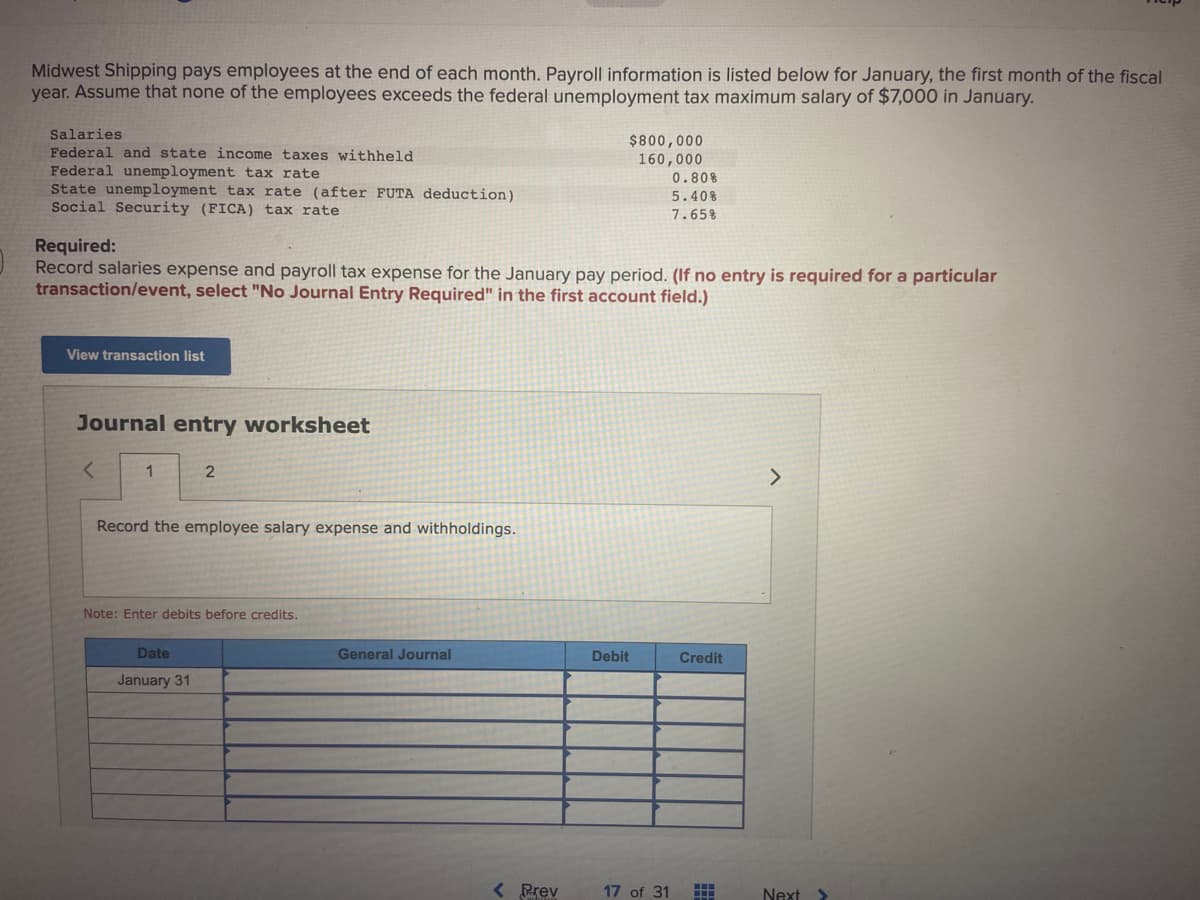

Midwest Shipping pays employees at the end of each month. Payroll information is listed below for January, the first month of the fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Salaries Federal and state income taxes withheld Federal unemployment tax rate State unemployment tax rate (after FUTA deduction) Social Security (FICA) tax rate Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 Record the employee salary expense and withholdings. Note: Enter debits before credits. Date January 31 General Journal $800,000 160,000 0.80% 5.40% 7.65% < Prev Debit 17 of 31 Credit HH ... > Next >

Midwest Shipping pays employees at the end of each month. Payroll information is listed below for January, the first month of the fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Salaries Federal and state income taxes withheld Federal unemployment tax rate State unemployment tax rate (after FUTA deduction) Social Security (FICA) tax rate Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 Record the employee salary expense and withholdings. Note: Enter debits before credits. Date January 31 General Journal $800,000 160,000 0.80% 5.40% 7.65% < Prev Debit 17 of 31 Credit HH ... > Next >

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 3PB

Related questions

Question

2. Record employer payroll taxes.

Transcribed Image Text:Midwest Shipping pays employees at the end of each month. Payroll information is listed below for January, the first month of the fiscal

year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January.

Salaries

Federal and state income taxes withheld

Federal unemployment tax rate

State unemployment tax rate (after FUTA deduction)

Social Security (FICA) tax rate

Required:

Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular

transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

<

1

2

Record the employee salary expense and withholdings.

Note: Enter debits before credits.

Date

January 31

General Journal

$800,000

160,000

0.80%

5.40%

7.65%

< Prev

Debit

17 of 31

Credit

HH

...

>

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning