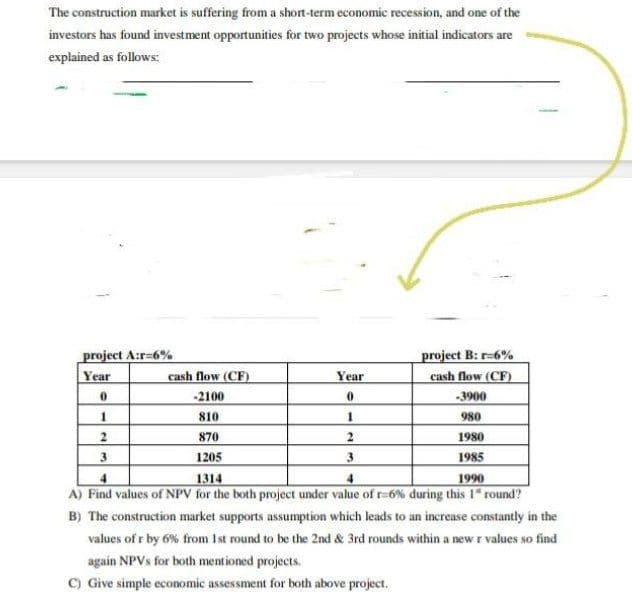

The construction market is suffering from a short-term economic recession, and one of the investors has found investment opportunities for two projects whose initial indicators are explained as follows: project A:r-6% project B: r-6% cash flow (CF) Year cash flow (CF) Year 0 -2100 0 -3900 1 810 1 980 2 870 2 1980 3 1205 3 1985 1314 1990 A) Find values of NPV for the both project under value of r-6% during this 1" round? B) The construction market supports assumption which leads to an increase constantly in the values of r by 6% from 1st round to be the 2nd & 3rd rounds within a new r values so find again NPVs for both mentioned projects. C) Give simple economic assessment for both above project.

The construction market is suffering from a short-term economic recession, and one of the investors has found investment opportunities for two projects whose initial indicators are explained as follows: project A:r-6% project B: r-6% cash flow (CF) Year cash flow (CF) Year 0 -2100 0 -3900 1 810 1 980 2 870 2 1980 3 1205 3 1985 1314 1990 A) Find values of NPV for the both project under value of r-6% during this 1" round? B) The construction market supports assumption which leads to an increase constantly in the values of r by 6% from 1st round to be the 2nd & 3rd rounds within a new r values so find again NPVs for both mentioned projects. C) Give simple economic assessment for both above project.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter5: Probability: An Introduction To Modeling Uncertainty

Section: Chapter Questions

Problem 29P: The Siler Construction Company is about to bid on a new industrial construction project. To...

Related questions

Question

Transcribed Image Text:The construction market is suffering from a short-term economic recession, and one of the

investors has found investment opportunities for two projects whose initial indicators are

explained as follows:

project A:r=6%

project B: r-6%

Year

cash flow (CF)

Year

cash flow (CF)

0

-2100

0

-3900

1

810

1

980

2

870

2

1980

3

1205

3

1985

4

1314

4

1990

A) Find values of NPV for the both project under value of r-6% during this 1* round?

B) The construction market supports assumption which leads to an increase constantly in the

values of r by 6% from 1st round to be the 2nd & 3rd rounds within a new r values so find

again NPVs for both mentioned projects.

C) Give simple economic assessment for both above project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning