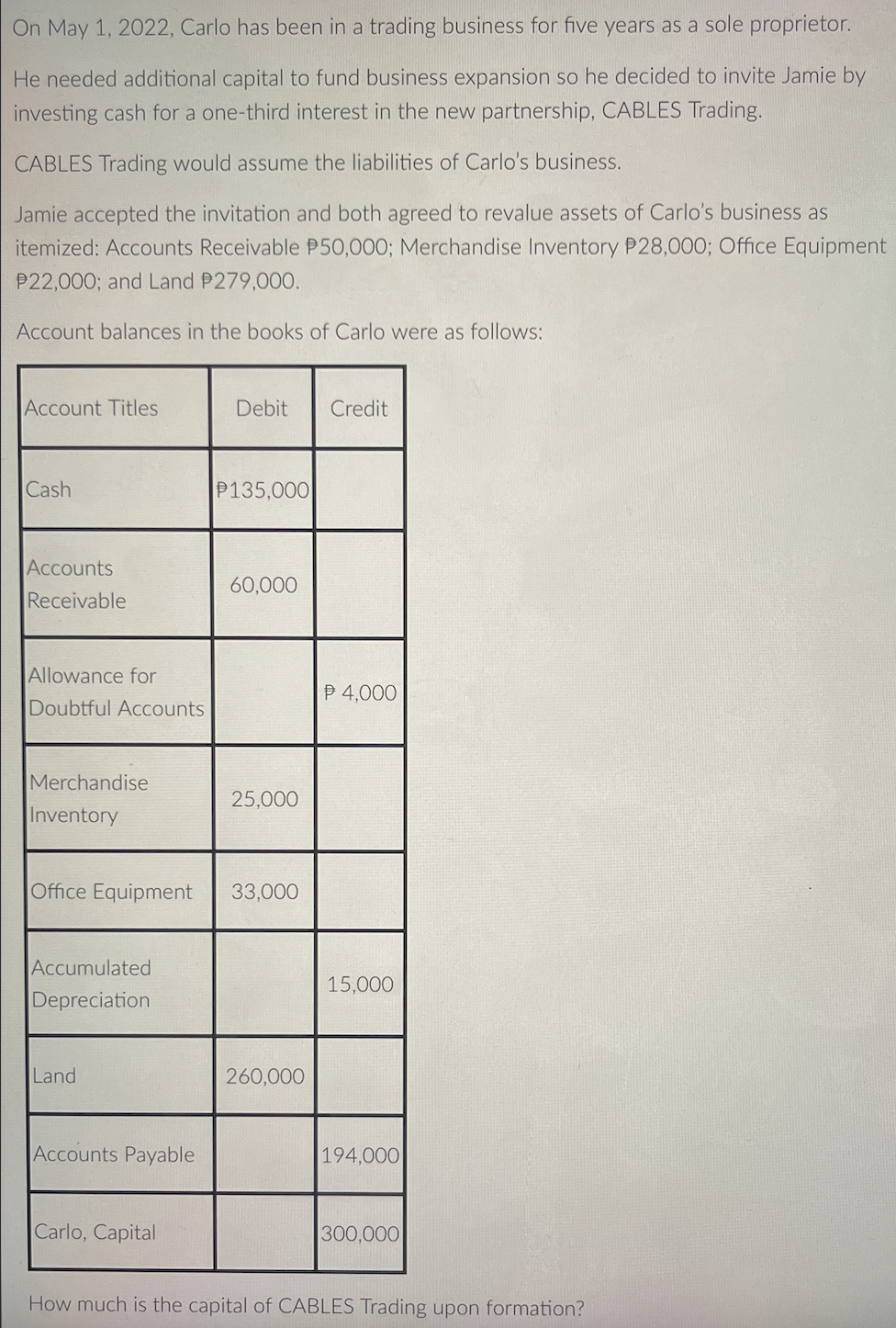

On May 1, 2022, Carlo has been in a trading business for five years as a sole proprietor. He needed additional capital to fund business expansion so he decided to invite Jamie by investing cash for a one-third interest in the new partnership, CABLES Trading. CABLES Trading would assume the liabilities of Carlo's business. Jamie accepted the invitation and both agreed to revalue assets of Carlo's business as itemized: Accounts Receivable P50,000; Merchandise Inventory P28,000; Office Equipment P22,000; and Land P279,000. Account balances in the books of Carlo were as follows: Account Titles Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise 25,000 Inventory Office Equipment 33,000 Accumulated 15,000 Depreciation Land 260,000 Accounts Payable 194,000 Carlo, Capital 300,000 How much is the capital of CABLES Trading upon formation? P135,000 60,000 P 4,000

On May 1, 2022, Carlo has been in a trading business for five years as a sole proprietor. He needed additional capital to fund business expansion so he decided to invite Jamie by investing cash for a one-third interest in the new partnership, CABLES Trading. CABLES Trading would assume the liabilities of Carlo's business. Jamie accepted the invitation and both agreed to revalue assets of Carlo's business as itemized: Accounts Receivable P50,000; Merchandise Inventory P28,000; Office Equipment P22,000; and Land P279,000. Account balances in the books of Carlo were as follows: Account Titles Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise 25,000 Inventory Office Equipment 33,000 Accumulated 15,000 Depreciation Land 260,000 Accounts Payable 194,000 Carlo, Capital 300,000 How much is the capital of CABLES Trading upon formation? P135,000 60,000 P 4,000

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 53P

Related questions

Question

Transcribed Image Text:On May 1, 2022, Carlo has been in a trading business for five years as a sole proprietor.

He needed additional capital to fund business expansion so he decided to invite Jamie by

investing cash for a one-third interest in the new partnership, CABLES Trading.

CABLES Trading would assume the liabilities of Carlo's business.

Jamie accepted the invitation and both agreed to revalue assets of Carlo's business as

itemized: Accounts Receivable P50,000; Merchandise Inventory P28,000; Office Equipment

P22,000; and Land P279,000.

Account balances in the books of Carlo were as follows:

Account Titles

Debit Credit

Cash

Accounts

Receivable

Allowance for

Doubtful Accounts

Merchandise

25,000

Inventory

Office Equipment 33,000

Accumulated

15,000

Depreciation

Land

260,000

Accounts Payable

194,000

Carlo, Capital

300,000

How much is the capital of CABLES Trading upon formation?

P135,000

60,000

P 4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you