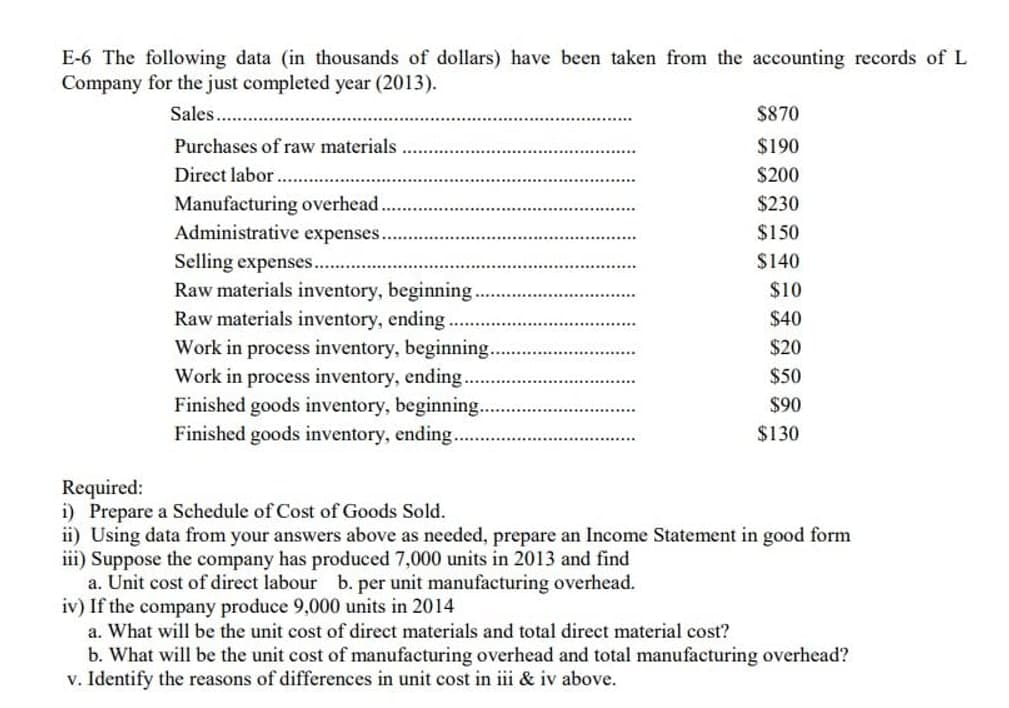

E-6 The following data (in thousands of dollars) have been taken from the accounting records of L Company for the just completed year (2013). Sales.. $870 Purchases of raw materials $190 Direct labor $200 Manufacturing overhead Administrative expenses. Selling expenses. Raw materials inventory, beginning. Raw materials inventory, ending. Work in process inventory, beginning. Work in process inventory, ending.. Finished goods inventory, beginning. Finished goods inventory, ending.. $230 $150 $140 $10 $40 $20 $50 $90 $130 Required: i) Prepare a Schedule of Cost of Goods Sold. ii) Using data from your answers above as needed, prepare an Income Statement in good form iii) Suppose the company has produced 7,000 units in 2013 and find a. Unit cost of direct labour b. per unit manufacturing overhead. iv) If the company produce 9,000 units in 2014 a. What will be the unit cost of direct materials and total direct material cost? b. What will be the unit cost of manufacturing overhead and total manufacturing overhead? v. Identify the reasons of differences in unit cost in iii & iv above.

E-6 The following data (in thousands of dollars) have been taken from the accounting records of L Company for the just completed year (2013). Sales.. $870 Purchases of raw materials $190 Direct labor $200 Manufacturing overhead Administrative expenses. Selling expenses. Raw materials inventory, beginning. Raw materials inventory, ending. Work in process inventory, beginning. Work in process inventory, ending.. Finished goods inventory, beginning. Finished goods inventory, ending.. $230 $150 $140 $10 $40 $20 $50 $90 $130 Required: i) Prepare a Schedule of Cost of Goods Sold. ii) Using data from your answers above as needed, prepare an Income Statement in good form iii) Suppose the company has produced 7,000 units in 2013 and find a. Unit cost of direct labour b. per unit manufacturing overhead. iv) If the company produce 9,000 units in 2014 a. What will be the unit cost of direct materials and total direct material cost? b. What will be the unit cost of manufacturing overhead and total manufacturing overhead? v. Identify the reasons of differences in unit cost in iii & iv above.

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 12PB: The following data summarize the operations during the year. Prepare a journal entry for each...

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:E-6 The following data (in thousands of dollars) have been taken from the accounting records of L

Company for the just completed year (2013).

Sales..

$870

Purchases of raw materials

$190

Direct labor

$200

Manufacturing overhead

Administrative expenses.

Selling expenses.

Raw materials inventory, beginning.

Raw materials inventory, ending.

Work in process inventory, beginning.

Work in process inventory, ending..

Finished goods inventory, beginning.

Finished goods inventory, ending..

$230

$150

$140

$10

$40

$20

$50

$90

$130

Required:

i) Prepare a Schedule of Cost of Goods Sold.

ii) Using data from your answers above as needed, prepare an Income Statement in good form

iii) Suppose the company has produced 7,000 units in 2013 and find

a. Unit cost of direct labour b. per unit manufacturing overhead.

iv) If the company produce 9,000 units in 2014

a. What will be the unit cost of direct materials and total direct material cost?

b. What will be the unit cost of manufacturing overhead and total manufacturing overhead?

v. Identify the reasons of differences in unit cost in iii & iv above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning