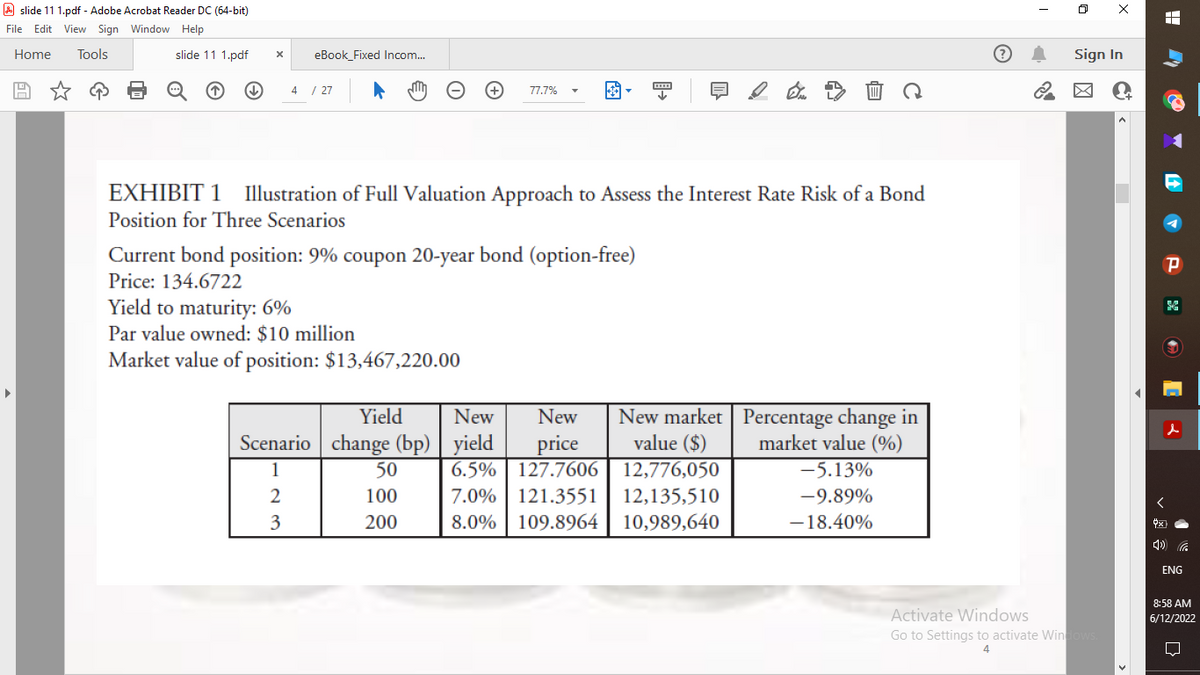

EXHIBIT 1 Illustration of Full Valuation Approach to Assess the Interest Rate Risk of a Bond Position for Three Scenarios Current bond position: 9% coupon 20-year bond (option-free) Price: 134.6722 Yield to maturity: 6% Par value owned: $10 million Market value of position: $13,467,220.00 Yield New New Percentage change in market value (%) Scenario change (bp) yield price 1 50 6.5% 127.7606 -5.13% 2 100 7.0% 121.3551 -9.89% 3 200 8.0% 109.8964 -18.40% New market value ($) 12,776,050 12,135,510 10,989,640

EXHIBIT 1 Illustration of Full Valuation Approach to Assess the Interest Rate Risk of a Bond Position for Three Scenarios Current bond position: 9% coupon 20-year bond (option-free) Price: 134.6722 Yield to maturity: 6% Par value owned: $10 million Market value of position: $13,467,220.00 Yield New New Percentage change in market value (%) Scenario change (bp) yield price 1 50 6.5% 127.7606 -5.13% 2 100 7.0% 121.3551 -9.89% 3 200 8.0% 109.8964 -18.40% New market value ($) 12,776,050 12,135,510 10,989,640

Chapter5: Bond, Bond Valuation, And Interest Rates

Section: Chapter Questions

Problem 24SP

Related questions

Question

how can I calculate the column of New price in this picture according to new yield column? I don't remember it's formula.

Transcribed Image Text:slide 11 1.pdf - Adobe Acrobat Reader DC (64-bit)

File Edit View Sign Window Help

Home

Tools

slide 11 1.pdf

X eBook_Fixed Incom...

4 / 27

77.7%

▪▪▪▪

↓

EXHIBIT 1 Illustration of Full Valuation Approach to Assess the Interest Rate Risk of a Bond

Position for Three Scenarios

Current bond position: 9% coupon 20-year bond (option-free)

Price: 134.6722

Yield to maturity: 6%

Par value owned: $10 million

Market value of position: $13,467,220.00

New

New

Yield

Scenario change (bp) | yield

New market

value ($)

Percentage change in

market value (%)

50

price

6.5% 127.7606

7.0% 121.3551

12,776,050

-5.13%

2

100

12,135,510

-9.89%

3

200

8.0% 109.8964 10,989,640

-18.40%

I

X

Sign In

风

C+

Activate Windows

Go to Settings to activate Windows.

4

Ox

P

S

[

ENG

8:58 AM

6/12/2022

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning