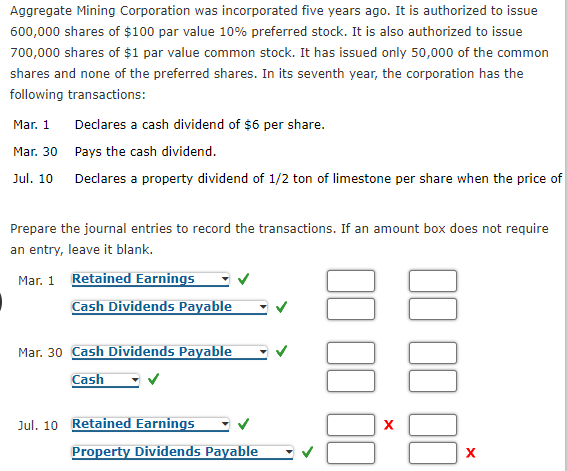

Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 600,000 shares of $100 par value 10% preferred stock. It is also authorized to issue 700,000 shares of $1 par value common stock. It has issued only 50,000 of the common shares and none of the preferred shares. In its seventh year, the corporation has the following transactions: Mar. 1 Declares a cash dividend of $6 per share. Mar. 30 Pays the cash dividend. Jul. 10 Declares a property dividend of 1/2 ton of limestone per share when the price of Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Mar. 1 Retained Earnings Cash Dividends Payable Mar. 30 Cash Dividends Payable Cash Jul. 10 Retained Earnings Property Dividends Payable

Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 600,000 shares of $100 par value 10% preferred stock. It is also authorized to issue 700,000 shares of $1 par value common stock. It has issued only 50,000 of the common shares and none of the preferred shares. In its seventh year, the corporation has the following transactions: Mar. 1 Declares a cash dividend of $6 per share. Mar. 30 Pays the cash dividend. Jul. 10 Declares a property dividend of 1/2 ton of limestone per share when the price of Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Mar. 1 Retained Earnings Cash Dividends Payable Mar. 30 Cash Dividends Payable Cash Jul. 10 Retained Earnings Property Dividends Payable

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 9PA: Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000...

Related questions

Question

Transcribed Image Text:Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue

600,000 shares of $100 par value 10% preferred stock. It is also authorized to issue

700,000 shares of $1 par value common stock. It has issued only 50,000 of the common

shares and none of the preferred shares. In its seventh year, the corporation has the

following transactions:

Mar. 1

Declares a cash dividend of $6 per share.

Mar. 30 Pays the cash dividend.

Jul. 10

Declares a property dividend of 1/2 ton of limestone per share when the price of

Prepare the journal entries to record the transactions. If an amount box does not require

an entry, leave it blank.

Mar. 1 Retained Earnings

Cash Dividends Payable

Mar. 30 Cash Dividends Payable

Cash

Jul. 10 Retained Earnings

Property Dividends Payable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning