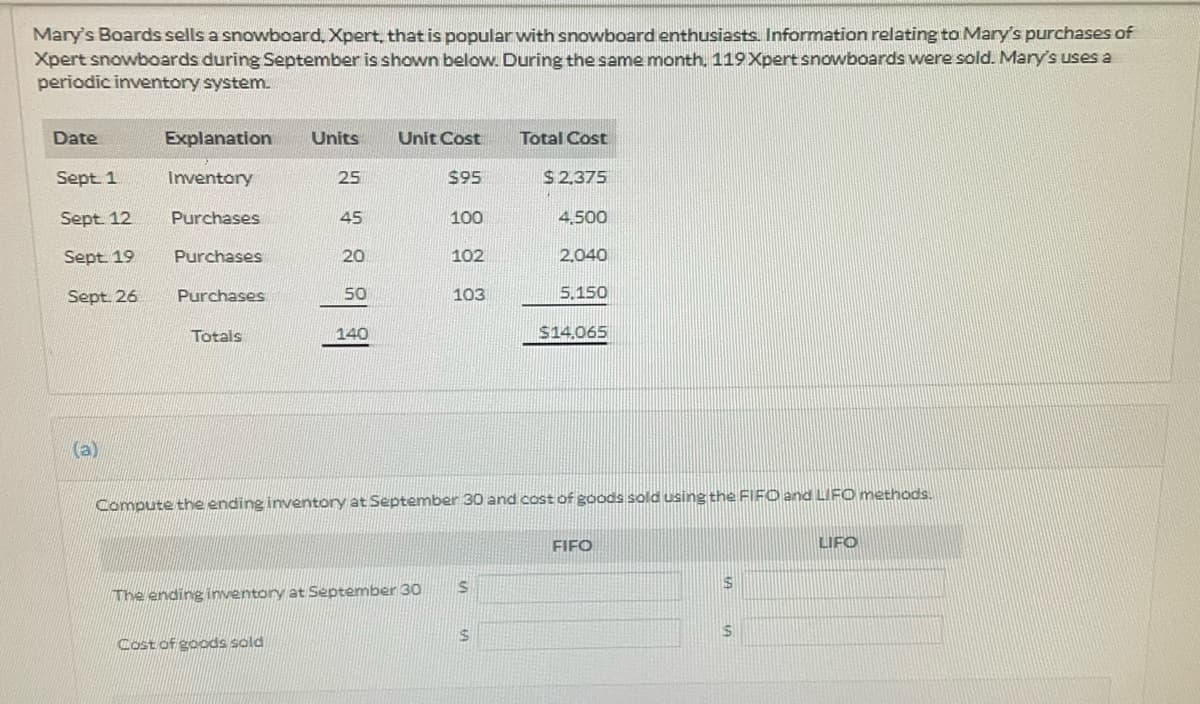

Mary's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Mary's purchases of Xpert snowboards during September is shown below. During the same month, 119Xpert snowboards were sold. Mary's uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 25 $95 $2,375 Sept 12 Purchases 45 100 4,500 Sept 19 Purchases 20 102 2,040 Sept. 26 Purchases 50 103 5.150 Totals 140 $14.065 (a) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. FIFO LIFO The ending inventory at September 30 Cost of goods sold

Mary's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Mary's purchases of Xpert snowboards during September is shown below. During the same month, 119Xpert snowboards were sold. Mary's uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 25 $95 $2,375 Sept 12 Purchases 45 100 4,500 Sept 19 Purchases 20 102 2,040 Sept. 26 Purchases 50 103 5.150 Totals 140 $14.065 (a) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. FIFO LIFO The ending inventory at September 30 Cost of goods sold

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 10RE: Jessie Stores uses the periodic system of calculating inventory. The following information is...

Related questions

Topic Video

Question

Transcribed Image Text:Mary's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Mary's purchases of

Xpert snowboards during September is shown below. During the same month, 119Xpertsnowboards were sold. Mary's uses a

periodic inventory system.

Date

Explanation

Units

Unit Cost

Total Cost

Sept 1

Inventory

25

$95

$2,375

Sept. 12

Purchases

45

100

4.500

Sept 19

Purchases

20

102

2,040

Sept. 26

Purchases

50

103

5.150

Totals

140

$14.065

(a)

Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods.

FIFO

LIFO

The ending inventory at September 30

Cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage