The current amount of money that can be afford to invest is

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 5P

Related questions

Question

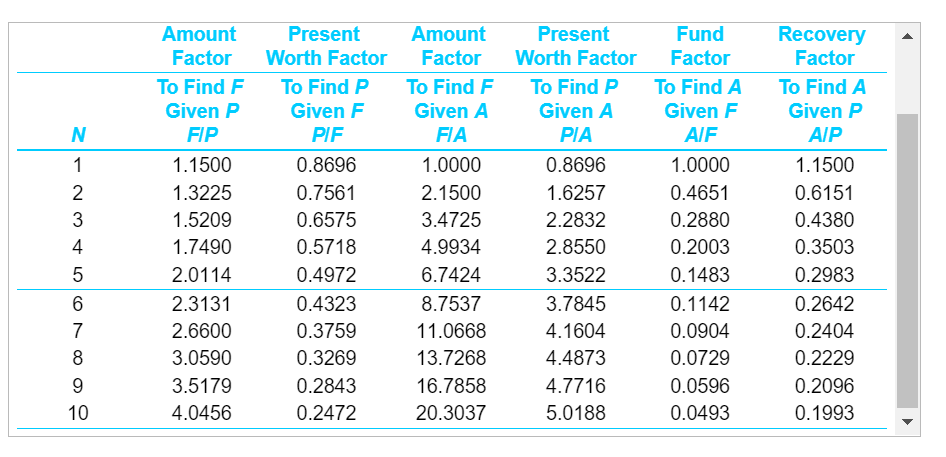

Transcribed Image Text:N

1

2345

2

6

7

8

9

10

Amount

Factor

To Find F

Given P

FIP

1.1500

1.3225

1.5209

1.7490

2.0114

2.3131

2.6600

3.0590

3.5179

4.0456

Present

Worth Factor

To Find P

Given F

PIF

0.8696

0.7561

0.6575

0.5718

0.4972

0.4323

0.3759

0.3269

0.2843

0.2472

Amount

Factor

To Find F

Given A

FIA

1.0000

2.1500

3.4725

4.9934

6.7424

8.7537

11.0668

13.7268

16.7858

20.3037

Present

Worth Factor

To Find P

Given A

PIA

0.8696

1.6257

2.2832

2.8550

3.3522

3.7845

4.1604

4.4873

4.7716

5.0188

Fund

Factor

To Find A

Given F

AIF

1.0000

0.4651

0.2880

0.2003

0.1483

0.1142

0.0904

0.0729

0.0596

0.0493

Recovery

Factor

To Find A

Given P

AIP

1.1500

0.6151

0.4380

0.3503

0.2983

0.2642

0.2404

0.2229

0.2096

0.1993

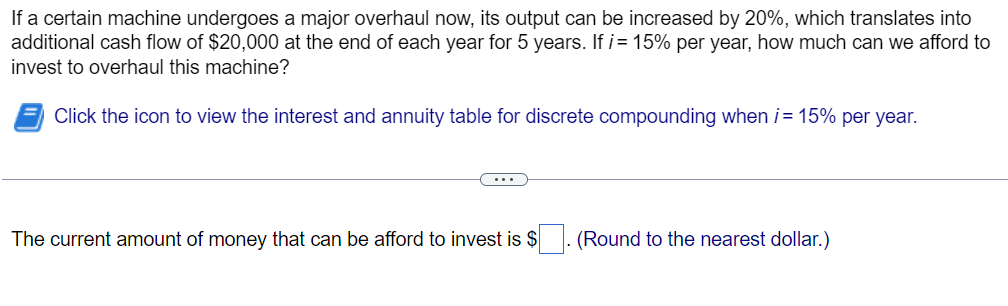

Transcribed Image Text:If a certain machine undergoes a major overhaul now, its output can be increased by 20%, which translates into

additional cash flow of $20,000 at the end of each year for 5 years. If i= 15% per year, how much can we afford to

invest to overhaul this machine?

Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year.

The current amount of money that can be afford to invest is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub