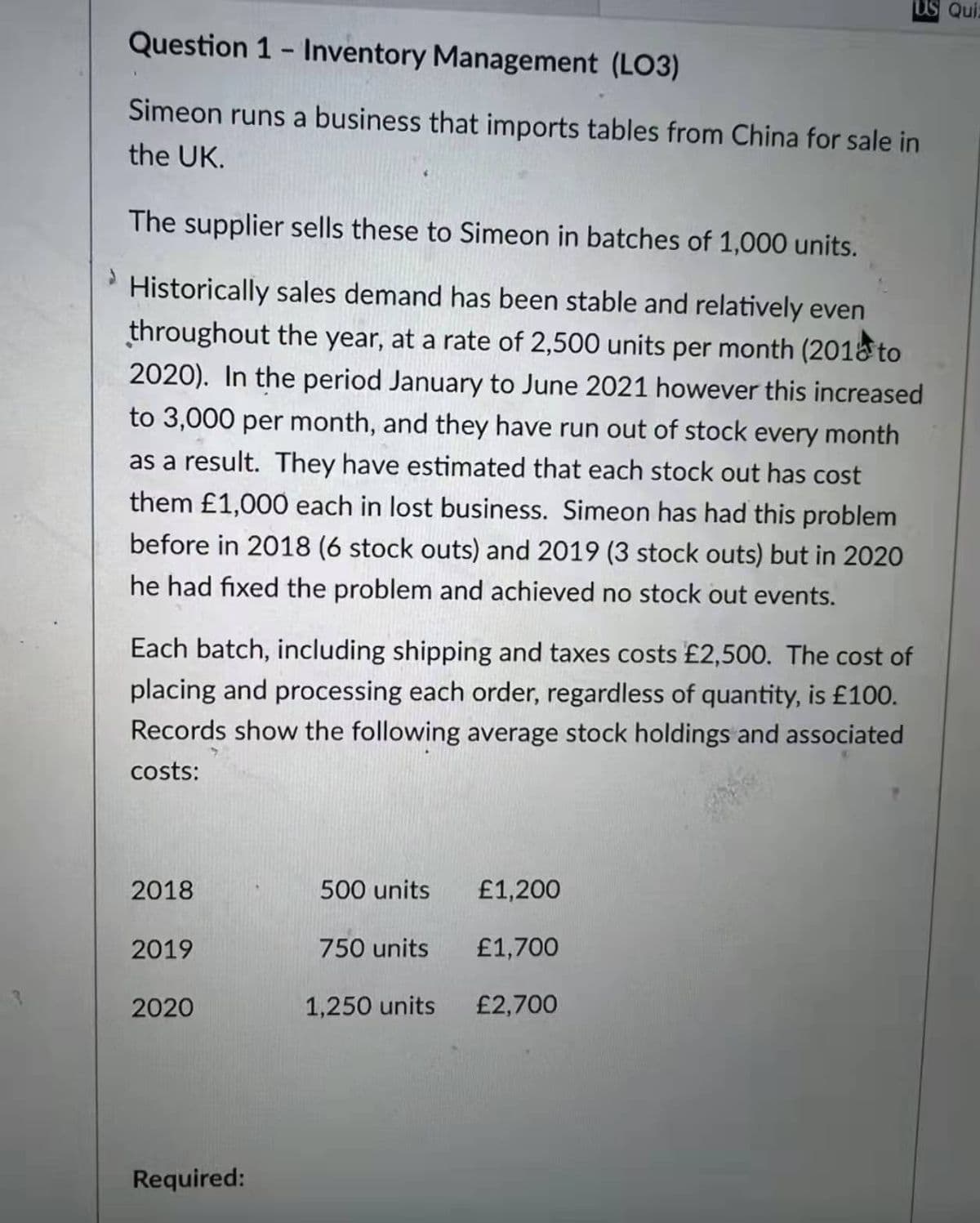

Required: b) Also, what is the optimum base stock level? US Qui Question 1- Inventory Management (LO3) Simeon runs a business that imports tables from China for sale in the UK. The supplier sells these to Simeon in batches of 1,000 units. Historically sales demand has been stable and relatively even throughout the year, at a rate of 2,500 units per month (2018 to 2020). In the period January to June 2021 however this increased to 3,000 per month, and they have run out of stock every month as a result. They have estimated that each stock out has cost them £1,000 each in lost business. Simeon has had this problem before in 2018 (6 stock outs) and 2019 (3 stock outs) but in 2020 he had fixed the problem and achieved no stock out events. Each batch, including shipping and taxes costs £2,500. The cost of placing and processing each order, regardless of quantity, is £100. Records show the following average stock holdings and associated costs: 2018 500 units £1,200 2019 750 units £1,700 2020 1,250 units £2,700 Required:

Required: b) Also, what is the optimum base stock level? US Qui Question 1- Inventory Management (LO3) Simeon runs a business that imports tables from China for sale in the UK. The supplier sells these to Simeon in batches of 1,000 units. Historically sales demand has been stable and relatively even throughout the year, at a rate of 2,500 units per month (2018 to 2020). In the period January to June 2021 however this increased to 3,000 per month, and they have run out of stock every month as a result. They have estimated that each stock out has cost them £1,000 each in lost business. Simeon has had this problem before in 2018 (6 stock outs) and 2019 (3 stock outs) but in 2020 he had fixed the problem and achieved no stock out events. Each batch, including shipping and taxes costs £2,500. The cost of placing and processing each order, regardless of quantity, is £100. Records show the following average stock holdings and associated costs: 2018 500 units £1,200 2019 750 units £1,700 2020 1,250 units £2,700 Required:

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.12E: Inventory analysis Costco Wholesale Corporation (COST) and Wal-Mart Stores Inc. (WMT) compete...

Related questions

Question

Transcribed Image Text:Required:

b)

Also, what is the optimum base stock level?

Transcribed Image Text:US Qui

Question 1- Inventory Management (LO3)

Simeon runs a business that imports tables from China for sale in

the UK.

The supplier sells these to Simeon in batches of 1,000 units.

Historically sales demand has been stable and relatively even

throughout the year, at a rate of 2,500 units per month (2018 to

2020). In the period January to June 2021 however this increased

to 3,000 per month, and they have run out of stock every month

as a result. They have estimated that each stock out has cost

them £1,000 each in lost business. Simeon has had this problem

before in 2018 (6 stock outs) and 2019 (3 stock outs) but in 2020

he had fixed the problem and achieved no stock out events.

Each batch, including shipping and taxes costs £2,500. The cost of

placing and processing each order, regardless of quantity, is £100.

Records show the following average stock holdings and associated

costs:

2018

500 units

£1,200

2019

750 units

£1,700

2020

1,250 units

£2,700

Required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning