00 %24 %23 A machine purchased three years ago for $313,000 has a current book value using straight-line depreciation of $189,000; its operating expenses are $32,000 per year. A replacement machine would cost $236,000, have a useful life of ten years, and would require $9,000 per year in operating expenses. It has an expected salvage value of $65,000 after ten years. The current disposal value of the old machine is $74,000; if it is kept 10 more years, its residual value would be $20,000. Required Calculate the total costs in keeping the old machine and purchase a new machine. Should the old machine be replaced? Keep Old Machine Purchase New Machine Total costs Should the old machine be replaced? < Prev 6 of 6 e to search Next M f5 91 81 61 LL 12 Su prt sc 1A4 delete 3. home 9. 67 -> backspace R nu H. enter B. pause T shi alt alt

00 %24 %23 A machine purchased three years ago for $313,000 has a current book value using straight-line depreciation of $189,000; its operating expenses are $32,000 per year. A replacement machine would cost $236,000, have a useful life of ten years, and would require $9,000 per year in operating expenses. It has an expected salvage value of $65,000 after ten years. The current disposal value of the old machine is $74,000; if it is kept 10 more years, its residual value would be $20,000. Required Calculate the total costs in keeping the old machine and purchase a new machine. Should the old machine be replaced? Keep Old Machine Purchase New Machine Total costs Should the old machine be replaced? < Prev 6 of 6 e to search Next M f5 91 81 61 LL 12 Su prt sc 1A4 delete 3. home 9. 67 -> backspace R nu H. enter B. pause T shi alt alt

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: REPLACEMENT ANALYSIS The Dauten Toy Corporation currently uses an injection molding machine that was...

Related questions

Question

Transcribed Image Text:00

%24

%23

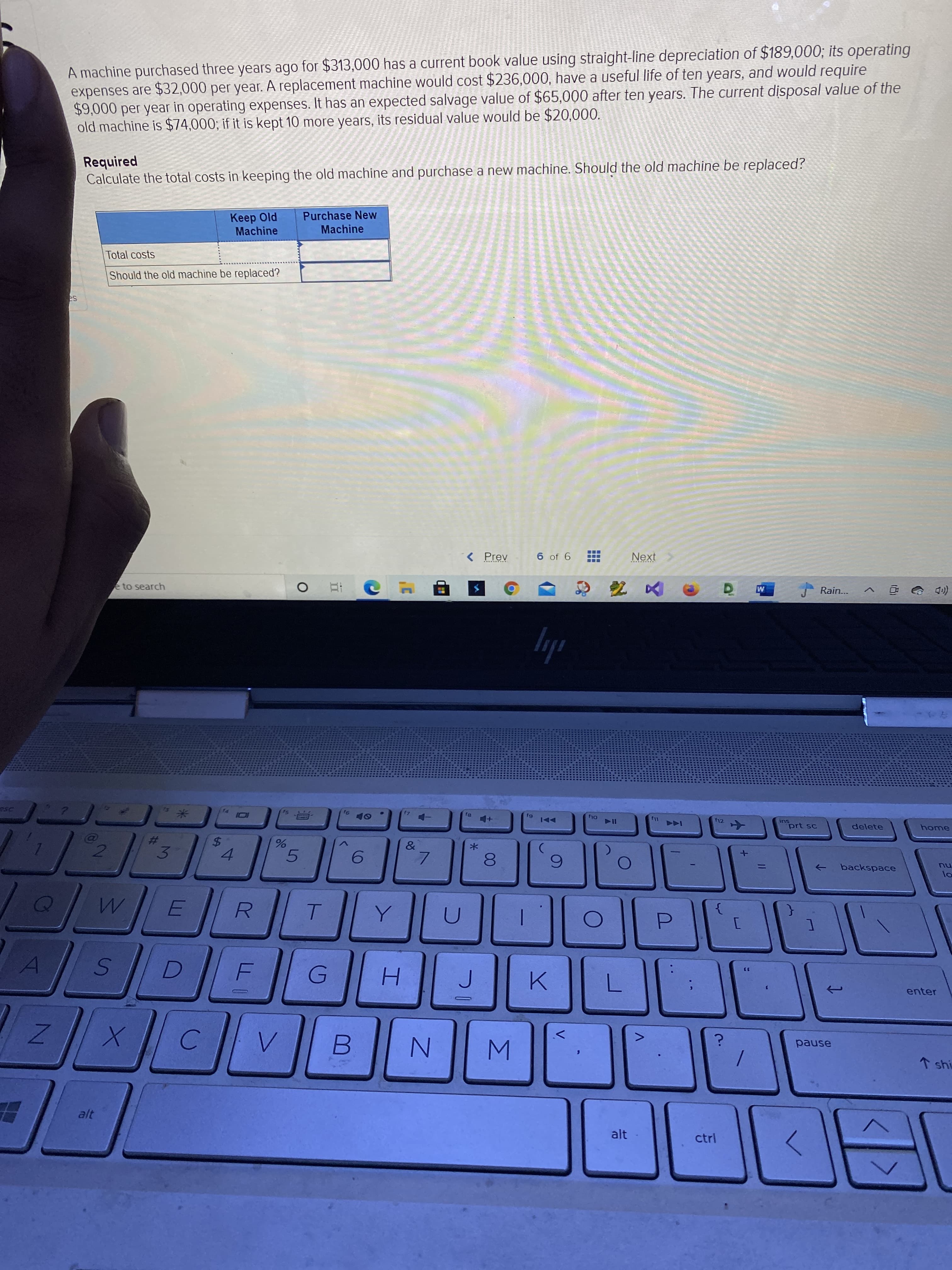

A machine purchased three years ago for $313,000 has a current book value using straight-line depreciation of $189,000; its operating

expenses are $32,000 per year. A replacement machine would cost $236,000, have a useful life of ten years, and would require

$9,000 per year in operating expenses. It has an expected salvage value of $65,000 after ten years. The current disposal value of the

old machine is $74,000; if it is kept 10 more years, its residual value would be $20,000.

Required

Calculate the total costs in keeping the old machine and purchase a new machine. Should the old machine be replaced?

Keep Old

Machine

Purchase New

Machine

Total costs

Should the old machine be replaced?

< Prev

6 of 6

e to search

Next

M

f5

91

81

61

LL

12

Su

prt sc

1A4

delete

3.

home

9.

67

->

backspace

R

nu

H.

enter

B.

pause

T shi

alt

alt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning