During 2020, you receive from your employer: • a $400 gift certificate. • a $600 chair for outstanding customer service. • 4 coffee mugs that cost the employer $20. • an Easter basket of gourmet treats valued at $245. • a cash award of $300 in recognition of 10 years of service with the employer. What is the amount that will be included in your 2020 Net Income (Division B)?

During 2020, you receive from your employer: • a $400 gift certificate. • a $600 chair for outstanding customer service. • 4 coffee mugs that cost the employer $20. • an Easter basket of gourmet treats valued at $245. • a cash award of $300 in recognition of 10 years of service with the employer. What is the amount that will be included in your 2020 Net Income (Division B)?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 4RP

Related questions

Question

100%

Question 2 – During 2020, you receive from your employer:

• a $400 gift certificate.

• a $600 chair for outstanding customer service.

• 4 coffee mugs that cost the employer $20.

• an Easter basket of gourmet treats valued at $245.

• a cash award of $300 in recognition of 10 years of service with the employer.

What is the amount that will be included in your 2020 Net Income (Division B)?

A) $800.

B) $1,000.

C) $1,300.

D) $700.

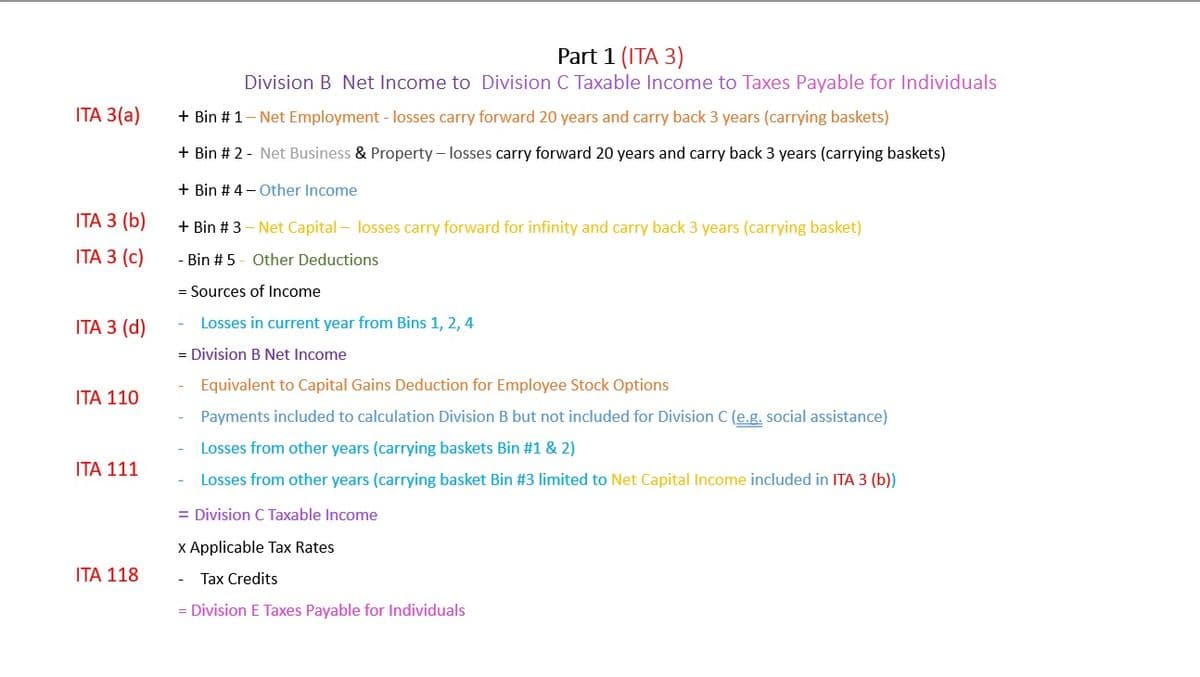

Transcribed Image Text:Part 1 (ITA 3)

Division B Net Income to Division C Taxable Income to Taxes Payable for Individuals

ITА 3(a)

+ Bin #1- Net Employment - losses carry forward 20 years and carry back 3 years (carrying baskets)

+ Bin # 2 - Net Business & Property – losses carry forward 20 years and carry back 3 years (carrying baskets)

+ Bin # 4 - Other Income

ITА 3 (b)

+ Bin # 3 – Net Capital – losses carry forward for infinity and carry back 3 years (carrying basket)

IТА З (c)

- Bin # 5 - Other Deductions

= Sources of Income

ITA 3 (d)

Losses in current year from Bins 1, 2, 4

= Division B Net Income

Equivalent to Capital Gains Deduction for Employee Stock Options

ITA 110

Payments included to calculation Division B but not included for Division C (e.g. social assistance)

- Losses from other years (carrying baskets Bin #1 & 2)

ITA 111

Losses from other years (carrying basket Bin #3 limited to Net Capital Income included in ITA 3 (b)

= Division C Taxable Income

x Applicable Tax Rates

ΙΤΑ 118

Tax Credits

= Division E Taxes Payable for Individuals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you