

35,000

15,000

7,500

4,500

20,000

12,000

3,000

2,500

Maintenance Costs

Motor Vehicle Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning