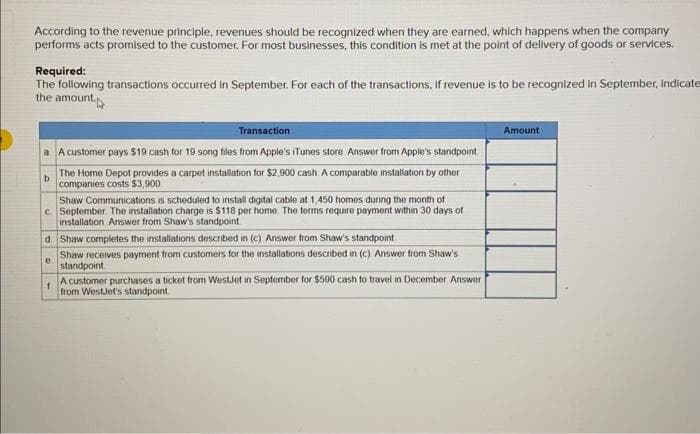

According to the revenue principle, revenues should be recognized when they are earned, which happens when the company performs acts promised to the customer. For most businesses, this condition is met at the point of delivery of goods or services. Required: The following transactions occurred in September. For each of the transactions, if revenue is to be recognized in September, indicate the amount Transaction a A customer pays $19 cash for 19 song files from Apple's iTunes store Answer from Apple's standpoint b The Home Depot provides a carpet installation for $2,900 cash. A comparable installation by other companies costs $3,900 Shaw Communications is scheduled to install digital cable at 1,450 homes during the month of c September. The installation charge is $118 per home. The terms require payment within 30 days of installation. Answer from Shaw's standpoint d. Shaw completes the installations described in (c) Answer from Shaw's standpoint Shaw receives payment from customers for the installations described in (c) Answer from Shaw's standpoint e 1 A customer purchases a ticket from WestJet in September for $590 cash to travel in December. Answer from WestJet's standpoint. Amount

According to the revenue principle, revenues should be recognized when they are earned, which happens when the company performs acts promised to the customer. For most businesses, this condition is met at the point of delivery of goods or services. Required: The following transactions occurred in September. For each of the transactions, if revenue is to be recognized in September, indicate the amount Transaction a A customer pays $19 cash for 19 song files from Apple's iTunes store Answer from Apple's standpoint b The Home Depot provides a carpet installation for $2,900 cash. A comparable installation by other companies costs $3,900 Shaw Communications is scheduled to install digital cable at 1,450 homes during the month of c September. The installation charge is $118 per home. The terms require payment within 30 days of installation. Answer from Shaw's standpoint d. Shaw completes the installations described in (c) Answer from Shaw's standpoint Shaw receives payment from customers for the installations described in (c) Answer from Shaw's standpoint e 1 A customer purchases a ticket from WestJet in September for $590 cash to travel in December. Answer from WestJet's standpoint. Amount

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.1E: Types of Events For each of the following events, identify whether it is an external event that...

Related questions

Question

Ww.211.

Transcribed Image Text:According to the revenue principle, revenues should be recognized when they are earned, which happens when the company

performs acts promised to the customer. For most businesses, this condition is met at the point of delivery of goods or services.

Required:

The following transactions occurred in September. For each of the transactions, if revenue is to be recognized in September, indicate

the amount.

Transaction

a A customer pays $19 cash for 19 song files from Apple's iTunes store Answer from Apple's standpoint

The Home Depot provides a carpet installation for $2,900 cash. A comparable installation by other

companies costs $3,900

b

Shaw Communications is scheduled to install digital cable at 1,450 homes during the month of

c September. The installation charge is $118 per home. The terms require payment within 30 days of

installation, Answer from Shaw's standpoint

d. Shaw completes the installations described in (c) Answer from Shaw's standpoint

Shaw receives payment from customers for the installations described in (c) Answer from Shaw's

standpoint

1.

A customer purchases a ticket from WestJet in September for $590 cash to travel in December. Answer

from WestJet's standpoint

e

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College