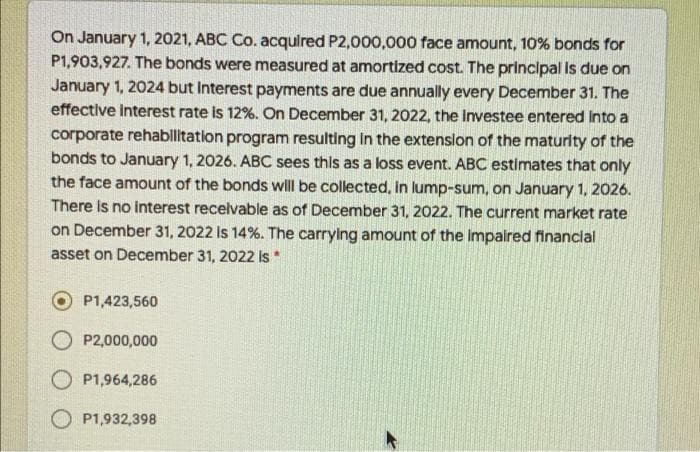

On January 1, 2021, ABC Co. acqulred P2,000,000 face amount, 10% bonds for P1,903,927. The bonds were measured at amortized cost. The principal Is due on January 1, 2024 but Interest payments are due annually every December 31. The effective interest rate is 12%. On December 31, 2022, the Investee entered Into a corporate rehabilitation program resulting In the extenslon of the maturity of the bonds to January 1, 2026. ABC sees this as a loss event. ABC estimates that only the face amount of the bonds will be collected, in lump-sum, on January 1, 2026. There Is no interest recelvable as of December 31, 2022. The current market rate on December 31, 2022 Is 14%. The carrying amount of the impalred financlal asset on December 31, 2022 Is* P1,423,560 O P2,000,000 O P1,964,286 O P1,932,398

On January 1, 2021, ABC Co. acqulred P2,000,000 face amount, 10% bonds for P1,903,927. The bonds were measured at amortized cost. The principal Is due on January 1, 2024 but Interest payments are due annually every December 31. The effective interest rate is 12%. On December 31, 2022, the Investee entered Into a corporate rehabilitation program resulting In the extenslon of the maturity of the bonds to January 1, 2026. ABC sees this as a loss event. ABC estimates that only the face amount of the bonds will be collected, in lump-sum, on January 1, 2026. There Is no interest recelvable as of December 31, 2022. The current market rate on December 31, 2022 Is 14%. The carrying amount of the impalred financlal asset on December 31, 2022 Is* P1,423,560 O P2,000,000 O P1,964,286 O P1,932,398

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

13

Transcribed Image Text:On January 1, 2021, ABC Co. acqulred P2,000,000 face amount, 10% bonds for

P1,903,927. The bonds were measured at amortized cost. The principal Is due on

January 1, 2024 but Interest payments are due annually every December 31. The

effective interest rate is 12%. On December 31, 2022, the Investee entered Into a

corporate rehabilitation program resulting In the extenslon of the maturity of the

bonds to January 1, 2026. ABC sees this as a loss event. ABC estimates that only

the face amount of the bonds will be collected, in lump-sum, on January 1, 2026.

There Is no interest recelvable as of December 31, 2022. The current market rate

on December 31, 2022 Is 14%. The carrying amount of the impalred financlal

asset on December 31, 2022 Is*

P1,423,560

O P2,000,000

O P1,964,286

O P1,932,398

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning