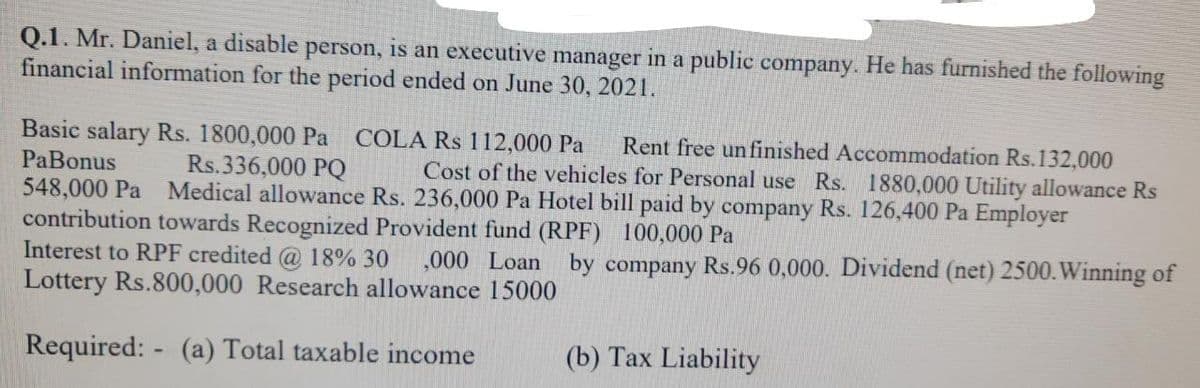

Q.1. Mr. Daniel, a disable person, is an executive manager in a public company. He has furnished the following financial information for the period ended on June 30, 2021. Basic salary Rs. 1800,000 Pa PaBonus 548,000 Pa Medical allowance Rs. 236,000 Pa Hotel bill paid by company Rs. 126,400 Pa Employer contribution towards Recognized Provident fund (RPF) 100,000 Pa Interest to RPF credited @ 18% 30 Lottery Rs.800,000 Research allowance 15000 COLA Rs 112,000 Pa Rent free unfinished Accommodation Rs.132,000 Rs.336,000 PQ Cost of the vehicles for Personal use Rs. 1880,000 Utility allowance Rs ,000 Loan by company Rs.96 0,000. Dividend (net) 2500.Winning of Required: - (a) Total taxable income (b) Tax Liability

Q.1. Mr. Daniel, a disable person, is an executive manager in a public company. He has furnished the following financial information for the period ended on June 30, 2021. Basic salary Rs. 1800,000 Pa PaBonus 548,000 Pa Medical allowance Rs. 236,000 Pa Hotel bill paid by company Rs. 126,400 Pa Employer contribution towards Recognized Provident fund (RPF) 100,000 Pa Interest to RPF credited @ 18% 30 Lottery Rs.800,000 Research allowance 15000 COLA Rs 112,000 Pa Rent free unfinished Accommodation Rs.132,000 Rs.336,000 PQ Cost of the vehicles for Personal use Rs. 1880,000 Utility allowance Rs ,000 Loan by company Rs.96 0,000. Dividend (net) 2500.Winning of Required: - (a) Total taxable income (b) Tax Liability

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 59P

Related questions

Question

1

Transcribed Image Text:Q.1. Mr. Daniel, a disable person, is an executive manager in a public company. He has furnished the following

financial information for the period ended on June 30, 2021.

Basic salary Rs. 1800,000 Pa

PaBonus

548,000 Pa

contribution towards Recognized Provident fund (RPF) 100,000 Pa

Interest to RPF credited @ 18% 30

COLA Rs 112,000 Pa

Rent free un finished Accommodation Rs.132,000

Cost of the vehicles for Personal use Rs. 1880,000 Utility allowance Rs

Rs.336,000 PQ

Medical allowance Rs. 236,000 Pa Hotel bill paid by company Rs. 126,400 Pa Employer

,000 Loan by company Rs.96 0,000. Dividend (net) 2500.Winning of

Lottery Rs.800,000 Research allowance 15000

Required: - (a) Total taxable income

(b) Tax Liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT