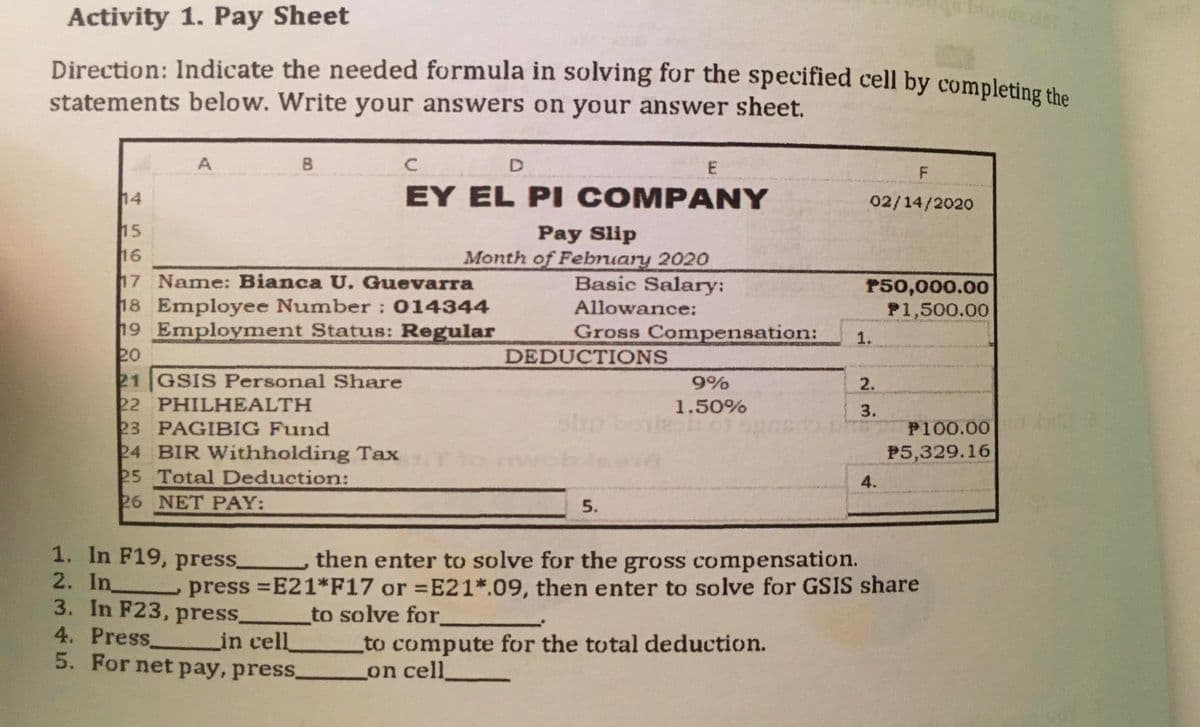

Activity 1. Pay Sheet Direction: Indicate the needed formula in solving for the specified cell by completing the statements below. Write your answers on your answer sheet. A B 14 EY EL PI COMPANY 02/14/2020 15 16 17 Name: Bianca U. Guevarra 18 Employee Number : 014344 19 Employment Status: Regular 20 21 GSIS Personal Share 22 PHILHEALTH 23 PAGIBIG Fund 24 BIR Withholding Tax 25 Total Deduction: 26 NET PAY: Pay Slip Month of February 2020 Basic Salary: P50,000.00 P1,500.00 Allowance: Gross Compensation: 1. DEDUCTIONS 9% 2. 1.50% 3. P100.00 to m P5,329.16 4. 5. 1. In F19, press_ then enter to solve for the gross compensation. 2. In press =E21*F17 or =E21*.09, then enter to solve for GSIS share 3. In F23, press_ 4. Press. 5. For net pay, press. to solve for. _to compute for the total deduction. Lon cell in cell

Activity 1. Pay Sheet Direction: Indicate the needed formula in solving for the specified cell by completing the statements below. Write your answers on your answer sheet. A B 14 EY EL PI COMPANY 02/14/2020 15 16 17 Name: Bianca U. Guevarra 18 Employee Number : 014344 19 Employment Status: Regular 20 21 GSIS Personal Share 22 PHILHEALTH 23 PAGIBIG Fund 24 BIR Withholding Tax 25 Total Deduction: 26 NET PAY: Pay Slip Month of February 2020 Basic Salary: P50,000.00 P1,500.00 Allowance: Gross Compensation: 1. DEDUCTIONS 9% 2. 1.50% 3. P100.00 to m P5,329.16 4. 5. 1. In F19, press_ then enter to solve for the gross compensation. 2. In press =E21*F17 or =E21*.09, then enter to solve for GSIS share 3. In F23, press_ 4. Press. 5. For net pay, press. to solve for. _to compute for the total deduction. Lon cell in cell

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1WT

Related questions

Question

100%

PLEASE ANSWER THEM ALL CORRECTLY FOR AN UPVOTE AND POSITIVE RATINGS.

Transcribed Image Text:Activity 1. Pay Sheet

Direction: Indicate the needed formula in solving for the specified cell by completing the

statements below. Write your answers on your answer sheet.

A

B

14

EY EL PI COMPANY

02/14/2020

15

16

17 Name: Bianca U. Guevarra

18 Employee Number : 014344

19 Employment Status: Regular

20

21 GSIS Personal Share

22 PHILHEALTH

23 PAGIBIG Fund

24 BIR Withholding Tax

25 Total Deduction:

26 NET PAY:

Pay Slip

Month of February 2020

Basic Salary:

P50,000.00

P1,500.00

Allowance:

Gross Compensation:

1.

DEDUCTIONS

9%

2.

1.50%

3.

P100.00

to m

P5,329.16

4.

5.

1. In F19, press_

then enter to solve for the gross compensation.

2. In press =E21*F17 or =E21*.09, then enter to solve for GSIS share

3. In F23, press_

4. Press.

5. For net pay, press.

to solve for.

_to compute for the total deduction.

Lon cell

in cell

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning