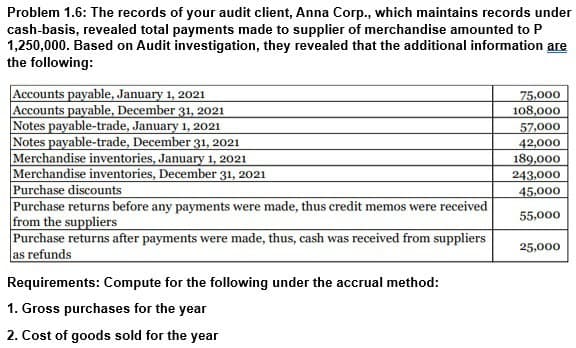

Problem 1.6: The records of your audit client, Anna Corp., which maintains records under cash-basis, revealed total payments made to supplier of merchandise amounted to P 1,250,000. Based on Audit investigation, they revealed that the additional information are the following: Accounts payable, January 1, 2021 Accounts payable, December 31, 2021 Notes payable-trade, January 1, 2021 Notes payable-trade, December 31, 2021 Merchandise inventories, January 1, 2021 Merchandise inventories, December 31, 2021 Purchase discounts Purchase returns before any payments were made, thus credit memos were received from the suppliers Purchase returns after payments were made, thus, cash was received from suppliers as refunds Requirements: Compute for the following under the accrual method: 1. Gross purchases for the year 2. Cost of goods sold for the year 75,000 108,000 57,000 42,000 189,000 243,000 45,000 55,000 25,000

Problem 1.6: The records of your audit client, Anna Corp., which maintains records under cash-basis, revealed total payments made to supplier of merchandise amounted to P 1,250,000. Based on Audit investigation, they revealed that the additional information are the following: Accounts payable, January 1, 2021 Accounts payable, December 31, 2021 Notes payable-trade, January 1, 2021 Notes payable-trade, December 31, 2021 Merchandise inventories, January 1, 2021 Merchandise inventories, December 31, 2021 Purchase discounts Purchase returns before any payments were made, thus credit memos were received from the suppliers Purchase returns after payments were made, thus, cash was received from suppliers as refunds Requirements: Compute for the following under the accrual method: 1. Gross purchases for the year 2. Cost of goods sold for the year 75,000 108,000 57,000 42,000 189,000 243,000 45,000 55,000 25,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 5C: Gross Profit Shelly Corporation is an importer and wholesaler. Its merchandise is purchased from...

Related questions

Question

Transcribed Image Text:Problem 1.6: The records of your audit client, Anna Corp., which maintains records under

cash-basis, revealed total payments made to supplier of merchandise amounted to P

1,250,000. Based on Audit investigation, they revealed that the additional information are

the following:

Accounts payable, January 1, 2021

Accounts payable, December 31, 2021

Notes payable-trade, January 1, 2021

Notes payable-trade, December 31, 2021

Merchandise inventories, January 1, 2021

Merchandise inventories, December 31, 2021

Purchase discounts

Purchase returns before any payments were made, thus credit memos were received

from the suppliers

Purchase returns after payments were made, thus, cash was received from suppliers

as refunds

Requirements: Compute for the following under the accrual method:

1. Gross purchases for the year

2. Cost of goods sold for the year

75,000

108,000

57,000

42,000

189,000

243,000

45,000

55,000

25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning